“I look to the future because that’s where I’m going to spend the rest of my life.” – George Burns

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will discuss: Planning for Unknowns – tax rates, Social Security, death.

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA In the Community

Join Team VNFA in honoring or remembering loved ones at the Wings of Hope Butterfly Release this weekend – Sunday, September 12 at 1 p.m. The free event at Cedar Crest College is a special event of the Cancer Support Community of the Greater Lehigh Valley. LEARN MORE

Tax Reminder

Third quarter estimated tax payments are due September 15, 2021. These estimates may include federal, state and/or local vouchers depending on your situation.

There may be situations where the estimates were generated, but an overpayment was applied in full or in part. If your income or withholdings have significantly changed since last year, please contact your tax preparer to review. If you change or do not make the estimates, please let your tax preparer know at tax filing time.

Current Market Observations

by William Henderson, Vice President / Head of Investments

In front of a Labor Day holiday weekend, stock markets closed the week with mixed returns and a quiet Friday trading session. Last week, the Dow Jones Industrial Average lost -0.2%, the S&P 500 Index gained +0.6% and the NASDAQ gained +1.6%. Regardless of the modest mixed results, 2021 year-to-date returns remain solidly in the black column with double-digit returns across all major indexes. Year-to-date, the Dow Jones Industrial Average has returned +17.1%, the S&P 500 Index +22.0% and the NASDAQ +19.8%. A weaker than expected jobs report on Friday suggested the Fed may remain on hold for rate hikes; patiently waiting for the unemployment rate to reach the targeted 4.5%. Regardless of the weaker economic news, U.S. Treasury Bonds sold off by the end of the week as thin trading on Wall Street continued to believe the Fed will taper its bond purchases by year end. The yield on the 10-year U.S. Treasury rose five basis points to 1.36% from 1.31% the previous week. The current 1.36% on the 10-Year U.S. Treasury is 38 basis points lower than the 1.74% yield level hit in March of this year.

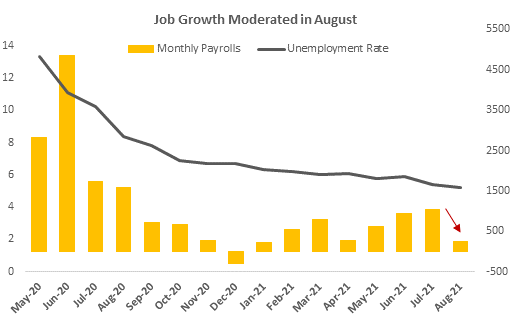

As mentioned above, the August employment report released on Friday showed a recovery hitting a small bump in the road. Monthly job gains totaled 235,000, significantly below economist’s expectations and a drop of 800,000 from July report. Renewed concerns around the Delta-variant of COVID-19 pointedly slowed job growth in the leisure and hospitality sector, emphasizing the results of resurfacing pandemic restrictions. (See the chart below from Bloomberg showing monthly payrolls and the unemployment rate.)

While the jobs report was weaker than expected, it is unlikely that this is the new direction of the economic recovery. A lot of noise could have been in that number including, summer job cessations due to students returning to school. Last weekend also marked the end of the Pandemic Unemployment Assistance, which in theory, should force many people back to a labor force starving for employees in many sectors and regions of the U.S. August’s weak labor number certainly gives the Fed some cover for delaying any bond purchase tapering and any thoughts of raising rates. The general direction of labor and the Fed’s position should keep the economic recovery on track.

Cornerstone Macro released a quick study on stock market sector rotation trading, i.e., growth to value or vice versa trades. “Despite all the machinations and zigging and zagging and rotation talk, the long-term winners remain in place,” the study noted. “From the March 2009 Financial Crisis low to present, only two Sectors have outperformed the market, Technology and Consumer Discretionary. One has paced the market – Health Care – while all the others have lagged.” From 2009 – 2021, Information Technology has returned +1106%, Consumer Discretionary +766% and Healthcare +415%, all other sectors underperformed the S&P 500 Index at +402%. The point of their study was simply to show that long-term investing and a long-term commitment is a winning “trade.” Further, an emphasis on investing in sectors which favor growth (technology) and demographic trends like aging western economies (health care) has historically proven to be additive to that trade.

We remain steadfast in our opinion that a dedication to long-term investing and solid financial planning rather than gimmicks like “market timing” or “sector rotation trading” is the only winning trade for investors.

The Numbers & “Heat Map”

THE NUMBERS

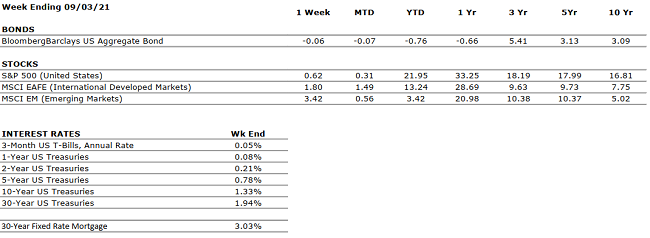

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

July retail sales declined 1.1% vs. June 2021 but are 15.8% higher than July 2020. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q2 sales and earnings grew an astonishing 25% and 89%, respectively, when compared to the heavily depressed figures from Q2 2020. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 5.2%. In August, new job creation was disappointing, but jobless claims were as low as they have been since March 2020. |

|

INFLATION |

NEUTRAL |

Inflation remained at 5.4% year-over-year in July, the same reading as in June. Fed Chairman Jay Powell believes that the high inflation is transitory and will decelerate as global supply chain bottlenecks resolve. |

|

FISCAL POLICY |

POSITIVE |

The Senate passed a $1 trillion infrastructure package. The bill is expected to be voted on by The House by the end of this year. |

|

MONETARY POLICY |

POSITIVE |

The Federal Reserve has indicated that it does not plan to increase interest rates until 2023. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

The Taliban’s control in Afghanistan is causing uncertainty and unrest around the globe. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and accommodative fiscal and monetary policies in place, 2021 is shaping up as one of the strongest economic years on record. The primary risk at present is that of persistent inflation which begets higher interest rates. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“The power of nature can make fun of the power of man at any time!” – Mehmet Murat Ildan

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will discuss: Paying taxes – self-employed vs employee

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

In observance of the Memorial Day holiday our offices will be closed on Monday, September 6.

Current Market Observations

by William Henderson, Vice President / Head of Investments

Fed Chairman Jay Powell gave the markets what they expected during his virtual Jackson Hole speech. He offered calming words around the effect of modest tapering of bond purchases by year-end and no rate hikes until unemployment is at or near the 4.5% target and average inflation hits 2%. Those few words gave solace to the markets and we saw a nice rally at the end of the week. Last week, the Dow Jones Industrial Average gained +1%, the S&P 500 Index gained +1.5% and the tech-heavy NASDAQ gained a juicy +2.8%. Strong weekly gains added to already strong year-to-date gains, shaping 2021 into quite a year for stock market returns. Year-to-date, the Dow Jones Industrial Average has returned +17.3%, the S&P 500 Index +21.2% and the NASDAQ +17.9%. The Fed’s dovish tone during Powell’s speech kept Treasury Bonds from drastically selling off on the bond tapering news. The yield on the 10-year U.S. Treasury rose five basis points to 1.31% from 1.26% the previous week. The current rate is 43 basis points lower than the 1.74% yield level hit in March of this year.

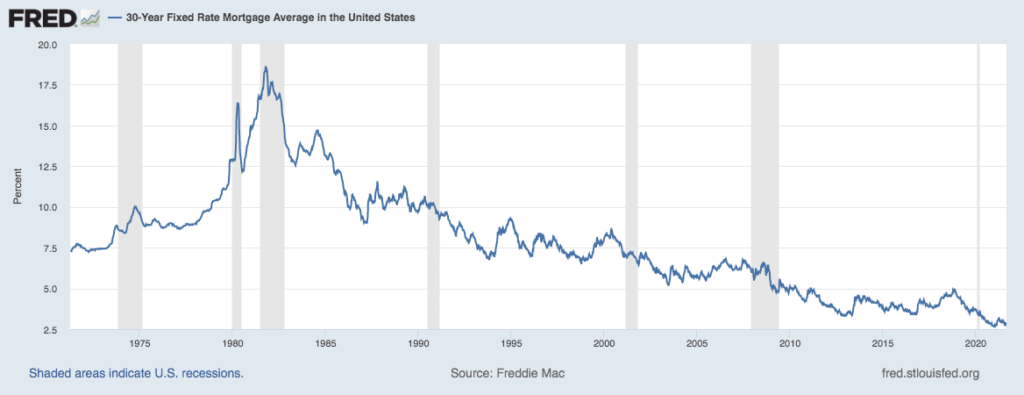

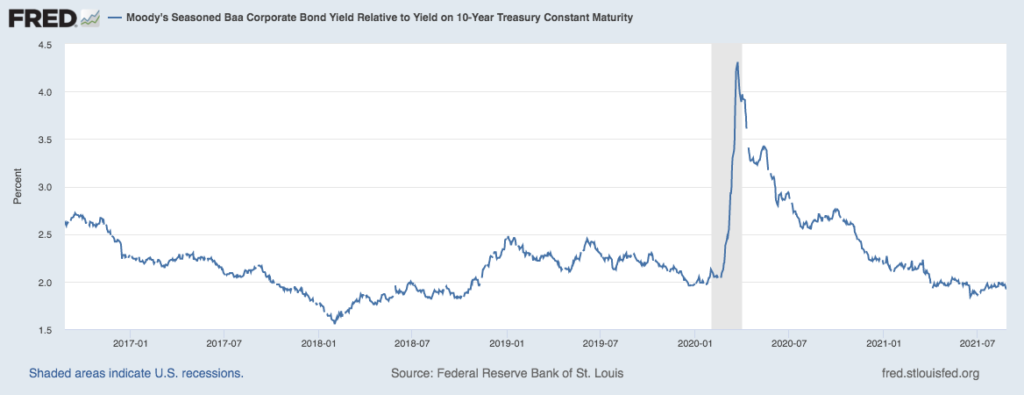

Low Treasury Bond yields impact corporate borrowing levels and mortgage rates, both of which have positive implications on the overall economy. Corporations can borrow at historically low levels and low mortgage rates also continue to boost the U.S. housing market. (See the two charts below, both from the Federal Reserve Bank of St. Louis). The first chart shows the 30-year fixed rate mortgage average in the United States and the second, by Moody’s, shows corporate bond yields relative to the 10-year Treasury (commonly called the “spread” to treasuries). Both charts are at or near record low levels.

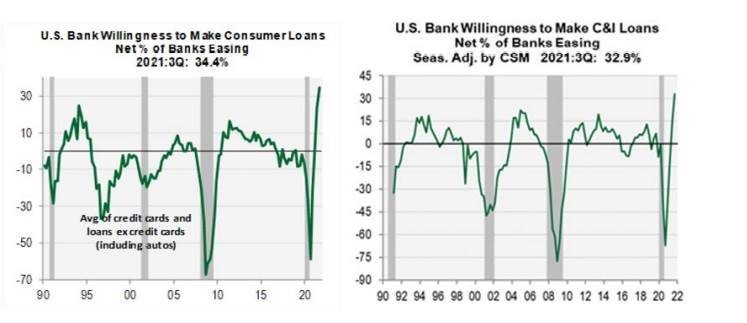

Several issues remain solidly behind the markets and the economy. First, as we have shown many times, the consumer is flush with cash (from stimulus money, decreased spending over the past year and increased savings). Second, the banking system is in great shape to fuel an already expanding economy. Two charts by Cornerstone Macro show U.S. banks willingness to make consumer loans and Commercial and Industrial Loans (C&I) at or near record levels in both cases. Low rates and banks’ strong willingness to lend make a good partnership.

And third, as mentioned above, Treasury yields remain low, allowing mortgage rates to stay low and corporations to borrow at near record low levels. All three issues point to the continuation of a healthy growing economy and a strong finish to 2021.

It would not be prudent to speak only in terms of positive indicators. Truthfully, each week we scour the headlines searching for headwinds and pockets of negativity. Concerns about unrest in Afghanistan and elsewhere across the globe, supply chain disruptions, and uncertainty around COVID-19 variants seem to always be bubbling just under the surface. Remember, every healthy bull market has frequent selloffs (sometimes by 5% or more), so it is important to realize that markets go down and markets go up; we just hope that in the end, there are more ups than downs. Like a broken record going around a turntable (are we dating ourselves?), we repeat: a long-term outlook and sound financial plan is a solid recipe for success. Pay attention to what’s behind the growth story and the solid economic foundation the Fed has built.