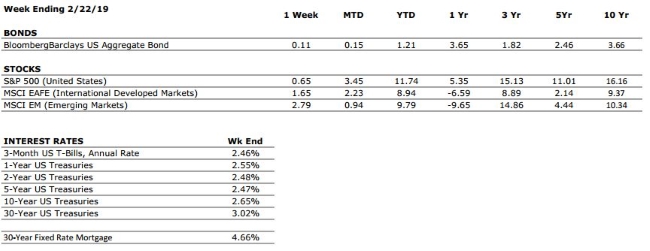

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

We have downgraded our consumer spending grade to A from A+ following weaker than expected December retail sales data and some declines in consumer confidence surveys. However, monthly data can be volatile and we still believe that the US consumer is in a healthy position. |

|

FED POLICIES |

C- |

The Federal Reserve implemented four interest rate hikes during 2018, and while the rate hike cycle appears to be on pause for now, rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

B+ |

Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. We are also beginning to see a higher number of companies reducing forward earnings guidance, a sign that earnings growth may have reached its peak in 2018. |

|

EMPLOYMENT |

A+ |

The US economy added 304,000 new jobs in January, soundly beating estimates for the second straight month. The labor market is one of the strongest components of the economic backdrop at this time. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.