“If opportunity doesn’t knock, build a door.” -Milton Berle

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” on WDIY 88.1FM. Laurie will discuss: Year-end Tax Planning Odds and Ends.

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Veterans Day Interesting Facts of The Week

Do you know why Veterans Day is always on the 11th day of November every year? That’s because it is meant to honor the “eleventh hour of the eleventh day of the eleventh month”

Want to read more facts about Veterans Day, visit history.com

According to History.com, Veterans Day originated as “Armistice Day” on November 11, 1919, the first anniversary of the end of World War I. Congress passed a resolution in 1926 for an annual observance, and November 11 became a national holiday beginning in 1938. Unlike Memorial Day, Veterans Day pays tribute to all American veterans—living or dead—but especially gives thanks to living veterans who served their country honorably during war or peacetime.

Do you know why Veterans Day is always on the 11th day of November every year? That’s because it is meant to honor the “eleventh hour of the eleventh day of the eleventh month”

Want to read more facts about Veterans Day, visit history.com

Current Market Observations

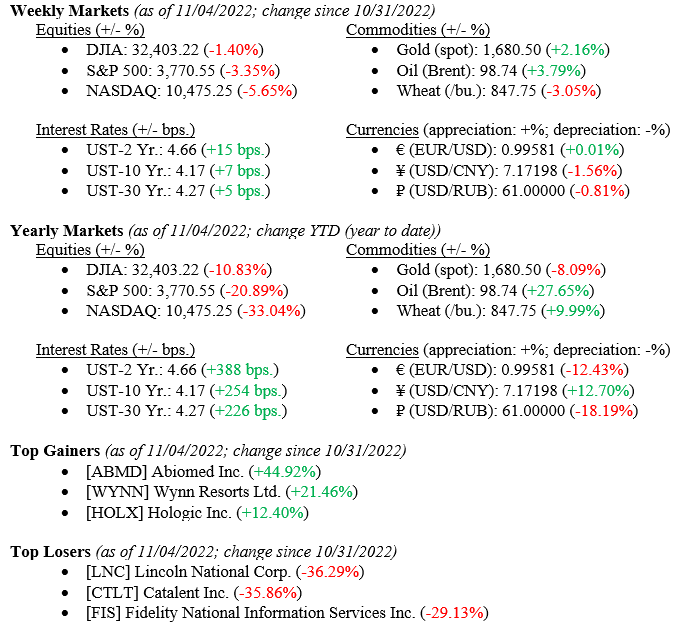

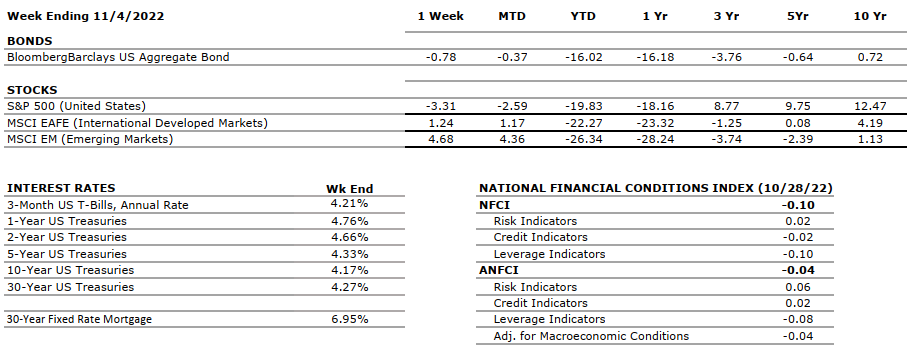

Markets reacted negatively to Fed Chairman Jay Powell’s press conference, which occurred after the Federal Open Markets Committee announced an added 0.75% hike in the Fed Funds Rate, bringing the range to 3.75% to 4.00%. While the 0.75% rate hike was expected, Chair Powell’s “hawkish” comments at the press conference, where he noted that the pace of added hikes is not slowing, were not expected. Stock markets immediately sold off and bond yields rose because of a similar sell-off in the fixed income markets (See Weekly Markets below). Unemployment moved slightly higher during October, but it is important to note that the labor market still is robust. Additionally, midterm elections are this week and, regardless of what happens, market results tend to be agnostic to party over the long-term.

Global Economy

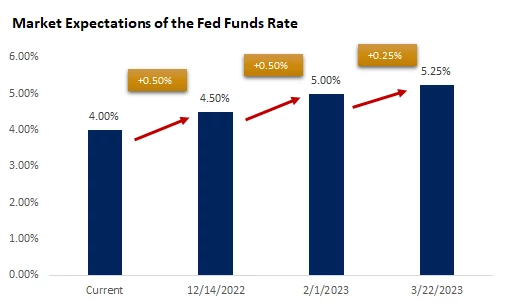

As noted above, the Fed hiked interest rates 0.75% last week. Chair Powell noted that this year’s interest rate hikes have affected the economy, the Federal Open Markets Committee believes that further tightening is necessary to slow the economy enough to deal with the decades-high hot inflation currently weighing on the markets, economy, and the consumer. According to the Chicago Mercantile Exchange, futures on Fed Funds Rate are now pricing in three added hikes with a final terminal level near 5.25%. (See Chart 1 below)

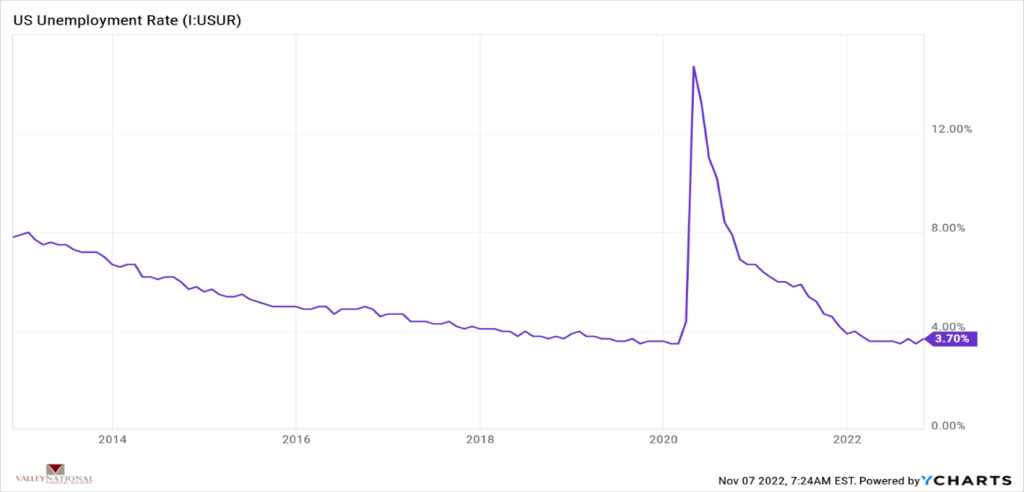

Higher interest rates weigh heavily on consumers (loans, mortgages, credit card interest rates) and directly affect areas of the economy that rely on loans and loan demand (housing). Higher rates also affect those companies that rely on loans for growth such as high-tech, and impact less so on well established companies such in the industrial segment. We saw the divergence of returns last week with the NASDAQ down -5.65% while the Dow Jones Industrial Average was down -1.4%. The labor market remains healthy and last week we saw that 261,000 new non-farm jobs were created during October while the unemployment rate ticked up to 3.7% from 3.5. (See Chart 2 below).

Policy and Politics

U.S. midterm elections happen this week and historically the party in power (currently the Democrats) loses seats in both the House and the Senate. This is expected to happen this week as well, what to watch will be the extent of the losses that the Democrats suffer. From a markets perspective, results are historically agnostic to election results over the long-term and neither really shows an edge on the other for markets returns to investors.

What to Watch

- U.S. Retail Gas Price on Nov. 7th @ 4:30 PM EST (Prior: $3.857/gal)

- U.S. Consumer Price Index (Year over Year) on Nov. 10th @ 8:30 AM EST (Prior: 8.20%)

- U.S. Inflation Rate on Nov. 10th @ 8:30 AM EST (Prior: 8.20%)

- 30 Year Mortgage Rate on Nov. 10th @ 10:00 AM EST (Prior: 6.95%)

- U.S. Index of Consumer Sentiment on Nov. 11th @ 10:00 AM EST (Prior: 59.90)

The Numbers & “Heat Map”

THE NUMBERS

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

According to the second estimate, real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. The advance estimate for Q3 2022 shows Real GDP to have increased by an annual rate of 2.6%. |

|

CORPORATE EARNINGS |

NEUTRAL |

The estimated growth rate for Q3 2022 is 2.2%, which was adjusted downward from 9.8% in June and 2.4% three weeks ago. So far, with 85% of S&P500 companies reporting actual results, 70% of them reported a positive EPS surprise and 71% beat revenue expectations. |

|

EMPLOYMENT |

NEUTRAL | U.S. Nonfarm Payrolls for October 2022 increased by 261,000 and the unemployment rate rose from 3.5% in September to 3.7%. October’s gains were broad-based but primarily driven by manufacturing and healthcare sectors which added 32,000 and 53,000 jobs respectively. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 8.2% for September 2022 — down slightly from 8.3% in August but still a stubbornly high result and above expectations. Core CPI increased by 6.6% year-over-year marking the highest gain since August 1982. CPI for the month of October will be released on Thursday morning and it is expected to come in at 7.9%. Core CPI is projected to be6.5%. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE |

The Fed approved a fourth consecutive 75 bps hike last week which took its target range to 3.75%- 4.00% – the highest it has been since 2008. The Fed hinted at potentially reducing the magnitude of future rate increases from 75 to 50 bps but also mentioned the possibility of a new higher target range closer to 5%. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia held controversial referendums for the annexation of four Ukrainian regions and the Russian Parliament unanimously recognized these regions as part of Russia. Ukraine and Western countries have condemned these actions by Russia by declaring them illegitimate and illegal. Additional sanctions are being imposed on Russia by many countries. |

|

ECONOMIC RISKS |

NEGATIVE |

COVID-19 lockdowns in China are persistent and the ongoing Russian-Ukraine war is causing a major energy crisis in Europe. Gas supplies from Russia to Europe have decreased by 88% over the past year and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. The U.S. is now dealing with a major diesel shortage with national reserves at their lowest levels since 1951 and a ban on Russian products that will intensify the issue. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“The goal isn’t more money; The goal is living life on your own terms” –Will Rogers

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” on WDIY 88.1FM. Laurie will discuss: Business Structures and their consequences.

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA In the News

Our Chief Investment Officer William Henderson talks about very important topics this week – he explains the recession meter used by VNFA, talks about inflation, and shares some tips on the differences between Bull and Bear markets.

Did You Know…?

November is Alzheimer’s Awareness Month

According to The Alzheimer’s Association financial planning often gets pushed aside when a person is dealing with the stress of their diagnose. Here are four steps that will help you when planning.

- Knowing where to begin.

- What care cost?

- How will you pay for care?

- What professional assistance is available?

Want to dive into “Financial Planning” read the full article by The Alzheimer’s Association on what steps to take for your financial future.

Current Market Observations

Last week, we saw diverging pressures on the markets resulting in diverging results on equity indexing. Hopes of a FED slowing their aggressive interest rate hikes moved equity markets higher across the board and bond yields lower, but weak earnings releases from “Big Tech” equities (AMZN, GOOG, META) weighed heavily on the tech-heavy NASDAQ. Still, all major indexes moved higher for the week (see details below) and the 10-Year US Treasury ended the week at 4.02%, 23 basis points lower than the previous week.

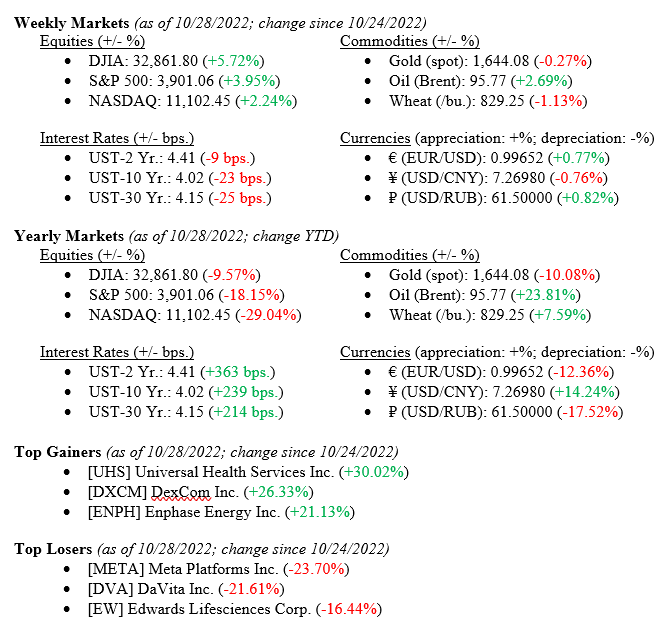

Weekly Markets (as of 10/28/2022; change since 10/24/2022)

Global Markets

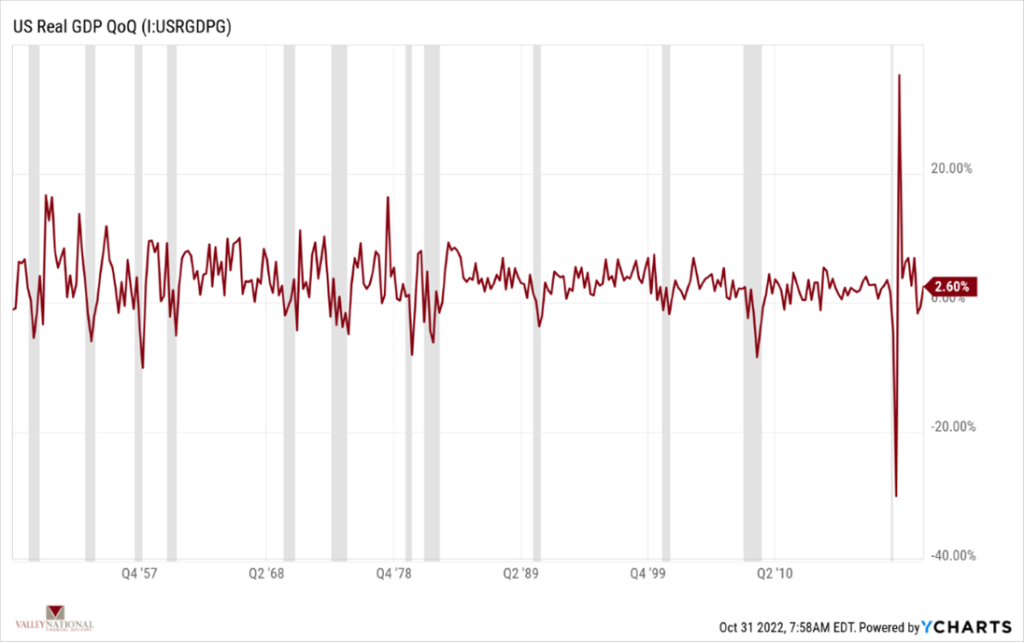

As noted above, weekly returns were favorable across all major indexes and returns for the full month of October 2022 are shaping up to be some of the best monthly returns in decades. Solid consumer spending, as evidenced by earnings releases from Visa and American Express, continue to fuel economic growth. Last week, U.S. Real GDP (Gross Domestic Product) for the 3rd quarter was released and the number came in at +2.60%, compared to -0.60% for the 2nd quarter of 2022 and +2.70% for the full year 2021. (See Chart 1 below from Valley National Financial Advisors & Y Charts). What we found telling was how GDP has now normalized moving closer to recent historical averages compared to wild pandemic-related swings we saw previously.

Mortgage rates continue to move higher in response to higher interest rates overall. This has had a drastic impact on the housing market. Last week, the National Association of Realtors released U.S. Pending Home Sales data that was significantly below expectations (-10.17% vs expected of –4.0%) (See Chart 2 below from Valley National Financial Advisors and Y Charts showing the 30 Year Mortgage Rate vs U.S. Pending Home Sales).

While not a devastating impact on the economy, housing is a key component of economic growth especially given the knock-on effects of home sales – additional purchases of appliances, home improvements made, sales of replacement furniture and fixtures all contribute to or detract from economic activity.

This week the Federal Reserve meets, and expectations are for another +0.75% rate hike. This is expected so any move higher or lower will have an impact on the markets because, as we all know, markets hate uncertainty. Additionally, about 1/3 of the S&P 500 Index Companies report earnings this week, which will also have a corresponding impact on the markets if the data is more positive or negative compared to Wall Street analysts’ predictions.

What to Watch

- U.S. Job Openings: Total Nonfarm for September 2022, released 11/01/22 (Prior +10.05m)

- Target Federal Funds Rate by Federal Open Markets Committee released 11/02/22, current upper range 3.25%

- U.S. Initial Claims for Unemployment Ins. for week of 10/29/22, released 11/3/11 (prior 217k)

There has been a modest turnaround in equities and the month of October has rewarded patient investors handsomely. 10-Year US Treasury yields have come off their recent highs (4.33%), moving lower to 4.02% but markets have yet to express optimism that yields have peaked. The FED meets this week and markets have priced in a +0.75% bump in the Fed Funds Target. The language around that move and additional directional information from Fed Chair Jay Powell is what we are really waiting for with Wednesday’s announcement. Global uncertainty is focused on the Russian/Ukraine war and Covid related lockdowns in China – thankfully, these are not new uncertainties, and the markets continue to accurately price in the story. Watch for impactful data this week while also remaining focused on the long-term trends. Reach out to us at Valley National Financial Advisors for any additional information.