“If today were the last day of your life, would you want to do what you are about to do today?” – Steve Jobs

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM. Laurie will discuss Employer retirement plans and benefits.

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Welcome Dulce Cardinal to Team VNFA

We are pleased to welcome Dulce Cardinale to our team as an Administrative Assistant. Dulce has more than 18 years of experience in the financial services industry.

She will be supporting multiple financial advisors and collaborating across our team to serve clients out of our Bethlehem headquarters.

Current Market Observations

by William Henderson, Vice President / Head of Investments

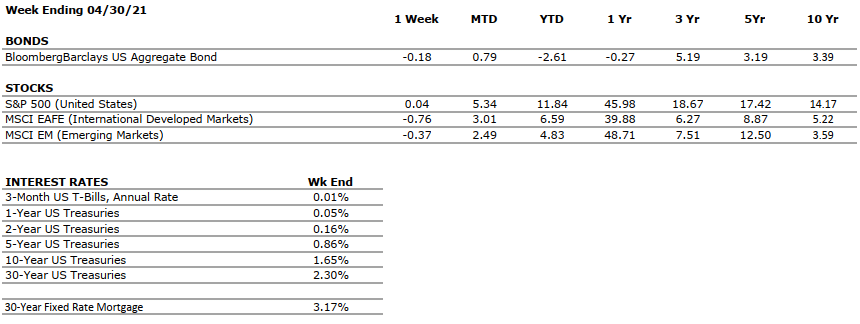

As the month of April 2021 wrapped up, we saw modest selling across the markets as both stocks and bonds ended the week lower in price. For the week that ended April 30, 2021, the Dow Jones Industrial Average fell by -0.5%, the S&P 500 Index was unchanged, and the NASDAQ fell by -0.4%. The 10-year U.S. Treasury Bond closed the week at 1.64%, higher by six basis points compared to the previous week. Bond yields move in the opposite direction of bond prices. While selling was evident, the resulting pressure on the markets did nothing to erase the strong year-to-date returns we have seen. Year-to-date, the Dow Jones Industrial Average has returned +11.3%, the S&P 500 Index +11.8% and the NASDAQ +8.6%.

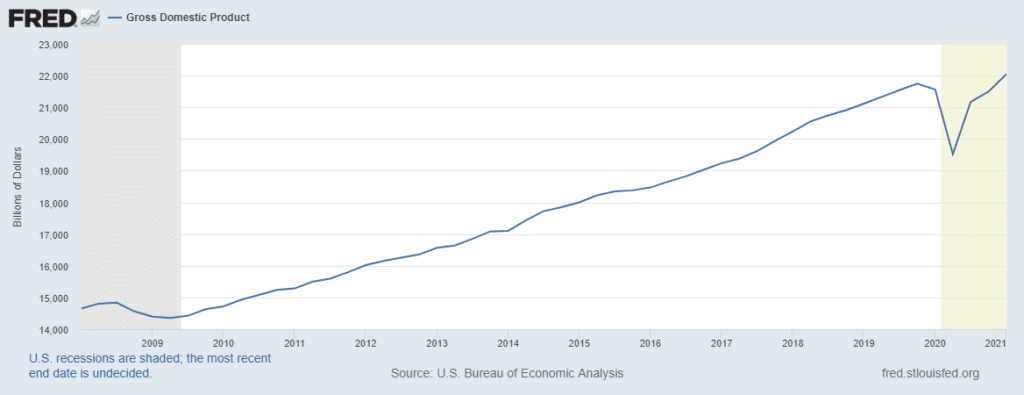

First quarter 2021 U.S. GDP was released last week, and the number was a blow out, as expected. With the help of two rounds of stimulus payments and continued progress in vaccinations, first-quarter GDP grew by 6.4% on an annualized basis up from 4.3% in the fourth quarter of 2020. The chart below from the Federal Reserve Bank of St. Louis, shows GDP is now only 1% below its previous high and is clearly on track to return to pre-pandemic levels as soon as the second quarter of 2021. Further, economic activity was strong in consumer spending, up 10.7% in the first quarter, and business investment up a solid 9.9% in the same period.

Last week’s selling took place in the technology sector, specifically production firms related to oil or oil production. The price of West Texas Intermediate crude oil fell more than 2% last week and is now running 4% below the high hit at the beginning of March 2021. While that may be bad news for oil drillers, it is good news for the rare person these days that is worried about inflation.

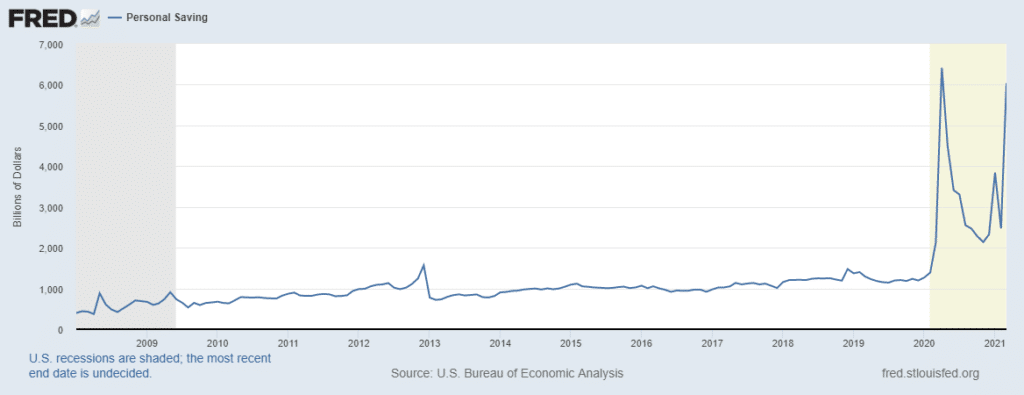

Last week also produced some winners; importantly we saw strong performance in “reopening-sensitive” stocks such as Norwegian Cruise Lines and American Airlines. As vaccine distribution continues across the country, more and more sectors of the economy will open, and the consumer will be released to spend the cash hoard they have amassed over the past year. See the graph below from the Federal Reserve Bank of St. Louis showing the personal savings rate for the U.S. households.

As we have said for many weeks now, the building blocks of vaccine distribution, healthy consumer and corporate balance sheets, record fiscal stimulus and continued monetary stimulus, are all in place to propel the economy and markets forward well into 2022. Confirming the monetary stimulus, last week U.S. Fed Chairman Jerome Powell, in his press conference after the FOMC meeting, stuck to his dovish tune on interest rates and nearly guaranteed that rates will stay low for a long time. The Fed remains laser-focused on employment and inflation and neither are meeting the target they have set: full employment and inflation averaging 2% per year.

As a final boost to consumer spirits, resulting from favorable progress on fighting the pandemic, President Biden announced eased restrictions on wearing masks outdoors and several major cities, including New York and Philadelphia, will completely “reopen” July 1. Vastly positive economic conditions exist in the U.S. and we expect continuation of the same, even in the face of potentially higher personal and corporate income tax rates.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The economy expanded at a 6.4% annualized pace in Q1. At the current rate, U.S. GDP will return to pre-COVID levels by midyear. |

|

CORPORATE EARNINGS |

POSITIVE |

With over half of S&P constituents having reported Q1 earnings, sales and earnings growth have come in at 9% and 45%, respectively, representing extremely strong results. |

|

EMPLOYMENT |

POSITIVE |

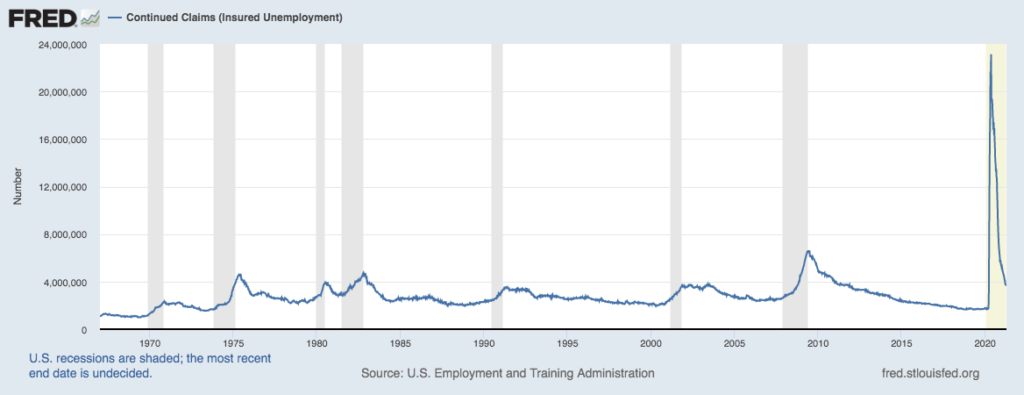

The unemployment rate declined to 6% in March, from 6.2% in February |

|

INFLATION |

POSITIVE |

Inflation was 2.6% in March. The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has generally been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden recently unveiled a stimulus package directed towards infrastructure that would total more than $2 trillion over eight years. President Biden is also considering a significant capital gains tax increase. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve continues to indicate that the monetary environment will remain very accommodative for the foreseeable future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and highly accommodative fiscal and monetary policies in place, 2021 may be one of the strongest economic years on record. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Pass on what you have learned. Strength, mastery. But weakness, folly, failure also. Yes, failure most of all. The greatest teacher, failure is.” – Yoda

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM. Laurie and her guest David Ellowitch, CFP® will discuss: The SECURE ACT – New Planning

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

TAX TIPS

Tax Day is Monday, May 17!

If your return has already been prepared, make sure to sign and return your 8879 forms to us authorizing filing. This is the final step for clients to make sure returns are filed with and accepted by the IRS and state authorities.

If you have not yet given us your complete tax documentation, we are recommending filing an extension in most cases. Extensions will extend the final filing deadline to October 15. Please note that if it is estimated that you owe taxes, that payment will still be due by May 17.

If you worked with us to file your 2019 return and have made other arrangements for 2020 tax preparation, please notify our Tax Department as soon as possible.

From the Pros… VIDEO

Team Chat April 2021 – Trending Topics (Cryptocurrency)

Bill Henderson, Head of Investments and Matt Petrozelli, CEO, discuss Cryptocurrency. WATCH NOW

Current Market Observations

by William Henderson, Vice President / Head of Investments

As is typical in any protracted bull market, major stock indices took a pause last week. As a result, we saw some selling of equities with negative returns across all three market averages. For the week that ended April 23, 2021, the Dow Jones Industrial Average fell by -0.5%, the S&P 500 Index lost -0.1% and the NASDAQ fell by -0.3%. Profit taking and selling are typical in any market especially in one that has produced such strong results since the bottom of the pandemic in March 2020. Year-to-date returns on all market indices remain solidly in the green column; with the Dow Jones Industrial Average returning +11.9%, the S&P 500 Index +11.8% and the NASDAQ +9.0%. There were whispers of a Biden-led capital gains tax increase throughout the week and demand for less risky U.S. Treasuries stayed steady. The 10-year U.S. Treasury Bond closed the week at 1.58%, unchanged from the previous week. The market still has the facets needed to sustain favorable returns going forward. Interest rates are low, fiscal stimulus is strong, corporate balance sheets are in great shape and the vaccination rate continues to increase. Quarterly earnings seasons got into full swing last week and most reports provided evidence that the economy is gradually moving to a post-pandemic environment. The last remaining market sector to continue exhibiting weakness: travel and leisure, showed a few glimmers of hope last week. Although major airlines, including Southwest, American and United, posted weak quarterly earnings, they reported seeing significant pick up in travel demand as greater numbers of people are vaccinated and therefore becoming more comfortable traveling.

The U.S. Labor market continued to show renewed strength. According to the Department of Labor and Federal Reserve Bank of St. Louis, initial unemployment claims fell to the lowest level since the onset of the pandemic in March 2020.

While labor and manufacturing are showing renewed strength, the recovery in services on the back of vaccination efforts and the gradual lifting of social distancing measures should lead to accelerating growth over the remainder of the year for rest of the economy.

This week we have a rush of tech stock earnings reports including Tesla, Facebook, Amazon, and Google. These reports will give us a view forward to the full year of earnings if recent strength in the sector is able to continue its run.

Consumers have cash on hand and healthy personal balances sheets to fuel the economic recovery well into 2022 especially if the vaccination rate accelerates and travel and leisure returns to a normal level. Market setbacks like rumors of capital gains tax increases are visible risks that always present themselves in the short run. We like to be concerned about the long run and staying invested and staying the course is the right plan.