“We can throw stones, complain about them, stumble on them, climb over them, or build with them.”

William Arthur Ward

“We can throw stones, complain about them, stumble on them, climb over them, or build with them.”

William Arthur Ward

Science Breakthrough of the Year-The First Quantum Machine –

This year’s Breakthrough of the Year represents the first time that scientists have demonstrated quantum effects in the motion of a human-made object,” said Adrian Cho, a news writer for Science. On a conceptual level that’s cool because it extends quantum mechanics into a whole new realm. On a practical level, it opens up a variety of possibilities ranging from new experiments that meld quantum control over light, electrical currents and motion to, perhaps someday, tests of the bounds of quantum mechanics and our sense of reality.”

Source: www.kurzweilai.net/sciences-breakthrough-of-the-year-the-first-quantum-machine?utm_source=KurzweilAI+Daily+Newsletter&utm_campaign=57f08c1716-UA-946742-1&utm_medium=email

Researchers Discover Where Unconscious Memories Form –

A small area deep in the brain called the perirhinal cortex is critical for forming unconscious conceptual memories, researchers at the UC Davis Center for Mind and Brain have found. The perirhinal cortex was thought to be involved, like the neighboring hippocampus, in “declarative” or conscious memories, but the new results show that the picture is more complex.

Source: www.kurzweilai.net/where-unconscious-memories-form?utm_source=KurzweilAI+Daily+Newsletter&utm_campaign=57f08c1716-UA-946742-1&utm_medium=email .

I wish I had more time to pursue my interest in astronomy. But, there is little in common between astronomy and financial planning. I think most clients would appreciate my time being spent analyzing the new tax law instead of observing celestial events. But, I am sure to watch celestial events if they are rare or spectacular like the event tonight.

For the first time in 372 years, a total lunar eclipse will take place on the Winter’s solstice on December 20 to 21, 2010. It will be visible after midnight Eastern Standard Time on December 21 in North and South America. EST/12:17 a.m. PST.

According to space.com, if you are residing in the US particularly in the East Coast, expect to see the lunar eclipse as it begins half an hour after midnight on Tuesday, December 21, 2010. On the West Coast, it begins around 9:30 p.m. PST Monday. In all cases, the whole eclipse will be observable before the moon sets in the west just as the sun is rising in the east. Maximum eclipse is at 3:17 a.m.

This lunar eclipse will be followed by a meteor shower named as Ursids which is expected to peak on December 22 to 23, 2010. The Ursid meteor shower usually coincides with the winter solstice, and is best seen by polar bears since they come from near the celestial North Pole. Generally speaking they produce about a dozen or so per hour at their peak. However, with the lunar eclipse occuring there may be some opportunities to catch an Ursid meteor or two from our region!

For more information about the Lunar Eclipse, visit http://www.nasa.gov/topics/solarsystem/features/watchtheskies/index.html

For more information about the Ursids meteor shower, visit

http://www.space.com/spacewatch/lunar-eclipse-ursid-meteor-shower-101217.html

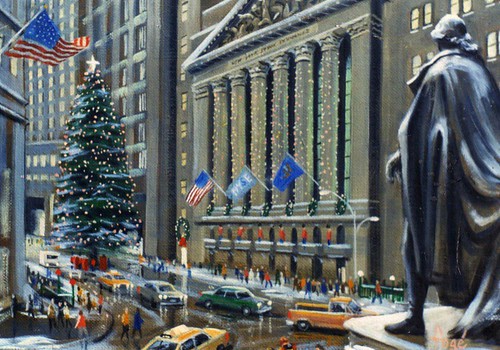

(Photo courtesy artist Bill Foge)

Stocks kept their winning streak alive last week, even if in the muted fashion typical of the stretch before Christmas.

The Standard & Poor’s 500 Index gained 3.51 points, or 0.28%, on the week, closing at 1243.91. That was its highest closing since Sept. 19, 2008, just days after the Lehman Brothers collapse. If it moves above its “pre-Lehman level,” as one market watcher called it, of around 1250, there would be some good reason for optimism about 2011.

Small-cap stocks, as measured by the Russell 2000, climbed 0.34%, to 779.51—the benchmark’s fifth consecutive weekly gain. The blue-chip Dow Jones Industrial Average was up 81.59 points, closing at 11491.91, its third straight week of gains. And the tech-heavy Nasdaq Composite notched its fourth week of gains, climbing 0.21% to 2642.97. That marked its fourth straight week of appreciation.

Behind the uniform gains, however, some pros saw an important shift taking place. “You’re seeing people de-risk, to some extent,” says Mike O’Rourke, chief market strategist at BTIG. In other words, they’re starting to take profits from small caps and plow the money into more stable large caps, reversing a big trend of 2010.

FedEx (ticker: FDX) was perhaps the most interesting of the big stocks last week. The shipping giant, considered a proxy for the economy, said its profits fell by 19% in its most recent quarter. Investors, however, didn’t punish the stock, taking comfort in the company’s raised outlook for the rest of the year. FedEx closed Friday down only slightly for the week, at about 93.

The week also brought some good economic news, helping the climate for stocks, including an uptick in sentiment among small businesses. And in Washington, the Republicans and Democrats worked out a deal on extending the Bush tax cuts, long popular on Wall Street. President Obama signed the bill on Friday.

Interest rates backed up early last week, and the dollar strengthened. The 10-year Treasury’s yield climbed to 3.568% last Thursday, the highest it’s been since May, before finishing the week at 3.329% as more buyers emerged. Still, yields have moved up steadily as 2010 has wound down. The U.S. Dollar Index, which measures the greenback against a basket of currencies, was around 80.4, versus 75 and change in early November.

Several weeks do not make a trend. There is considerable debate on whether rates will continue to rise and how much strength the dollar actually has. But no matter how they play out, these two issues are sure to be central to the stock market’s performance in 2011 (Source: Barrons Online).

Last week U.S. Stocks and Bonds both increased. Meanwhile, Foreign Stocks declined. During the last 12 months, U.S. STOCKS outperformed BONDS.

Returns through 12-17-2010 | 1-week | Y-T-D | 1-Year | 3-Years | 5-Years | 10-Years |

Bonds- BarCap Aggregate Index | .1 | 6.2 | 4.9 | 6.1 | 5.8 | 5.8 |

US Stocks-Standard & Poor’s 500 | .3 | 13.7 | 15.8 | – 2.7 | 1.8 | 1.4 |

Foreign Stocks- MS EAFE Developed Countries | -.1 | 2.6 | 4.7 | – 9.6 | – .7 | 1.0 |

For 350 years, the Royal Society has called on the world’s biggest brains to unravel the mysteries of science. Its president, Martin Rees, considering today’s big issues, asked the leading thinkers to describe the puzzles they would love to see solved. The 10 big puzzles:

What is consciousness?

What happened before the big bang?

Will science and engineering give us back our individuality?

How are we going to cope with the world’s burgeoning population?

Is there a pattern to the prime numbers?

Can we make a scientific way of thinking all pervasive?

How do we ensure humanity survives and flourishes?

Can someone explain adequately the meaning of infinite space?

Will I be able to record my brain like I can record a program on television?

Can humanity get to the stars?

“What lies behind us and what lies before us are tiny matters compared to what lies within us.”

Oliver Wendell Holmes

As I mentioned last week I was out of town on Monday, November 29 taking care of a fever. You hunters know the remedy for this sickness. I told you I would let you know if I was successful in its treatment.

Cured! At 11AM. It was a tough fever – took 5 shots but I finally kicked that fever.

The economy continues to give us mixed signals – here is a succinct list of what happened last week:

Positives:

1) Irish bailout helps to calm markets by week’s end

2) Spain and Portugal successfully sell debt, also calming nerves

3) Trichet remains patient, says no to peer pressure, doesn’t further blur line between monetary and fiscal policy

4) Chinese mfr’g indices rise to 7 mo high

5) Taiwan and South Korea PMI’s both rise

6) Thailand raises rates to face inflation

7) ISM services and mfr’g indices hold steady

8) Pending Home Sales show big upside

9) ABC confidence at 7 week high

Negatives:

1) Payrolls well below estimates and unemployment rate at 7 mo high

2) Mortgage rates continue higher, refi’s fall 22%

3) S&P/Case Shiller show softer home prices

4) Gasoline prices highest since May

5) Asia continues rate hikes

Source: The Big Picture

Americans may understandably feel that they need scorecards to keep track of the changes required by health-care reform that could affect them. It’s true that the most far-reaching of the new law’s rules do not go into effect until 2014. That’s when individuals will be mandated to obtain health insurance or pay penalties, and when insurers will no longer be able to deny coverage to people with pre-existing conditions or to charge them higher premiums.

But 77 rules either have already been implemented or will be before 2014, according to the Kaiser Family Foundation’s Health Reform timeline. Most of these are the responsibilities of insurance companies and government agencies. In late September, for instance, insurers were required to begin providing dependent coverage for adult children until they turn 26 and were prohibited from placing a cap on lifetime benefits.

Similarly, Medicare will soon implement several health-care reform changes that will affect most retirees. In 2011, preventive tests will be fully covered with no cost sharing, and brand-name drugs will be discounted by 50% for those who reach the Part D coverage gap known as the doughnut hole. Also, retirees earning more than $85,000 a year ($170,000 for couples) will pay higher Part D premiums for the first time.

2010

Individuals: Pre-existing condition insurance plan (PCIP). People who have been without insurance for six months or longer may qualify for this coverage. With $5 billion in federal subsidies, PCIP policies are expected to be the lowest-cost alternatives for those who are eligible. To qualify, individuals must provide proof (such as a letter) that they have been denied coverage because of pre-existing conditions. Even if they have been offered insurance, they are considered denied if the policy won’t cover their pre-existing conditions.

PCIP plans are available in all 50 states and their benefits are federally mandated—out-of-pocket limits, for instance, cannot be more than those for health savings accounts. And premiums are to be the same as they would be for a standard population, with adjustments for age limited to four times the rate for the youngest policyholders.

In addition to the PCIP plans created by health-care reform, 34 states have their own high-risk pool plans. These state plans, most of which have been in existence for several years, will continue to operate alongside the PCIP plans. The rules for these state-sponsored plans vary widely—many, for example, do not require the individual to have been uninsured for six months. In 2014, policyholders in both PCIPs and the state-sponsored plans will be transitioned to coverage through the state-based exchanges. Information about PCIP benefits and premiums in different states is available at www.healthcare.gov/law/provisions/preexisting.

Small Businesses: Tax credits. Health-care reform takes several steps to encourage small businesses to offer health insurance to their workers. Probably the most important of these is a tax credit that starts with the 2010 tax year and that may be available to companies with fewer than 25 full-time workers. Among the criteria: The average wage for all company employees must be less than $50,000, and the employer must pay at least one-half of the workers’ premiums.

The amount of the tax credit is based on a sliding scale: Firms with fewer than 10 employees and an average wage under $25,000 will get the maximum credit, which equals 35% of the employer’s contribution to workers’ premiums. And in 2014, this top bracket will increase to 50%. For companies with more than 10 (but fewer than 25) employees, the size of the credit is smaller, and in some cases is zero. Finally, businesses can use this credit for no more than six years (and can use the 50% credit for only two years).

Early retiree reinsurance program. Since its start in June, more than 2,000 companies have been approved for this program, which subsidizes employers’ coverage for retirees ages 55-64 who are not eligible for Medicare. Although businesses of all sizes can apply, it’s expected that mostly small businesses will participate because relatively few of them offer health coverage to early retirees.

Under the rules, the government will reimburse businesses for 80% of retiree claims that fall between $15,000 and $90,000. Employers can then use that money to reduce premiums and other health-care costs. The program is scheduled to last until 2014, but many believe that its $5 billion funding will be exhausted within two years.

2011

Individuals: Health savings accounts, health reimbursement accounts and flexible spending accounts. Health-care reform made two short-term tweaks to these tax-advantaged health accounts, both of which become effective in 2011. First, money from HSAs, HRAs and FSAs can no longer be used to buy over-the-counter drugs unless they are prescribed by a physician.

The other change applies only to health savings accounts, where the penalty for using HSA funds for non-medical expenses before age 65 will double from 10% to 20% (for Archer Medical Savings Accounts, the penalty goes from 15% to 20%). The 2011 amounts for HSA contributions, minimum deductibles and maximum out-of-pocket limits are the same as in 2010.

Small Businesses: W-2 reporting. Beginning with the 2011 tax year, employers will be required to show on Form W-2 the total cost of employer-provided health insurance. Initially this provision is for information only. Then in 2018 insurers will pay an excise tax on so-called Cadillac plans—those whose total cost as shown on the W-2 exceeds a certain threshold. The tax will apply only to the portion of the cost that exceeds the threshold.

SIMPLE cafeteria safe harbor. Companies with fewer than 100 employees may take advantage of a health-care reform provision that allows them to establish cafeteria (Section 125) plans for workers without complying with Section 125’s strict nondiscrimination rules. The new law does this by establishing a safe harbor with rules that are easier to comply with and that reduce administrative costs; moreover, companies can use the safe harbor until their number of employees reaches 200.

Wellness grants. Companies with fewer than 100 employees can qualify for $200 million in grants over a five-year period if they start wellness programs. To be eligible, businesses cannot have had wellness programs in existence as of March 23, 2010 (the date that the health-care reform act was signed into law), but can apply for funds if they started (or will start) such programs after that date. The grants are to be focused on specific needs—nutrition, smoking cessation, physical fitness and stress management (Source: Financial Advisor magazine).