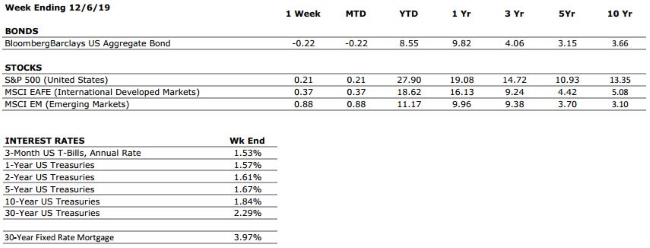

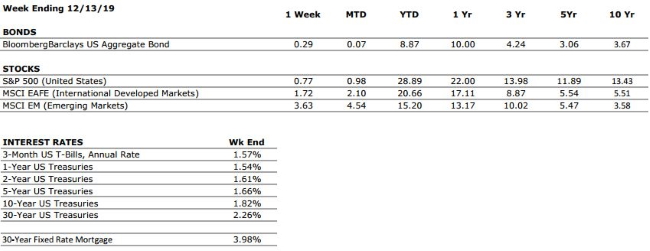

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A despite recent softening in retail sales numbers. US consumer confidence remains high, and we anticipate a strong holiday shopping season. The consumer has been the bedrock of the US economy through much of the current expansion. |

|

FED POLICIES |

A- |

The Federal Reserve cut its interest rate target three times during 2019, but projections in the Fed’s “Dot Plot” following its most recent meeting yielded, on balance, no changes in 2020. We expect this to remain the case moving forward until we see a meaningful shift in the economic data (either positive or negative). |

|

BUSINESS PROFITABILITY |

B- |

As was largely expected by markets, corporate earnings growth was weak during Q3 as a result of the global slowdown and trade policy uncertainty. However, according to Factset, 75% of S&P 500 companies reported a positive earnings surprise, meaning things were not quite as weak as many had feared. |

|

EMPLOYMENT |

A |

November’s headline jobs growth number of 266,000 smashed consensus estimates and provided further evidence that the US economy remains on solid footing. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

6 |

Following progress made last week on two key geopolitical concerns (Brexit and US/China trade relations), we are reducing our International Risks metric to a 6. Other key areas of focus for markets include the rising economic nationalism around the globe and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.