by Connor Darrell, Head of Investments CLICK HERE TO GET TO KNOW CONNOR

It was another bumpy week on Wall Street, though markets closed out the month of March and rolled into the holiday weekend on a positive note. Bonds outperformed stocks as the 10 year treasury yield slipped down to 2.77% after reaching as high as 2.94% during the middle of the prior week. A lot has been made of tariffs and trade policy over the past few weeks, and we touched upon that a bit in last week’s update, but moving forward our primary focus is elsewhere. See below for more details.

What We Are Focusing On

As investment managers, we must always be challenging ourselves to identify possibilities that markets haven’t yet appreciated. After all, a portfolio manager who follows the common “consensus” will never outperform. Sound risk management is about recognizing risks in the market before they have major impacts on asset returns, and identifying strategies that can mitigate their effects on a portfolio. As such, we are constantly asking ourselves “What could conceivably transpire that would cause us to fundamentally change our market outlook?”

Following years of historically low levels of volatility, we believe that the equity sell-offs in February and March were simply a return to what might be considered “normal”, and that economic fundamentals remain supportive of further gains. However, as we evaluate the state of the economy and markets, we see two interrelated risks that could temper our optimism; interest rates and inflation.

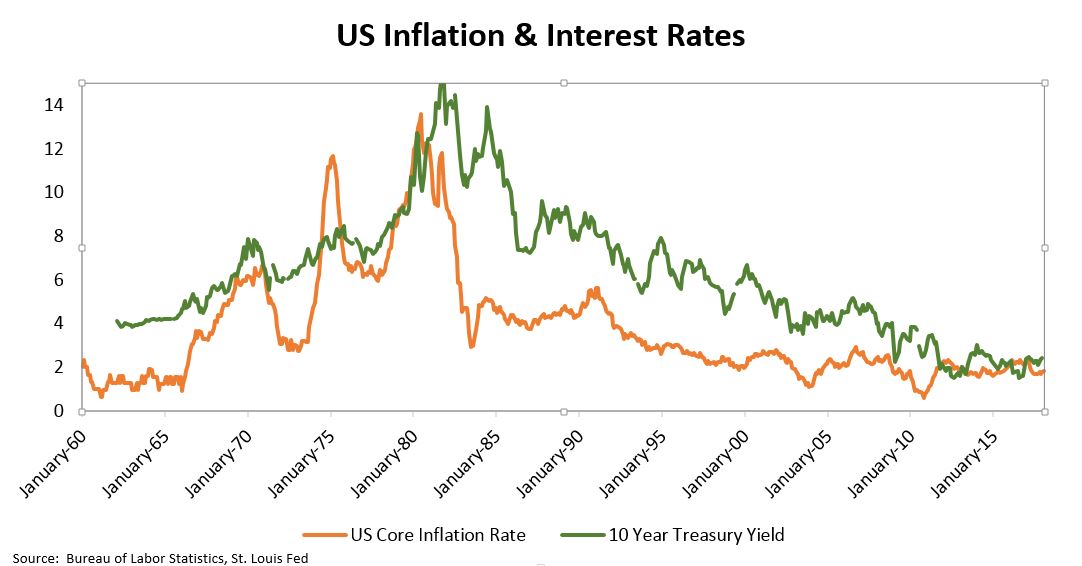

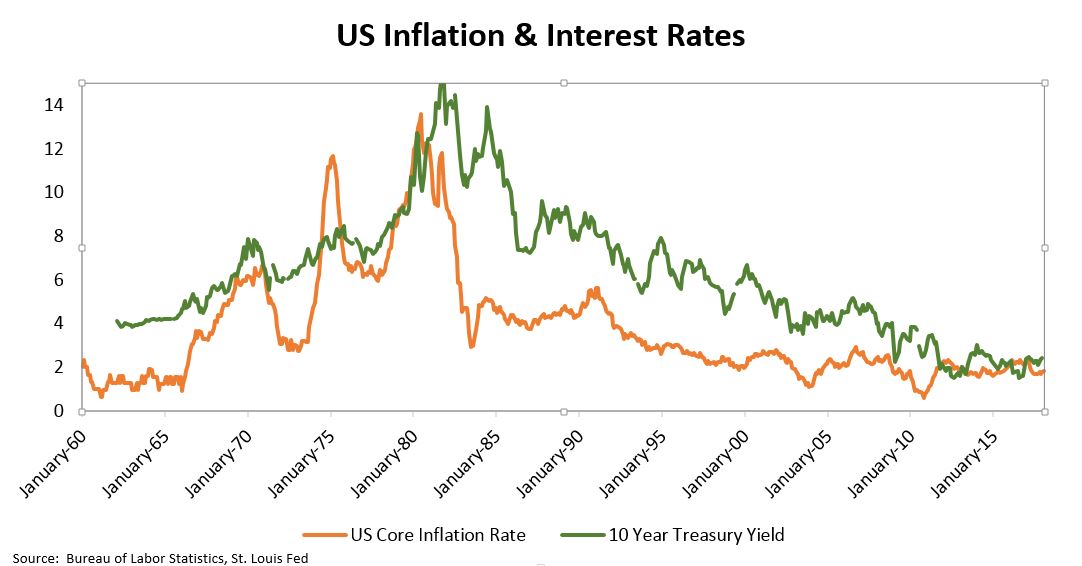

Since the 2008 financial crisis, central banks around the world have taken extreme measures to try and breathe life back into the global economy. Pushing interest rates lower and lower in an attempt to encourage lending and stimulate the economy. Over longer periods of time however, interest rates are driven primarily by inflation and growth expectations, not central bank policy. The chart below shows the US Inflation rate alongside the yield on the 10 Year Treasury. As you can see, there is a strong relationship between the two.

There is a theory in economics that inflation should be negatively correlated to the unemployment rate in an economy. The logic is that as the unemployment rate declines, there are fewer workers available for hire, and companies must increase wages to attract new employees from a smaller supply of available workers. These increased wages put pressure on profits and force companies to increase prices, leading to inflation. While far from an infallible rule of economics, this phenomenon has been observed through a variety of different periods in history.

With the US unemployment rate approaching its lowest level since the turn of the century (which itself was the lowest level since May of 1969), the potential for rising wages and input costs to begin putting upward pressure on inflation has increased. When we combine this possibility with the fact that interest rates have been moving steadily lower for over 35 years (see chart from above), we believe it will be incredibly important to watch inflation expectations moving forward. Since long term trends tend to break suddenly rather than gradually, a meaningful upward shift in inflation expectations could impact interest rates and cause disruption in the market.

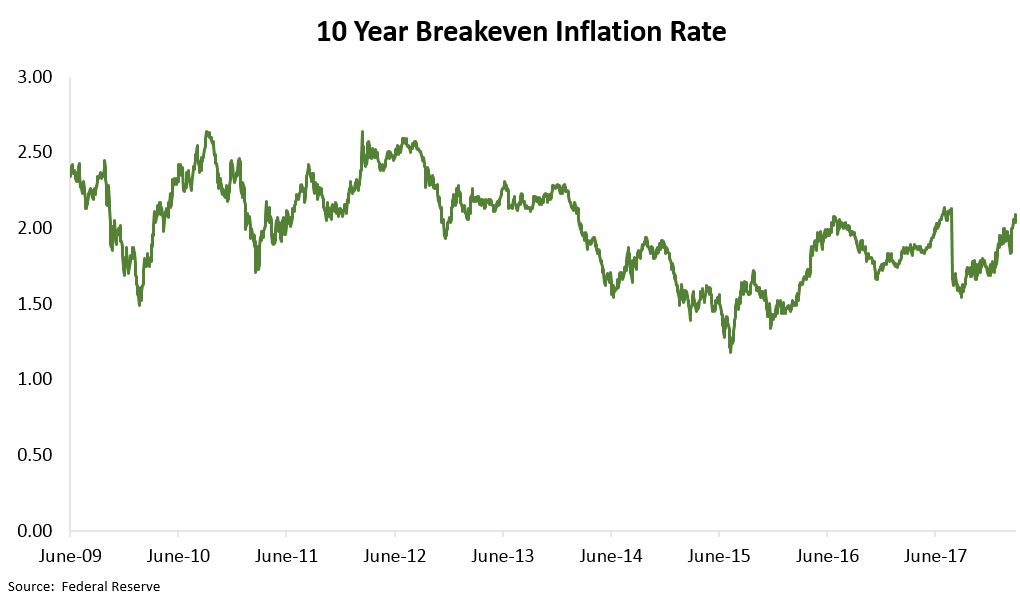

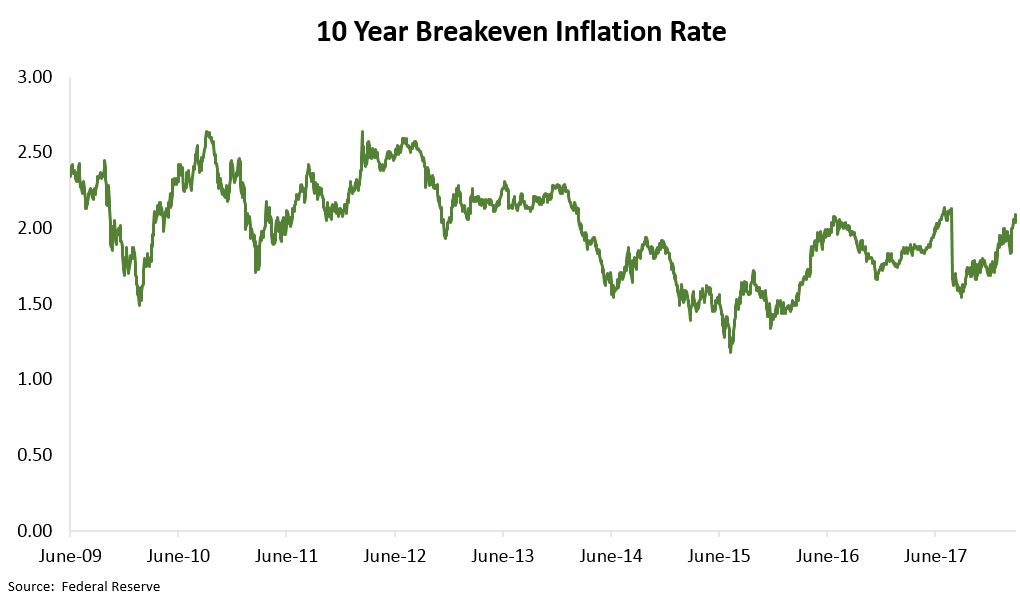

Building upon the notion that portfolios tracking consensus expectations do not outperform, the below chart shows how inflation expectations have evolved since we emerged from the financial crisis.

The 10 Year breakeven Inflation Rate is calculated by subtracting the yield on 10 Year Inflation Protected Treasuries from the yield on 10 Year Treasury Bonds and is used as a proxy for the market’s expectation of inflation over that time period. Thus, we can gather from the chart that inflation expectations have remained quite subdued over the past ten years or so. We saw a slight increase recently, but far from meaningful given expectations are still very close to where they were back in 2016. The key takeaway from this chart is that markets are still not convinced that inflation, and therefore long term interest rates, will push significantly higher over the next few years. We at Valley National are not “convinced” either, but we do believe that there exists a distinct possibility that inflation expectations are adjusted upward as economic growth continues to improve and unemployment continues to decline. Shielding a portfolio from this risk involves reducing interest rate sensitivity by shifting towards short term bonds. We view this as relatively inexpensive “insurance”, since it does not require investors to sacrifice a significant amount of income given that bond yields are already at historic lows. If you have any questions about specific strategies for your portfolio, please contact your financial advisor.