by Connor Darrell CFA, Assistant

Vice President – Head of Investments

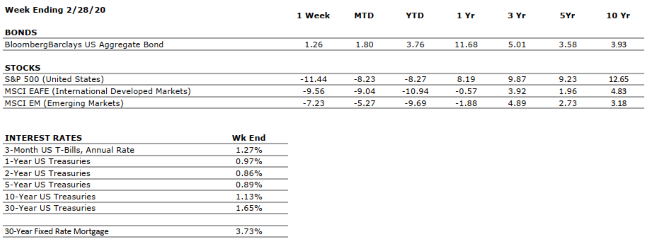

It

was a “risk off” week for global markets as stocks retreated from their highs

and bonds generated positive returns amid growing fears of further spreading of

the coronavirus. Many of those fears were realized over the weekend as evidence

emerged of a substantial increase in the number of cases outside of mainland

China, particularly in Italy, South Korea, and Iran. We have discussed in

previous iterations of The Weekly Commentary that two key areas we are focusing

on with respect to evaluating the risks posed by the virus are contagion and

severity. In our assessment of contagion, our internal discussions have focused

on evaluating whether containment efforts in China would be successful in

keeping the virus from spreading beyond Chinese borders. The significant

increase in cases outside of China over the weekend suggests to us that these

measures have likely failed. As a result, we are increasing our assessment of

geopolitical risks within our economic Heat Map from “Negative” to “Very

Negative”. Below, we provide further

details of our current thinking.

Coronavirus Update: How Should Investors Be Approaching the Issue?

In our view, it is becoming increasingly likely that the spread of this disease will reach pandemic status, and many in the scientific community believe it is already at that point. There is of course a significant symbolic weight behind the word ‘pandemic’, and the simple reclassification of the current state of the coronavirus situation has the potential to strike fear into the general public. But by definition, the World Health Organization (WHO) defines a pandemic as simply “the worldwide spread of a new disease.” There is no specific standard that must be met with respect to the severity of the disease or its financial impact. It just needs to spread globally in order to reach the status of pandemic. We think that this is an important point to make, because that leaves open the very real possibility that a disease reaches pandemic status without the need for mass hysteria. In fact, the 2009 strain of H1N1 flu reached pandemic status with more than 60 million cases in the U.S. alone; and few if any of us look back at that pandemic and associate it with intense fear.

As investors, it is imperative that we

disentangle our concerns for the near-term impacts on public health from our

long-term expectations for markets. As a financial planning firm, we are

long-term investors by nature. Everything we do for clients stems from the

financial plan, which is constructed through a process that is designed to

account for bouts of market volatility stemming from exogenous shocks (such as

a pandemic virus) that may happen over the course of the implementation period.

The beauty of the technology used by financial planners when constructing

long-term plans is that we can test the resiliency of our plans across

different scenarios, and those possibilities can be baked into the

recommendations as well as into the construction of client portfolios. In our

view, as long as a financial plan is properly constructed in a way that it

aligns with an investor’s long-term goals, there should be no need for the

investor to become overly concerned with the potential near-term impacts of

these types of risks.

The important assumption that is made in

the paragraph above is that the impacts of the coronavirus will be near-term in

nature. There are multiple reasons that we continue to operate based on this

assumption. The first relates to the

severity of the disease. Looking back through history, there is really only one

pandemic illness over the last 100+ years that was severe enough to

unilaterally push the global economy into recession; and that was the Spanish

Influenza of 1918. When we compare the data currently available on the

coronavirus with what we know about the Spanish Flu, it becomes immediately

clear that the two diseases are miles apart in terms of their severity. There

are some conflicting estimates of the true severity of the Spanish Flu, but

most suggest a mortality rate somewhere in the range of 10-20%, with

significantly higher rates among certain age cohorts. The severity of the

coronavirus remains somewhat difficult to fully evaluate given that it is an

ongoing situation, but the current estimate is a mortality rate somewhere

around 3%. Furthermore, the Spanish Flu is infamous among epidemiologists for

being particularly deadly among younger, healthier adults. The data we have

thus far regarding the coronavirus is that the mortality rates are

significantly higher among older patients with compromised immune systems, much

like the seasonal flu.

The second reason we continue to operate

under the assumption of short-term impacts is recent history. An evaluation of

several of the most recent viral epidemics (including SARS, H1N1, Ebola, and

MERS) reveals that both economic and market impacts of the diseases could be

measured in quarters rather than years. It would take a particularly deadly and

long-lasting disease to alter the trajectory of economic output worldwide for

more than a couple of quarters, and until we see evidence that this disease is

capable of that, we are not sounding the alarm for investors to run for cover. It

will continue to be important for investors to keep themselves informed of new

developments, and it is our intention to provide as many updates as we can

through The Weekly Commentary, but long-term investors should continue

operating through a long-term lens.

There remains the distinct possibility that additional news flow related to the disease could continue to weigh on equity markets, so investors who have near-term spending needs and plan to draw money from their portfolios within a year should make sure they have that money available in a low-risk investment vehicle. But for many others, an adjustment to the investment strategy should not be necessary. If you have specific questions related to your situation or a change in circumstances that warrants further consideration, your financial advisor is available to help you evaluate what the best course of action might be for your unique situation.