Team VNFA is pleased to once again partner with WDIY 88.1 FM during this membership drive to help Second Harvest Food Bank of the Lehigh Valley and Northeast Pennsylvania. For every $100 WDIY receives in donations during the membership drive, Valley National Financial Advisors will fund 21 meals to individuals and families in our community. Last year, the partnership resulted in almost 12,000 meals. The Membership Drive began yesterday, October 12, 2020. READ MORE

Daily Archives: October 13, 2020

Current Market Observations

by William

Henderson, Vice President / Head of Investments

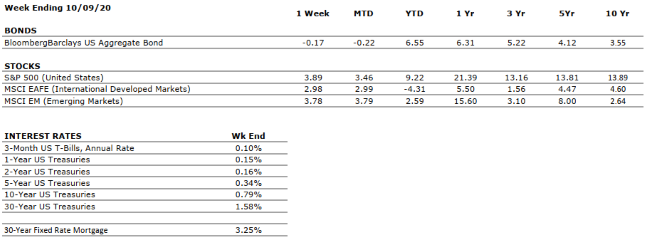

With

September in the books and the fourth quarter on everyone’s mind, the markets

looked to the renewed stimulus talks and posted some of the best weekly returns

in months. For the week ending October 9, 2020, Dow Jones Industrial

Average increased +3.3%, the S&P 500 improved by +3.7% and the NASDAQ was

up +4.6%. These weekly returns moved all three broad markets indices into

positive territory for the full year of 2020; with the Dow at +0.2%, S&P

500, +7.6% and the NASDAQ up a stunning +29.1%. While equity returns have

given investors something to smile about, bonds continue to offer nominal

returns even in the face of a steepening yield curve. The two-year U. S

Treasury Note moved two basis points higher in the week to 0.16% and the 10-year

U.S. Treasury Note rose eight basis points to 0.79%. Low rates continue to push

down mortgage rates which are fueling a strong rebound in new home sales. According

to Freddie Mac, the average 30-year fixed rate mortgage for the week ending

October 9, 2020 was a record low of 2.87%. With such low rates, buyer demand

remains robust with first-time buyers coming into the market. The demand is

particularly strong in more affordable regions of the country such as the

Midwest. The binding theme on all three markets – equities, bonds and real

estate – is the Fed’s unwavering goal of keeping rates lower for longer and

maintaining a near Zero Interest Rate Policy (ZIRP).

We continue to have concerns around a COVID-19 fall resurgence in cases. Concurrently, there is global cooperation on finding a vaccine and hopes remain that the FDA will approve one this year, with global populations actually being vaccinated by Q3 2021. Uncertainty remains around the Presidential Election, and although national polls show Joe Biden ahead over President Trump, these same pollsters and pundits had Hillary Clinton ahead by nearly the same margin in 2016. The markets seem to be pricing in a mixed or balanced government after the election rather than a “blue” or “red” wave. A mixed government typically keeps a lid on drastic policy changes by either party regardless of who is in the White House. This week watch for a fight over media camera time between the SCOTUS’ Amy Coney Barret hearings, renewed stimulus talks among Speaker Pelosi and Treasury Secretary Mnuchin, and the back and forth between President Trump and former Vice President Biden.

Staying the course and maintaining a disciplined investment policy with a keen eye towards diversification and risk management remains our policy at Valley National Financial Advisors. While major uncertainty remains in macro terms, forces exist within the economy (Fed, mortgage rates, market liquidity) that continue to fuel positive returns in the broader markets.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

GDP declined at an annualized rate of 32.9% in Q2, the fourth-largest fall in the last 100 years. In mirror opposition, Q3 GDP is expected to represent the greatest quarter-over-quarter increase in history, coming in somewhere between 25-35% on an annualized basis. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

S&P 500 earnings fell by around 1/3 in Q2, the sharpest year-over-year decline since 2008. However, some companies in certain sectors have reported strong results, such as in Retail and Cloud Computing. Q3 earnings season kicks off this week, led by the major U.S. money-center banks. |

|

EMPLOYMENT |

VERY NEGATIVE |

The unemployment rate declined to 7.9% in September, from a peak of 14.7% in April. While the rebound is material, the jobless rate remains well above the historical average. |

|

INFLATION |

POSITIVE |

Core inflation has come in at 1.7% over the last twelve months. The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

VERY POSITIVE |

At this point, it appears as though a second major Coronavirus stimulus bill will not be passed until after the Presidential Election. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve has supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

The relationship between the US and China, the world’s two largest economies, was already weakened by the trade war but has deteriorated further as a result of COVID-19. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from COVID-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system; however, economic activity remains well- below that in 2019, and uncertainty remains high. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

October is Financial Planning Month, which serves as a useful, annual checkpoint to make sure you are on track to meet your long-term financial goals. You can use this time to learn about all of your options and prioritize your goals going into the New Year. Learn more about Financial Planning at plannersearch.org/ .

Team VNFA can help! Explore the Financial Planning section of our website: valleynationalgroup.com/financial-planning/

Quote of the Week

“You are young at any age if you’re planning for tomorrow.” – Anonymous

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your

Financial Choices” show on WDIY 88.1FM: Retirement

Planning for Longevity

Laurie

can take your questions live on the air at 610-758-8810, or address those

submitted via yourfinancialchoices.com.

Recordings of past shows are available to

listen or download at both yourfinancialchoices.com and wdiy.org.