by Connor Darrell CFA,

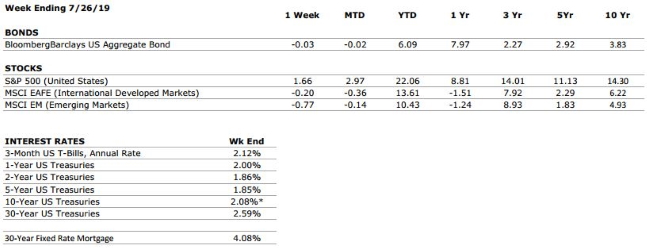

Assistant Vice President – Head of InvestmentsThe S&P 500 led global equities forward last week as the market’s focus

began to turn once again toward monetary policy. In Europe, the ECB indicated

that it would reduce short-term interest rates in September in an effort to

stimulate the eurozone’s softening economy. Meanwhile, the Federal Reserve is

widely expected to take a similar course of action when it meets this week.

Also weighing on global equity returns was

mounting uncertainty surrounding the ongoing Brexit saga. Boris Johnson, who

has pledged to deliver on 2016’s Brexit referendum with or without a concrete

deal in place, won the race to become the next Prime Minister of the United

Kingdom.

All Eyes on the Fed

At

this week’s meeting, the Federal Reserve is widely expected to cut short-term

interest rates by at least 25 bps. However, the bond market has had this

expectation baked into current prices for several weeks now, and any market

movements are likely to be driven by the forward outlook for monetary policy,

which will likely be discussed during the press conference on Thursday. At

present, markets are anticipating more than two rate cuts before the end of the

year.

Whether or not the market’s expectations

for monetary policy are met will be largely contingent upon the strength of

economic data between now and the end of the year. Last week, it was reported

that the U.S. economy expanded at a rate of 2.1% annualized, which was on the

upper range of consensus expectations. That growth was supported by very strong

consumer spending, which more than offset a slight decline in business

investment. Business investment has remained an area of weakness in recent GDP

figures around the world (primarily as a result of uncertainty surrounding

trade policy), but the strength of the consumer continues to help keep the U.S.

economy on a solid foundation. Furthermore, with face-to-face trade talks

resuming between the U.S. and China this week, there is some optimism that

progress can be made. Any meaningful progress on trade would likely improve

business confidence and could begin to push business investment trends back in

a positive direction.