“Change does not roll in on the wheels of inevitability but comes through continuous struggle.” – Martin Luther King, Jr.

Meet the Team

Donna D’Imperio, EA

Client Relationship Manager & Tax Preparation Specialist

Years at VNFA – 20 Years

“I always preach to our clients that they should ask any and all questions they have, because I do not want them walking out the door with any doubts in their head. If I don’t know the answer, I will get them an answer.”

About Donna: I work with Frank Stettner in the New Jersey office. My many roles involve tax preparation, customer service, meetings with clients, effectuating money and account transfers and daily management duties of the Phillipsburg office. I enjoy the challenge of helping people with transferring estates. The best part of my position is getting to know our valued clients on an intimate basis, and I look forward to our new relationships.

Interests/Hobbies: When not in the office, I am usually outside doing something or spending time with my grandchildren. I enjoy traveling and having new adventures with friends or new acquaintances.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss: “The SECURE Act – breaking it down.”

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA – 35 Years

In 1985…

- Coca-Cola introduced New Coke (in April and six months later they returned to the original formula).

- Microsoft Corporate released the first version of Windows (Windows 1.0)

- Michael Jordan was named the NBA’s “Rookie of the Year.”

- Compact Discs were introduced to American consumers.

- Route 66 was removed from the United States Highway System.

- Live Aid Concerts in Philadelphia and London raise more than $50 million for famine relief.

- Hurricane Gloria caused New York’s stock exchanges to close on September 28.

Tom Riddle established his company to help clients with their financial choices on August 28.

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

NOTE: Last week, we reported an incorrect number for the December jobs report, which was not released until 1/10. Refer to the “Heat Map” for more details on the most recent employment data.

The U.S. equity market extended its gains last week as tensions between the U.S. and Iran showed signs of easing. Markets seem to no longer anticipate an escalation in the conflict between the U.S. and Iran following what has been seen as a largely unprovocative response to the killing of Qassem Soleimani on the part of the Iranians. With geopolitical risks at a heightened level, there remains the risk for additional unsettling headlines that could spark volatility, but it is unlikely that any such headlines would have a material impact on global markets.

Here in the U.S., the December jobs report came in weaker than anticipated, though the unemployment rate remained at its 50-year low of 3.5%. Wage growth, which had shown signs of picking up during the latter half of 2019, also came in weaker than expected. The 2.9% annual rate of increase was the lowest reading since July of 2018. Month-to-month jobs data tends to be somewhat unpredictable, and we continue to view the employment situation, and tangentially the U.S. consumer, as the strongest component of the U.S. economy. In the coming weeks, we will be watching the beginning of Q4 earnings season for further insights into consumer spending during the holiday season.

The Numbers & “Heat Map”

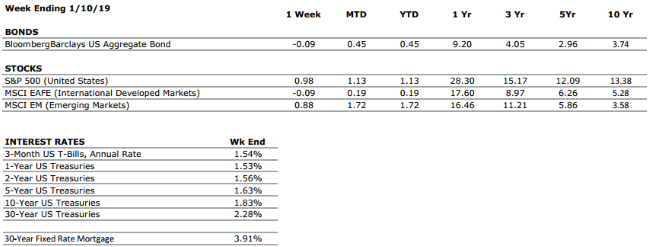

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A despite recent softening in retail sales numbers. US consumer confidence remains high, and we anticipate a strong holiday shopping season. The consumer has been the bedrock of the US economy through much of the current expansion. |

|

FED POLICIES |

B+ |

With the Federal Reserve expected to refrain from any further adjustments to interest rates without a material change in the economic outlook, we have downgraded our Fed Policies grade to a B+. The low level of interest rates remains a positive for markets, but sentiment will likely no longer be aided by anticipated rate cuts. |

|

BUSINESS PROFITABILITY |

B- |

As was largely expected by markets, corporate earnings growth was weak during Q3 as a result of the global slowdown and trade policy uncertainty. However, according to Factset, 75% of S&P 500 companies reported a positive earnings surprise, meaning things were not quite as weak as many had feared. |

|

EMPLOYMENT |

A |

December’s headline jobs growth number of 145,000 missed consensus expectations, though the unemployment rate remained stable at 3.5%; a 50-year low. Despite the softer than anticipated results in December 2019 was an incredibly strong year for the labor market, and it remains the healthiest area of the economy. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

We have raised our International Risks metric to a 7 following the US airstrike which killed Iranian General Qassem Soleimani. We expect heightened volatility in markets as a result of the further escalation of tensions that this action represents. However, we stress that volatility stemming from geopolitical events tends to be short-term. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

Form 1099-MISC Filing Requirements

As a general rule, you must issue a Form 1099-MISC to each individual, partnership, Limited Liability Company (“LLC”), Limited Partnership (“LP”), or Estate you have paid at least $600 during the calendar year in services, rents, or legal fees. Note that personal payments are not reportable.

Form 1099-MISC is also required if you withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

Some payments do not have to be reported on Form 1099-MISC, although they may be taxable to the recipient. The most common exceptions are payments to a corporation (including an LLC that is treated as a C or S corporation), payments of rent to real estate agents or property managers, and payments made with a credit card or payment card and certain other types of payments, including third-party network transactions.

Form 1099-MISC are due by January 31, 2020. You can submit Form 1099-MISC to the IRS by mail or online, using the Filing Information Returns Electronically (FIRE) system. Please note that if you issue more than 250 information returns, you are required to file electronically and may be penalized if you fail to do so. The IRS operates a centralized call site to answer questions about reporting on Form 1099 and other information returns. If you have questions related to reporting on information returns, the IRS centralized call site can be reached at (866) 455-7438.

Quote of the Week

“A dream doesn’t have

an expiration date. Take a deep breath and try again.” – Mel Robbins

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie and her guest, Nicholas Nanovic, Esq., LL.M., AEP® from Gross McGinley, LLP, will discuss: “Trusts – general estate planning, minor trusts, A/B trusts and more.”

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Quarterly Commentary – Q4 2019

Equities:

Equity markets closed out 2019 with another strong quarter which helped push the S&P 500 to its highest annual return since 2013. Markets continued to achieve new highs throughout most of the year as central bank rate cuts and robust consumer confidence countered the negative effects of trade uncertainty and declining global manufacturing. We often stress to investors that long-term market performance tends to track corporate earnings growth, but over shorter periods of time, it is common to see stock prices and earnings diverge. In our view, this was a key theme of 2019 as stock prices surged higher despite lackluster earnings growth. We can think of stock investing as simply purchasing the right to a share of the future earnings of a company. Thus, stocks have begun to look more “expensive” since investors must now pay a higher price for the same amount of future profits. An acceleration in corporate earnings growth will likely be needed in 2020 in order to sustain and support recent levels of stock market returns. As we move into 2020, consensus analyst estimates are calling for earnings growth just shy of 10%, which would represent a relatively meaningful acceleration from the flat growth we observed in 2019, but a tempering of return expectations going into the new year may be warranted.

Bonds:

The response by central banks around the world to softening economic activity throughout 2019 was also a boon for bond investors. Much of those gains were achieved during the first three quarters however, as optimism surrounding economic growth began to resurface during Q4 leading to a bounce in Treasury rates. Rates across the yield curve are influenced by expectations for economic growth and inflation, and with the unemployment rate at its lowest level since the 1960’s and evidence of wage growth at last emerging, an argument could be made that an uptick in inflation may not be far behind. Depending upon how significant it is, the emergence of inflation would potentially signal the next step in the maturation of the bull market and could push interest rates higher in the coming year.

Outlook:

The healthy returns achieved across most major asset classes made 2019 one of the best years of the current market cycle. Remarkably, it was largely the exact opposite of what occurred during 2018 when most major asset classes exhibited losses. Over the past two calendar years, the benefits of diversification have been harder to see as many assets that historically behaved differently from one another moved in lockstep. This is largely a result of bond yields sitting so close to their lower bounds, and as such, there are potential implications for the expected risk and return profiles of traditional balanced portfolios. If the correlation between stocks and bonds moving forward is higher than it has been in the past, then the diversification benefits of owning bonds will be diminished. This may create challenges for investors, but the good news is that the economy remains healthy and even began to show evidence of firming up during the fourth quarter. If this trend continues, then the probability of recession will decrease in the near-term and the primary risks to the market will remain geopolitical in nature. And as we have stressed in prior commentaries, market declines related to geopolitical events tend to be far shorter and shallower than those that have a more material impact on economic growth.

VIDEO: Q4 2019 Market Commentary

Connor Darrell CFA, Head of Investments, shares Valley National Financial Advisors’ summary of the fourth quarter as we enter 2020. WATCH NOW