“Your calm mind is the ultimate weapon against your challenges. So, relax.” – Bryant McGill

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will discuss: Considerations in Home Ownership

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Did You Know…?

The IRS accepts online payments. To begin using the IRS online services, taxpayers must first create an online account. New York also requires account setups to submit payments online. Pennsylvania will allow a taxpayer to make income tax payments without the creation of an online account. New Jersey allows one time or scheduled online payments without a personal login. Our Tax Department has created a step-by-step guide to setting up and using these online payment portals. It is available HERE and on our website at valleynationalgroup.com/tax

Many other states also offer electronic payments options. Please contact us if you have any questions regarding these other state payments.

Current Market Observations

by William Henderson, Vice President / Head of Investments

Markets were weaker across the board last week as each major index show a negative return. Further, as noted earlier last month, September proved to be a losing month overall, keeping with stock market history. Last week, the Dow Jones Industrial Average lost -1.4%, the S&P 500 Index lost -2.2% and the NASDAQ closed -3.2% lower. Poor weekly showing by the indexes chipped away at year-to-date gains, but each major index remains solidly in the black column. Year-to-date, the Dow Jones Industrial Average has returned +13.7%, the S&P 500 Index +17.3% and the NASDAQ +13.6%. Bond yields rose last week as implications of reduced monetary stimulus, inflation concerns and the Fed’s previous announcement of bond purchase tapering by year 2021, sank in and investors reacted accordingly. The 10-year U.S Treasury closed the week at 1.49%, eight basis points higher than the previous week but still below the March 2021 high of 1.74%.

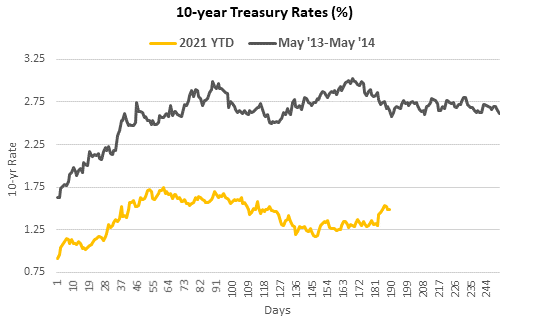

Much has been made of the Fed’s tapering and parallels have been drawn between the 2013-2014 “Taper Tantrum,” where the Fed previously announced and subsequently followed through with a substantial tapering of bond purchases. The chart below from Bloomberg shows the 10-year U.S. Treasury during two periods of rising rates (2013-2014) and (YTD 2021). In both instances, rates rose, and volatility entered the bond markets. However, also during both periods, the stock market continued its broader bull runs.

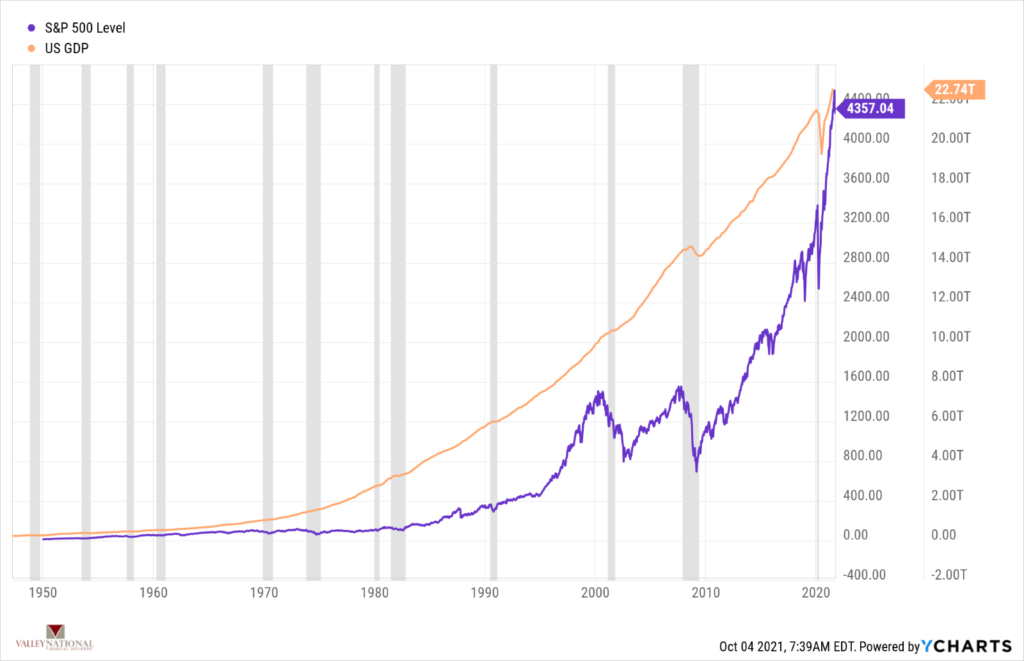

In our opinion, bond yields are impacted by the Fed while they maneuver through economic recessions and expansions, while the stock market is impacted by demographic trends and global macroeconomic factors such as GDP growth and population growth. This is evidenced by the chart below from YCharts and VNFA, where we show U.S. GDP and the S&P 500 Index from 1950 to present with recessions shaded. Notice the trend, from bottom left to upper right; and during all this time we had periods of bond yields falling and rising as impacted by the Federal Reserve’s monetary policy. Certainly, volatility in markets will never go away but trends are here to stay.

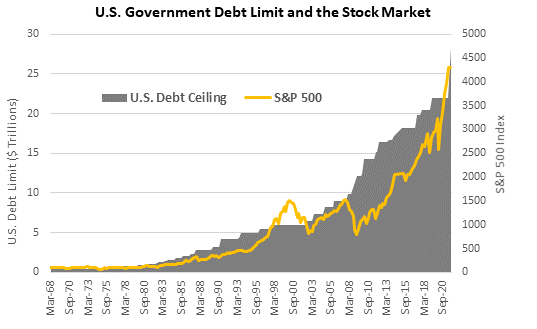

Looking beyond the U.S. economy and markets, we see some economic headwinds in a few places. China, the second largest economy behind the U.S., is dealing with supply chain concerns, energy shortages and fall out from Evergrande, the world’s largest indebted real estate developer, where bond holders are still awaiting their interest payment. Inflationary concerns are shared in many parts of the world as energy prices, food prices and labor shortages compound each other putting serious headwinds in the way of a global recovery from pandemic. In the U.S., lawmakers are still debating spending bills and an increase in the federal debt limit; both of which add unneeded uncertainty to the markets. While no one expects the U.S. Government to default on its debt, the anxiety produced by pandering on both sides of the aisle in Congress does not help the markets. Both sides know the debt limit must be increased but neither wants to be held responsible for adding more to the mountain of federal debt which already exceeds $28 trillion (about $86,000 per person in the U.S.).

It is likely that the debt limit will be increased in the eleventh hour simply because the result of not doing so would be catastrophic and neither side of Congress wants that to happen. Given how relatively low interest rates are, the cost of borrowing by the government to finance its activities also remains historically low; thereby naturally permitting greater amounts of debt. See the chart below from Bloomberg showing U.S. Government Debt limit levels and the S&P 500 Index. The market has consistently proved itself to be more efficient and forward thinking than our own congressional leaders.

We expect the Fed to keep interest rates low even as they engage in bond purchase tapering. The economy will continue to improve while dealing with COVID-19 variants, supply chain issues, higher energy and raw material prices, and squabbling in Washington but volatility in the markets is the result. Keep focused on long-term trends and returns rather than the short-term volatility.

The Numbers & “Heat Map”

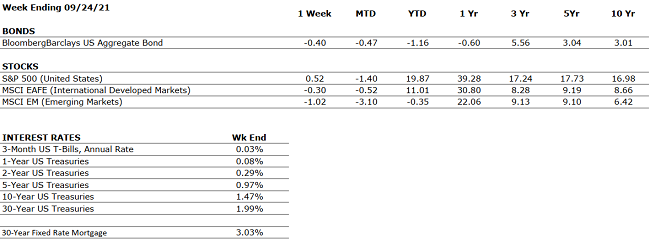

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

August retail sales surprised to the upside, increasing 0.7% month-over-month, indicating that the Delta variant has not had a material impact on the U.S. economy. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q2 sales and earnings grew an astonishing 25% and 89% respectively, when compared to the heavily depressed figures from Q2 2020. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 5.2%. In August, new job creation was disappointing, but jobless claims were as low as they have been since March 2020. |

|

INFLATION |

NEUTRAL |

CPI rose 5.3% year-over-year in August; CPI rose 5.4% in both June and July respectively. Fed Chairman Jay Powell is resolute that the high inflation is transitory and will decelerate as global supply chain bottlenecks resolve. Meanwhile, consumers expect CPI to be 5.2% over the next 12 months. |

|

FISCAL POLICY |

POSITIVE |

Congress came to a resolution to avoid the government shutdown through early December, but the debt ceiling still looms, which Treasury Secretary Yellen believes will be reached on October 18. Nonetheless, Democrats can adjust the debt ceiling without Republican support through budget reconciliation, so it seems likely a solution will be reached. |

|

MONETARY POLICY |

POSITIVE |

In recent communications, the Fed has indicated bond tapering may begin by the end of 2021 while rate hikes could commence by the end of 2022. Nonetheless, monetary policy remains relatively accommodative with rates at historical lows. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

Although the Taliban’s control in Afghanistan is concerning, it is unlikely to have a meaningful economic impact. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions caused by the Delta variant are hampering the economy, however, demand remains very strong. While supply bottlenecks will likely arise over time as new strains surface, the hold-ups appear primarily transitory and should ease progressively in a post-COVID world. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“You’ve got to think about big things while you’re doing small things, so that all the small things go in the right direction.” – Alvin Toffler

“Your Financial Choices”

October 5 will be a pre-recorded program on WDIY 881.FM. Laurie can address questions submitted during the next live broadcast.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

Welcome Brenda Hashagen to Team VNFA!

We are pleased to welcome Brenda Hashagen to our team as Administrative Assistant. Brenda will be part of a client service team, supporting Joseph Goldfeder, CFP and working out our Bethlehem headquarters. Brenda has more than 30 years of client service experience and a background in the banking industry. Most recently she worked as a Senior Branch Operations Coordinator for M&T Bank. Brenda is immediately available to assist clients at bhashagen@valleynationalgroup.com, in the office at 610-868-9000 x136 and remotely at 610-290-4180.

Current Market Observations

by William Henderson, Vice President / Head of Investments

Although the markets started the week headed down with record drops on Monday – due to a major Chinese debt holder, real estate developer Evergrande, flirting with bankruptcy, and concerns about the week’s FOMC (Federal Open Market Committee) meeting bringing Fed tapering of bond purchases – by week’s end things were in check and the markets ended flat to slightly up. Last week, the Dow Jones Industrial Average gained +0.6%, the S&P 500 Index increased +0.5%% and the NASDAQ closed unchanged. Year-to-date, the Dow Jones Industrial Average has returned +15.3%, the S&P 500 Index +19.9% and the NASDAQ +17.3%. As mentioned, China managed to stave off a major bankruptcy and the fixed income markets digested the widely anticipated tapering of the Fed’s bond-buying stimulus program. At his press conference on Wednesday, Fed Chairman Jerome Powell indicated that the Fed may cut back its bond purchases as early as this November. Further, Powell hinted that the Fed could begin a series of interest rate hikes sometime in 2022.

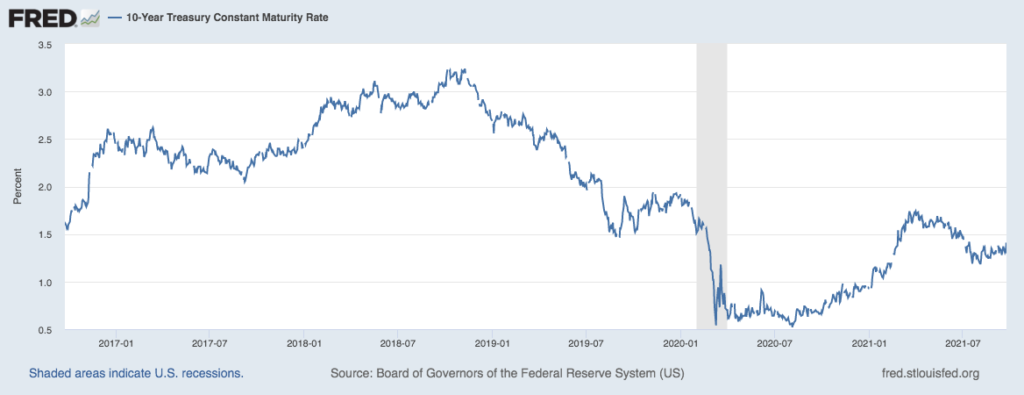

While the tapering news was expected, the fixed income markets still reacted negatively to the news. By the end of the week, the 10-year U.S. Treasury Bond reached 1.41%, eight basis points higher than the previous week, and the 10-year note’s highest level in three months (see chart below from the Federal Reserve Bank of St. Louis).

Bond yields are still off their levels seen in March of this year when the yield on the 10-year hit 1.74%. Investors should understand that in a portfolio that holds Treasury Bonds or other fixed-income securities, such as corporate investment grade bonds, those securities are held as a risk management tool and add stability to the portfolio when risky assets such as stocks sell off. While the increase in bond yields can be attributed to Powell’s comments about tapering bond purchases, investors garnered some comfort from the fact that monetary policy in the form of lower interest rates will continue for some time into 2022.

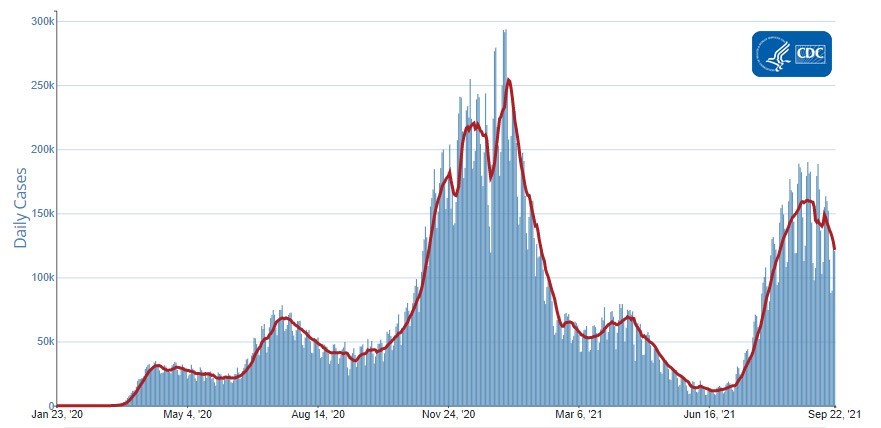

In economic news, we have seen a nice drop in weekly COVID-19 cases (see chart below from the CDC).

COVID-19 case movements are a

critical input in consumer confidence and consumer spending. Recall

the July/August upswing in COVID-19 cases and the resulting poor reading

in the August/September consumer confidence level. Two critical

sectors, retail sales and auto sales saw

softness in

early September. With cases dropping, headwinds

become tailwinds as consumer confidence and resultant consumer

spending increase, especially heading into the holiday selling season. Further,

as COVID-related extended employment benefits end, watch for a pickup in job

growth, continued

increases in wage gains, and consumers with excess savings looking for ways to

spend. Some persistent headwinds remain,

included increasing energy prices as we near fall/winter, limited inventory of

autos and

microchips and nagging supply chain disruptions.

We are always impressed by the

market’s

ability to keep things in balance, much better so than

an impressionable and impatient investor. Global

concerns always exist whether political turmoil or bankruptcy-type risks among

foreign banks and corporations. The stability and

strength of the U.S. Federal Reserve helps to offset

global concerns by stabilizing the largest

economy in the world. Higher bond yields worry some investors,

and they whisper “Taper Tantrum” but higher

yields also indicate the

economy is well on its way to a healthy recovery. Lastly,

there’s

always sector jockeying within the stock market with growth outpacing value and

then vice versa or tech selling off but energy rallying.

The Fed is keeping monetary stimulus policy

in place well into 2022, the consumer is healthy and still eager to spend, and

corporate and bank balance sheets remain the

strongest we have seen in years. Headwinds

– tailwinds – balance.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

August retail sales surprised to the upside, increasing 0.7% month-over-month, indicating that the Delta Variant has not had a material impact on the U.S. economy. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q2 sales and earnings grew an astonishing 25% and 89% respectively, when compared to the heavily depressed figures from Q2 2020. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 5.2%. In August, new job creation was disappointing, but jobless claims were as low as they have been since March 2020. |

|

INFLATION |

NEUTRAL |

CPI rose 5.3% year-over-year in August; CPI rose 5.4% in both June and July respectively. Fed Chairman Jay Powell is resolute that the high inflation is transitory and will decelerate as global supply chain bottlenecks resolve. Meanwhile, consumers expect CPI to be 5.2% over the next 12 months. |

|

FISCAL POLICY |

POSITIVE |

The Senate passed a $1 trillion infrastructure package. The bill is expected to be voted on by The House by the end of this year. |

|

MONETARY POLICY |

POSITIVE |

In recent communications, the Fed has indicated bond tapering may begin by the end of 2021 while rate hikes could commence by the end of 2022. Nonetheless, monetary policy remains relatively accommodative with rates at historical lows. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

Although the Taliban’s control in Afghanistan is concerning, it is unlikely to have a meaningful economic impact. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and accommodative fiscal and monetary policies in place, 2021 is shaping up as one of the strongest economic years on record. The primary risk at present is that of persistent inflation which begets higher interest rates. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.