American Rescue Plan

For tax year 2021 only, the amount of the child and

dependent care tax credit is significantly enhanced under the American Rescue

Plan Act of 2021. In addition, the maximum exclusion of employer-provided

dependent care assistance is also increased. READ

MORE

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will discuss: Charitable Giving during WDIY’s Spring Membership Drive.

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

We are less than one month away from the tax filing deadline – April 18. If our team is preparing your return(s), you must get your information and tax documents to us now. Remember that even filing for an extension requires information and time to complete. Reach out to us today if you need to coordinate delivery.

Current Market Observations

by William Henderson, Chief Investment Officer

In much the same way we have seen violent selloffs precipitated by a risk-off trade, last week we saw a massive rally in equities and a related risk-on trade across all equity market sectors. The major market indexes posted their largest weekly gains since November 2020. The Dow Jones Industrial Average rose +5.5%, the S&P 500 Index rose +6.2% and the NASDAQ jumped higher by +8.2%. We have often spoken about the pitfalls of market timing and risks of missing the “big-move” days, well last week was a big-move week that rewarded investors that stayed the course and remained committed to their long-term investment plan. Year-to-date returns, while still in negative territory for the year, gained back a lot of their losses thus far in 2022. Year-to-date, the Dow Jones Industrial Average is down -3.9%, the S&P 500 Index is down -6.1% and the NASDAQ, gaining back over half of its year-to-date loss is now down -11.1% in 2022.

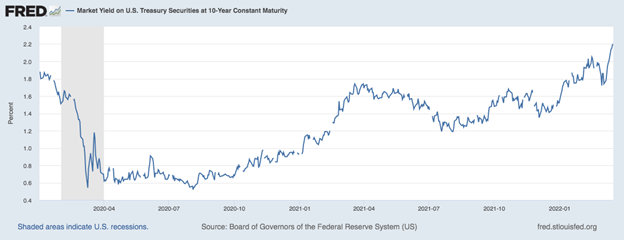

In potentially the least anticipated move of the year, the FOMC (Federal Open Market Committee) raised interest rates by a quarter of a point for the first time since 2018. Further, Fed Chair, Jay Powell, projected a clear path for 2022 with as many as six additional rate hikes bringing short-term rates to 1.75-2.00% by year-end 2022. Amid this news and continued high inflation readings, prices of government bonds fell, sending yields on U.S. Treasury Bonds higher for the second week in a row. The yield on the benchmark 10-Year U.S. Treasury Bond rose to 2.14% on Friday – the highest level in three years and up sharply from 1.73% just two weeks ago when the Ukraine / Russia war forced a temporary flight to quality amid major global geopolitical uncertainty. (See the chart below from the Federal Reserve Bank of St. Louis showing the 10-Year U.S. Treasury over the past three years.)

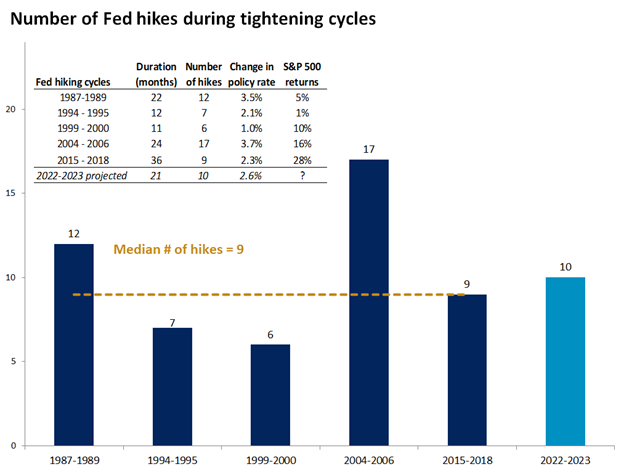

Despite the continued geopolitical uncertainty, inflation in the U.S. is clearly the dominant story and the absolute focus of the Fed. Chairman Powell is intent on raising rates this year to combat the strongest inflation data in 40 years. Price pressures exist on many fronts beyond those impacted by the pandemic and the resultant supply-chain crunch. Higher prices are being seen in autos, food, housing, rents, and many critical commodities such as oil and nickel, which are further pressured due to economic sanctions on Russia. During Powell’s press conference, after the FOMC meeting, he mentioned that Fed policymakers are now projecting inflation (as measured by core Personal Consumption Expenditure or PCE) to reach 4.1%, up from their previous projection of 2.7%. Policymakers are clearly acknowledging that inflation will remain elevated for an extended period, and they are intent on gradually raising rates to combat inflated prices. While interest rate hikes are on the horizon for 2022 and into 2023, it does not mean that equities will perform poorly. In fact, over previous rate hiking cycles, equities markets have performed quite well. (See the chart below from FactSet and Edward Jones showing previous rate hike cycles and returns of the S&P 500 Index.)

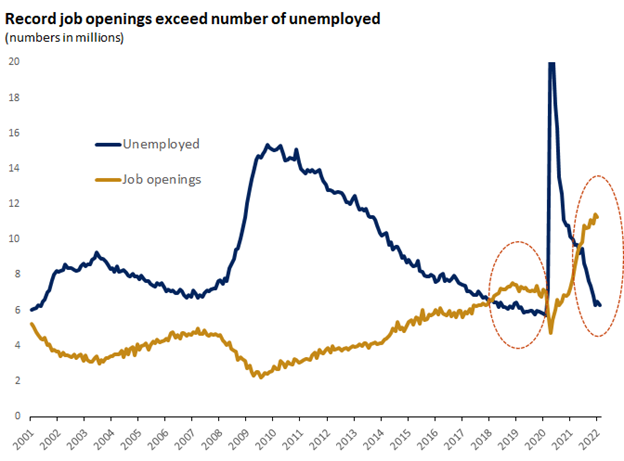

When you review the fundamentals of the U.S. economy and by extension the equity markets, the foundation for strength in both continues. In fact, most major components of the economy: housing, bank health, corporate strength, consumer health and labor remain solid. Chairman Powell pointed to the extraordinarily strong economy and tight labor conditions as additional reasons why they were raising rates at this time. Pointedly, unemployment is at a near record low 3.8%, while job openings continue to exceed the number of unemployed leaving a very tight labor market as a result. (See the chart below from FactSet showing the gap between job openings and the unemployed). The widening gap shown is evidence of tight labor conditions.

It is difficult, if not impossible, to project market returns weeks ahead, let alone months and years. The geopolitical concerns remain economic headwinds specifically the Russia / Ukraine war and price pressures in critical commodities like oil and rare earth metals and, as we have mentioned multiple times, markets hate uncertainty. The road ahead will be choppy and uncertain, and the Fed is attempting the oft impossible “economic soft-landing” of raising interest rates to stifle inflation, but not bringing the economy to a halt. As witnessed by last week’s stellar rally in equity markets, hiding on the sidelines is not a winning strategy.

The Numbers & “Heat Map”

THE NUMBERS

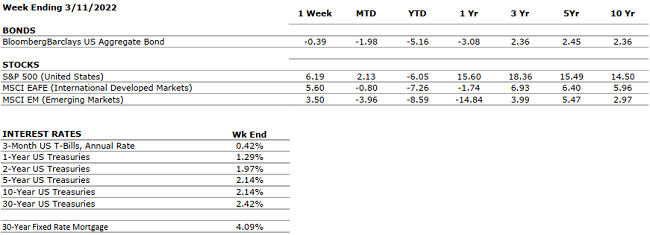

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. Real GDP growth for Q4 2021 increased at an annual rate of 7.0% compared to 2.3% in Q3 (according to second estimate). The acceleration was driven primarily by private inventory investment. Real GDP increased by 5.7% in 2021 versus a decrease of -3.4% in 2020. Disposable income saw a slight increase of 0.3% and personal saving rate decreased to 7.4% in Q4 from the previous 9.5% in Q3 highlighting increased consumer spending. |

|

CORPORATE EARNINGS |

POSITIVE |

Fourth quarter earnings showed strong results with 76% of S&P500 companies beating estimated earnings and 78% of companies reporting revenues in excess of forecasts. The blended growth rate for 2021 was 30.7%. For Q1 2022 the estimated earnings growth rate is 4.8% – the lowest since Q4 2020 (3.8%). So far, three out of seven companies reported a positive EPS surprise and six beat revenue expectations. |

|

EMPLOYMENT |

POSITIVE |

Total nonfarm payroll employment rose by 678,000 in February, and the unemployment rate edged down from 4% to 3.8%. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, health care, and construction. |

|

INFLATION |

NEGATIVE |

CPI rose 7.9% year-over-year in February 2022, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Inflation concerns are clearly impacting the markets, the FED and consumer behavior. |

|

FISCAL POLICY |

NEUTRAL |

Congress passed a $1.5 trillion spending package expected to be signed into law next week. Republicans rejected any additional COVID-19 related aid, which was removed from the bill. $13.6 billion aid package to help Ukraine saw strong bipartisan support. The Violence Against Women Act was reauthorized and Democrats pushed for a 6.7% increase in domestic spending. |

|

MONETARY POLICY |

NEUTRAL |

The Fed raised rates by the expected 25 bps last week and Jay Powell projected a clear path for 2022 with as many as 6 additional rate hikes bringing short-term rates to 1.75-2.00% by year end 2022. Reduction of the Fed’s balance sheet was not mentioned. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

The conflict between Russia and Ukraine keeps worsening as negotiations are not leading to any solutions and attacks by Russia do not cease. Russia requested China’s military and economic assistance as the U.S., E.U., and U.K. continue to support Ukraine and sanction Russia. COVID -19 restrictions are easing across the world. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian- Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“You should never make a permanent decision based on a temporary emotion.”– Unknown

Tax Corner – 2022 Tax Planning

Cryptocurrency and Virtual Currency IRS Guidance

Virtual currency transactions are taxable by law just like transactions in any other property. The IRS is aware that some taxpayers with virtual currency transactions may have incorrectly reported or failed to report income and pay the related tax. Therefore, it is actively addressing potential non-compliance in this area. Millions of taxpayers may find themselves the target of a new IRS initiative called Operation Hidden Treasure.

READ MORE

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will answer a fourth installment of Listener Tax Questions.

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Current Market Observations

by William Henderson, Chief Investment Officer

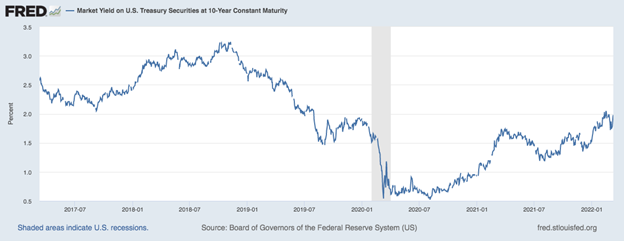

All major market indexes fell last week adding to an already poor start of the year in equity markets. Even a wild upward rally on Wednesday was not enough to thwart negative returns across the board. The Dow Jones Industrial Average fell -2.0%, the S&P 500 Index fell -2.9% and the NASDAQ lost -3.5%. Year-to-date returns have stayed well into negative territory for all three major market indexes. Year-to-date, the Dow Jones Industrial Average is down -8.9%, the S&P 500 Index is down -11.5% and the NASDAQ has moved into technical “Bear Market” territory being down -17.8%. The Russia / Ukraine war has taken a triple toll on the markets: pushing oil higher, further impacting overall inflation, and finally impacting U.S. Consumer Sentiment. Inflation fears and this week’s FOMC (Federal Open Market Committee) meeting, where markets are expecting the Fed to raise interest rates for the first time in three years, negatively impacted U.S. Treasury bonds leaving us with a very volatile week in fixed income markets. After finishing the previous week at 1.73%, the yield on the 10-Year U.S. Treasury bond jumped last week by 27 basis points to close at 2.00%. (See the chart below from the Federal Reserve Bank of St. Louis).

The yield on the 10-Year U.S. Treasury is now well off the dramatic all-time low of 0.50% hit during the peak of the COVID-19 outbreak and is working its way back to pre-pandemic levels. However, even as market participants are seeing higher yields, remember that if fear and uncertainty exist investors will need the risk management provided by fixed income securities.

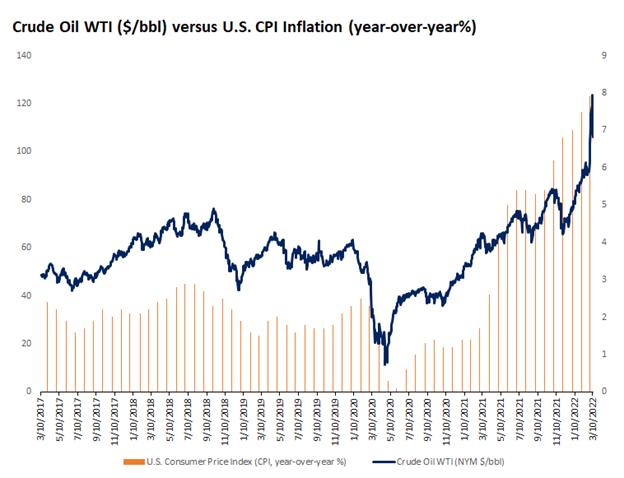

As mentioned, inflation, as measured by the U.S. CPI (Consumer Price Index), for February 2022 came in at 7.9% versus 2021, a 40-year high. All sectors, led by higher energy prices, showed increases including food and rent. See the chart below from FactSet showing oil prices (WTI Crude – left scale) and Inflation (U.S. CPI – right scale) and their close correlation.

Critically, understand that the inflation data is backward looking information from February 2022 and therefore has not even considered the recent run up in oil prices during the month of March. This gives us a lot more confidence around the Fed’s plan for higher interest rates soon.

Another data point that has us worried was last week’s release of the March preliminary University of Michigan Consumer Sentiment Index (previously called Consumer Confidence Index), which came in lower than expected at 59.7, versus a Bloomberg estimate of 61.0. At that level, the measure of consumer sentiment is the lowest since 2011 and well off the highs hit at the beginning of 2021 when COVID-19 was waning, and the geopolitical climate was a lot calmer. Throw in significantly higher oil prices and you get a worried consumer. (See the chart below from YCharts and Valley National Financial Advisors showing U.S. Consumer Sentiment since April 2021).

We always talk about the efficiency of the markets, and we believe this to be the case today as always. Last week’s wild ride in the markets saw a 650-point (+2%) swing in the Dow Jones Industrial Average on Tuesday based on rumors of positive comments from Russian leader Vladmir Putin and hints of a ceasefire. This upward move was quickly reversed when peace talks fell apart and instead Russian invasions efforts into Ukraine intensified. As we write this report, ceasefire whispers are again underway, and markets are rallying. The international pressure on Russia and by decree on Vladmir Putin are enormous. Aside from blocking monetary transactions on SWIFT, an oil embargo by the west and severe sanctions elsewhere, the U.S. Department of Justice announced an intense “hunt” for assets held in the U.S. belonging to Russian Oligarchs. Putin was desperate enough to ask China for military and economic aid for its Ukraine war. This action was met swiftly with rebuke from Washington strongly advising China against any assistance whatsoever with Russia. In fact, this week, Washington officials are scheduled to meet with Chinese counterparts in Rome to discuss the war.

It is difficult to see any outcome for Russia that ends well. The only plausible endgame is for a negotiated solution between Ukraine and Russia that gives Putin something yet allows Ukraine to remain and independent state. Unfortunately, if the war drags on, uncertainty and fear will persist, and the markets will react accordingly. Beyond the humanitarian impact the war is having, prices of such commodities as oil, natural gas and palladium are skyrocketing and inflation is the result which further impacts consumers and eventually economic growth. Expect inflation to continue for longer but the Fed will be on the move this week and their new objective will be to combat inflation. This week’s FOMC meeting will be important for reasons beyond the expected 25 basis point rate hike. The markets will be watching for language around the pace of future hikes and the scope of balance sheet reduction. This may add some calm and clarity to the markets, but it could be overshadowed by any breakdown in peace talks or unwelcomed involvement from China.

The Numbers & “Heat Map”

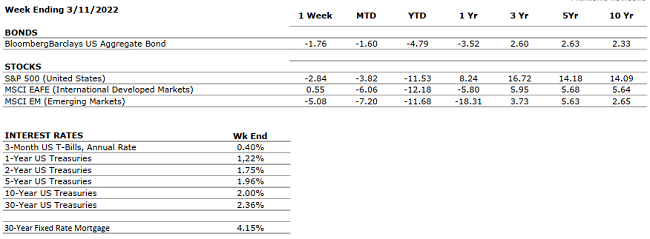

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. Real GDP growth for Q4 2021 increased at an annual rate of 7.0% compared to 2.3% in Q3 (according to second estimate). The acceleration was driven primarily by private inventory investment. Real GDP increased by 5.7% in 2021 versus a decrease of -3.4% in 2020. Disposable income saw a slight increase of 0.3% and personal saving rate decreased to 7.4% in Q4 from the previous 9.5% in Q3 highlighting increased consumer spending. |

|

CORPORATE EARNINGS |

POSITIVE |

Fourth quarter earnings are showing strong results with 76% of companies that reported earnings so far beating estimates by an average of 8.2%. Revenues also well above estimates with 78% of S&P 500 companies reporting actual revenue above forecasts. Blended earnings growth rate for 2021 was 30.7%. So far, 99% of S&P500 companies have reported earnings. |

|

EMPLOYMENT |

POSITIVE |

Total nonfarm payroll employment rose by 678,000 in February, and the unemployment rate edged down from 4% to 3.8%. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, health care, and construction. |

|

INFLATION |

NEGATIVE |

CPI rose 7.5% year-over-year in January 2022, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Inflation concerns are clearly impacting the markets, the FED and consumer behavior. February inflation numbers to be released on March 10th. |

|

FISCAL POLICY |

NEUTRAL |

President Biden is shifting from the Build Back Better Bill to a four-point economic rescue plan. Emphasis on reducing deficits and containing inflation will be critical to sway Senator Manchin. The four points will be: moving goods cheaper and faster, reducing everyday costs, promoting competition, and eliminating job barriers. |

|

MONETARY POLICY |

NEUTRAL |

Fed discussed a triple threat of tightening: raise interest rates, halt purchases, and reduce its balance sheet (reducing holdings of Treasurys and mortgage-backed securities). Gradual and steady reduction of liquidity will be key in preserving market performance (fast and sudden changes would most likely result in panic-driven sell offs). Upcoming Fed meeting on March 15- 16. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

The Russian invasion into Ukraine has now turned into a full-blown global event. US, UK and EU authorities are taking many steps to cripple Russia including closing their access to SWIFT. Commodity prices are spiking along with Oil. COVID-19 concerns continue to abate and re- openings are more the norm than closures and lockdowns. The CDC is easing rules. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian-Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also many other goods and services. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.