View/Download PDF version of Q3 Commentary (or read text below)

Equities

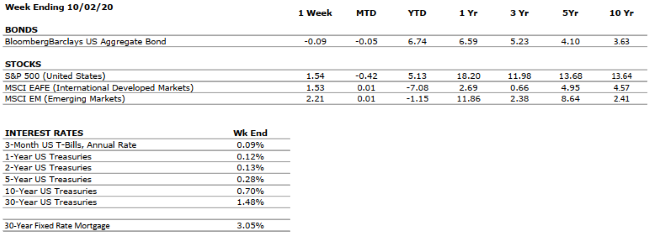

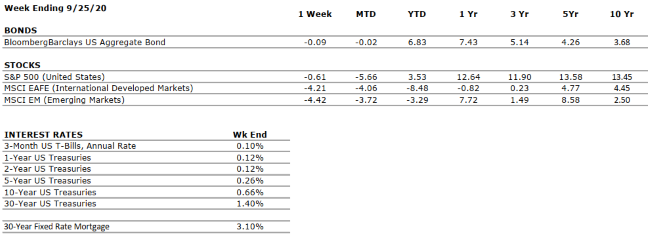

Global equities showed well in Q3, as all three major U.S. indices, International, and Emerging Markets provided positive returns in the mid-to-high single digits. However, equities were ubiquitously down in September, led by the tech-heavy Nasdaq 100 Index. After bidding up technology companies – who, in many cases, have benefitted from 2020’s societal changes – since March’s lows, investors reevaluated if such companies’ positive fundamental outlooks had been over-reflected in their stock prices. Nevertheless, the Dow Jones, S&P 500 and Nasdaq all remain in the green year-to-date, as market participants shun the paltry yields available in fixed income and conclude that their best bets for satisfactory long-term returns reside in the equity markets. In light of the volatility that pervaded Q3’s close, I am reminded of the following words from John Pierpoint (J.P.) Morgan, the grandfather of what is now the largest bank in the world, when he was asked over 100 years ago what the stock market is going to do. “It will fluctuate”, he foretold.

Fixed Income

Interest rates remain historically low, as the 10-year treasury yield hovers around 0.70%. Interest rates are representative of investors’ opportunity cost; with rates as low as they are, there is incentive to pay higher prices for equities, as discussed above, because the investor forgoes little by passing on fixed income. The Federal Reserve has communicated that rates are likely to stay low until 2023, meaning that market participants can incorporate minimal opportunity cost into their expectations for the foreseeable future. As Warren Buffett once said, “Interest rates are like gravity on [equity] valuations.” The gravitational pull on the stock market is likely to remain historically weak until inflation sustains at over 2% – something that has not materialized since 2008’s financial crisis – and central banks around the globe are forced to intervene with monetary tightening.

Outlook

The marquee event over the next three months is, obviously, the U.S. Presidential Election. While the election has wide-ranging implications, of course, its greatest pertinence with respect to financial markets is that Congress is unlikely to pass additional stimulus until the Executive Chief perch is solidified.

Covid-19 continues to alter everyday life; however, the U.S. economy has demonstrated some signs of a V-shaped recovery. Most notably, for example, the unemployment rate has retreated to 7.9%; while this figure is still considerably above historical averages, it is worth remembering that in March and April, economists debated for how long unemployment would persist in the double-digits, specifically, whether the jobless rate would remain above 10% through 2020. Additionally, certain consumer trends have emerged stronger than most anyone expected when Covid-19 roiled the markets in March. For instance, several retailers reported all-time high sales metrics in Q2.

Multiple pharmaceutical companies, including Pfizer, Moderna, and AstraZeneca, continue their phase 3 vaccine trials. At this point, it appears probable that at least one vaccine will be granted FDA approval by year-end, or, at latest, by the end of Q1 2021, and that a method of inoculation will be available to the American public by the middle of next year.

While the global economy will not be unshackled from the pandemic’s recessionary forces in the near-term, risk assets are likely to remain buoyed by accommodative monetary policy and another round of fiscal support, the latter of which will likely come to fruition in early 2021. It is conceivable that, around the same time, a vaccine will be in production and dissemination, a combination that would certainly appear facilitative of robust economic and corporate performance. In all cases, the shrewdest investment strategy is that of adherence to one’s long-term plan and resistance of short-term maneuvers.

VIDEO: Q3 2020 Market Commentary

Our CEO, Matt Petrozelli, introduces Bill

Henderson, Head of Investments who offers a review of the third quarter, and

economic outlook and perspective on long-term investing.

WATCH NOW