by Maurice (Mo) Spolan, Investment Research Analyst

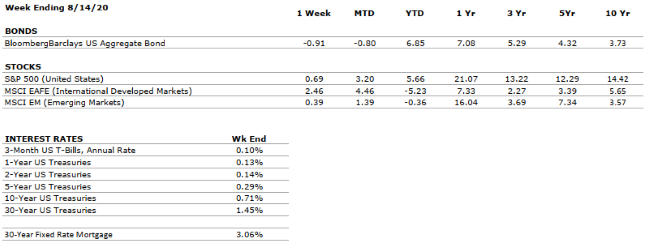

The S&P 500 was up 0.7% last week, as the index now rests less than 1% below its February all-time highs. The Barclay’s Aggregate Bond Index, by contrast, was down 0.9% as interest rates rose (bond prices decline when rates increase).

The headline economic figures of the week pertained to consumer spending, jobs and inflation. Retail sales increased 1.2% in July, a sharp deceleration from June’s 7.5% gain, but still a healthy figure in the midst of a pandemic. On the jobs front, unemployment claims fell below 1 million for the first time since March, an indication that Americans are returning to work. Last, inflation jumped 0.6%, the largest one-month increase since 1991. However, CPI is running at a moderate annualized pace of 1.6%, below the Fed’s 2% target, and more sustained hints of inflation will be required before the central bank adjusts its highly-stimulative stance.

As the presidential election looms less than three months away, Joe Biden made news by selecting Kamala Harris as his running mate. The Wall Street Journal reports that traders are bracing for a choppy finish to the year, as market volatility has historically been above average during election seasons. Also, in the political sphere, Congress broke for summer recess without passing another round of stimulus. While President Trump hopes to provide support by way of executive order, the constitutionality of his plan remains in question. The economy, particularly the consumer, is likely to suffer if no further fiscal stimulus is delivered.