We’re kicking off our tax preparation season. That means it is time to confirm tax preparation arrangements. Later this week, our tax team will be sending out customized communications to our clients with instructions and forms. You can also find these items and additional resources at our website: valleynationalgroup.com/tax

The Markets This Week

by Connor Darrell CFA, Assistant

Vice President – Head of Investments

Typically,

our quarterly commentary replaces “The Markets This Week” in our TWC

newsletter, but 2020 kicked off with some troubling developments in the Middle

East which we anticipate will dominate the news cycle early in the year. As

such, we wanted to take the opportunity to provide a summary of our current

thinking on the geopolitical environment as it pertains to U.S.-based investors.

On January 2, the United States announced that it had killed Iranian General Qassem Soleimani in an airstrike outside of Baghdad. Soleimani was a key military leader and a revered figure among the Iranian public. The attack represents a significant escalation in tensions between the U.S. and Iran, which have been festering since the Trump Administration’s decision to withdraw from the Iranian nuclear deal and re-impose economic sanctions. Security experts anticipate that the Iranian government will retaliate, and the uncertainty surrounding what that retaliation might entail has caused some minor volatility in equity markets. We have raised our assessment of “international risks” to a 7 out of 10 in our Economic Heat Map to reflect the elevated tensions between the U.S. and Iran. The rest of our Heat Map remains unchanged and we see no metrics flashing warning signs. Important to our outlook is that we do not feel the increased geopolitical risks pose any threat to the key economic pillars we track, and we do not recommend making any changes to portfolio strategy as a result of this news.

While we do believe that the attack represents a significant escalation and a meaningful change in tone of the Trump Administration’s dealings with Iran, we do not believe that tensions are at a point where they threaten the long-term stability of markets. We will likely see increased volatility due to headline risks, as well as disruptions in the oil market. However, the supply and demand dynamics at play in the oil market are vastly different than they were even ten or fifteen years ago, and the power of U.S. production is at an all-time high. Even in the face of significant geopolitical instability, we believe there is likely a cap on how high oil prices can push, though we do not know exactly where that cap might be. Investors maintaining a diversified global portfolio are well positioned to deal with short-term volatility in markets, and the evidence of improving economic fundamentals that emerged during the latter half of 2019 bode well for the economic expansion to continue in the near-term. We will continue to monitor the situation closely with particular interest in what Iran’s response might be, but we remain confident that long-term economic fundamentals will be largely unimpacted at this time.

Heads Up!

We are in the process of updating and improving the format through which we report our U.S. Economic Heat Map. We hope that these improvements make the report more informative and useful. Be on the lookout for these updates in the coming weeks!

The Numbers & “Heat Map”

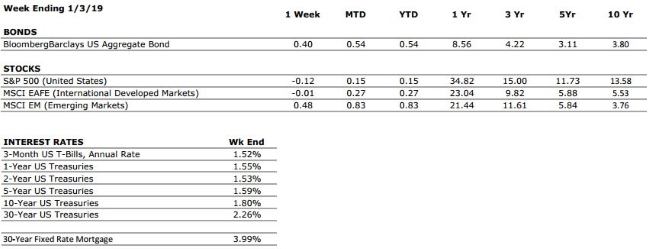

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A despite recent softening in retail sales numbers. US consumer confidence remains high, and we anticipate a strong holiday shopping season. The consumer has been the bedrock of the US economy through much of the current expansion. |

|

FED POLICIES |

B+ |

With the Federal Reserve expected to refrain from any further adjustments to interest rates without a material change in the economic outlook, we have downgraded our Fed Policies grade to a B+. The low level of interest rates remains a positive for markets, but sentiment will likely no longer be aided by anticipated rate cuts. |

|

BUSINESS PROFITABILITY |

B- |

As was largely expected by markets, corporate earnings growth was weak during Q3 as a result of the global slowdown and trade policy uncertainty. However, according to Factset, 75% of S&P 500 companies reported a positive earnings surprise, meaning things were not quite as weak as many had feared. |

|

EMPLOYMENT |

A |

December’s headline jobs growth number of 312,000 handily beat consensus estimates yet again and provided further evidence that the US consumer remains in a strong position to continue fueling the expansion. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

We have raised our International Risks metric to a 7 following the US airstrike which killed Iranian General Qassem Soleimani. We expect heightened volatility in markets as a result of the further escalation of tensions that this action represents. However, we stress that volatility stemming from geopolitical events tends to be short-term. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

by Michael Roper CPA, Assistant Vice President

Help Protect Your Documents from Scammers

Be careful when writing the date 2020 on checks or other legal documents. Someone could potentially alter the date if you abbreviate the year to two digits; ‘20’. For example, the date 1/7/20 written on a check could be changed to 1/7/2021 next year and present it for payment next year. The date 1/7/20 on a debt agreement could be altered to 1/7/2018 with a demand for back payments.

The easiest way to avoid these problems? Write or type the date completely – 1/7/2020.

Quote of the Week

“Never give up on something that you can’t go a day without thinking about.” – Winston Churchill

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie with guests Tim Roof, CFP® and Connor Darrell, CFA, will discuss: “2019 Market Review & Investor Tips” – like reviewing your 401k allocation, considering if you qualify for a ROTH and how that may offer another investment option, importance of an emergency reserve, and more.

Laurie will respond to questions submitted at yourfinancialchoices.com/contactlaurie during the next live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

Happy New Year

It is the last day of 2019! Our offices will be closed one more time tomorrow on New Year’s Day and re-open on Thursday morning, January 2. We wish you all a happy, safe and prosperous new year.

We Are Hiring

Our team is seeking a full-time Investment Research Analyst to serve as an active contributor and centralized resource for the investments department. valleynationalgroup.com/join-our-team

Time for Taxes

A New Year means it is time for our team to start sending out tax questionnaires and related instructions for the tax prep season. If you have engaged us to prepare your tax return, we will be sending out the information you need from us and guidance about what we need from you, starting next week.

Did You Know…?

The SECURE Act was signed into law on December 20. SECURE stands for Setting Every Community Up for Retirement Enhancement. The Act changes a number of rules related to tax-advantaged retirement accounts. Investopedia.com provided this overview of the major provisions:

- Make it easier for small businesses to set up 401(k)s by increasing the cap under which they can automatically enroll workers in “safe harbor” retirement plans, from 10% of wages to 15%.

- Provide a maximum tax credit of $500 per year to employers who create a 401(k) or SIMPLE IRA plan with automatic enrollment.

- Enable businesses to sign up part-time employees who work either 1,000 hours throughout the year or have three consecutive years with 500 hours of service.

- Encourage plan sponsors to include annuities as an option in workplace plans by reducing their liability if the insurer cannot meet its financial obligations.

- Push back the age at which retirement plan participants need to take required minimum distributions (RMDs), from 70½ to 72, for those who are not 70½ by the end of 2019.

- Allow the use of tax-advantaged 529 accounts for qualified student loan repayments (up to $10,000 annually).

- Permit penalty-free withdrawals of $5,000 from 401(k) accounts to defray the costs of having or adopting a child.

- Encourage employers to include more annuities in 401(k) plans by removing their fear of legal liability if the annuity provider fails to provide and also not requiring them to choose the lowest-cost plan. (This could be something of a double-edged sword. Employees will need to look extra-carefully as these options.)

One other key change in the new bill is paying for all this: the removal of a provision known as the stretch IRA, which has allowed non-spouses inheriting retirement accounts to stretch out disbursements over their lifetimes. The new rules will require a full payout from the inherited IRA within 10 years of the death of the original account holder, raising an estimated $15.7 billion in additional tax revenue. (This will apply only to heirs of account holders who die starting in 2020.)

If you have questions or concerns about how the SECURE Act may affect your retirement planning and outlook, contact your service team for more information.

The Markets This Week

by Connor Darrell

CFA, Assistant Vice President – Head of Investments

The

last full week of 2019 yielded additional positive returns for both stock and

bond investors. It has been a stellar year for investment returns, with the

S&P 500 poised to end the year up over 30% and the Barclays Aggregate Bond

index set to close things out with almost a 9% gain. For U.S. equities, this

would only be the 15th time since 1937 that market returns exceeded

30% in a single calendar year. Important to consider however, is that the

market’s strong returns this year were generated as a result of what analysts

refer to as “multiple expansion” and not earnings growth. Multiple expansion occurs

when stock prices rise faster than corporate earnings, meaning that stocks

become more expensive on a relative basis. Interestingly, the opposite occurred

in 2018, when stocks generated negative returns despite earnings growth well

over 20%. Over the long run, it is earnings growth that tends to be the primary

driver of returns, and while both 2018 and 2019 produced the opposite result in

isolation, when taken together, earnings growth actually does have strong

explanatory power over the past 24 months.

Following the significant multiple expansion that took place this year, the current price to earnings multiple for S&P 500 stocks is about 18.1, quite a bit above the historical average of 15.2. Moving forward, if U.S. equities are going to continue to climb higher, earnings growth will need to once again assume the role of primary catalyst. According to Refintiv, analysts are calling for mid to high single-digit earnings growth in 2020, which would be a marked improvement over 2019 earnings growth. Whether this is enough to support higher than average multiples remains to be seen. Investors can take solace in the fact that the underlying economy continues to show evidence of firming up and that the U.S. consumer remains on solid footing, both of which should help to support corporate earnings throughout the next year.

The Numbers & “Heat Map”

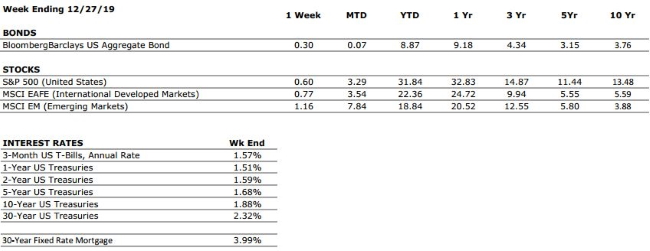

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A despite recent softening in retail sales numbers. US consumer confidence remains high, and we anticipate a strong holiday shopping season. The consumer has been the bedrock of the US economy through much of the current expansion. |

|

FED POLICIES |

B+ |

With the Federal Reserve expected to refrain from any further adjustments to interest rates without a material change in the economic outlook, we have downgraded our Fed Policies grade to a B+. The low level of interest rates remains a positive for markets but sentiment will likely no longer be aided by anticipated rate cuts. |

|

BUSINESS PROFITABILITY |

B- |

As was largely expected by markets, corporate earnings growth was weak during Q3 as a result of the global slowdown and trade policy uncertainty. However, according to Factset, 75% of S&P 500 companies reported a positive earnings surprise, meaning things were not quite as weak as many had feared. |

|

EMPLOYMENT |

A |

November’s headline jobs growth number of 266,000 smashed consensus estimates and provided further evidence that the US economy remains on solid footing. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

6 |

Following progress made on two key geopolitical concerns (Brexit and US/China trade relations), we are reducing our International Risks metric to a 6. Other key areas of focus for markets include the rising economic nationalism around the globe and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.