With the first half of 2021 well behind us, the second half started as simply more of the same thing. We saw positive returns across all three market indexes despite concerns about COVID variants and global growth. The Dow Jones Industrial Average rose by +0.7% last week and the S&P 500 Index and the NASDAQ both increased by +1.2%. Solid weekly gains in all three indexes allowed new highs across the board and set up very strong year-to-date gains as well. Year-to-date, the Dow Jones Industrial Average has returned +15.1%, the S&P 500 Index +17.2% and the NASDAQ +14.5%. Further, the earlier rotation between value and growth has abated as markets overall have converged upon similarly strong gains thus far in 2021. Bonds continued to be well bid and the yield on the 10-year U.S. Treasury dropped 10 basis points last week to close at 1.34%, a full 40 basis points lower than the 1.74% yield level hit in March of this year.

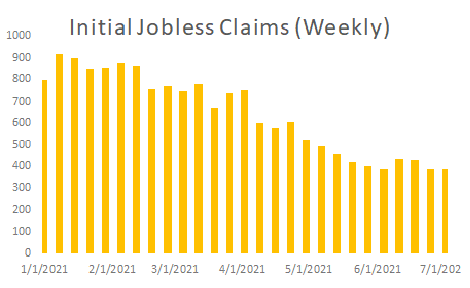

While the labor markets continue to show solid improvement, the pace of job gains has slowed a bit and last week we saw a bit of that slowness in the slight uptick the weekly jobless claims number released by the U.S. Department of Labor Department (see chart below).

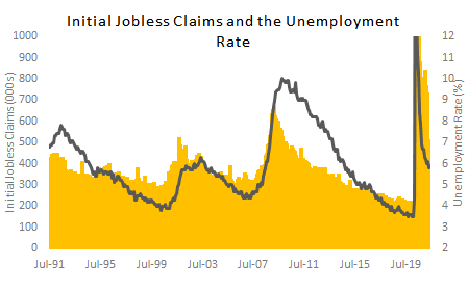

Further, while the unemployment rate continues to fall from

a pandemic high of 14.8% in April 2020 to

the current 5.9%, a

supply of and demand for labor mismatch exists (see chart below from the U.S.

Department of Labor).

One theory around this supply/demand mismatch is that during the pandemic we saw large scale demographic shifts in population as people moved residences; potentially due to COVID-19 reasons, work-from-home flexibility in family employment or simply the need to seek varied employment elsewhere. Regardless of the reasons, we may see an imbalance in worker demand and worker supply for some time and this economic oddity could weigh on the markets for a while. However, recall the Federal Reserve has been consistent in its message about two measures before they raise interest rates: the unemployment rate and inflation. We have seen inflation, transitory or not, in recent CPI numbers, but we have not seen unemployment at or near their target level of 4%, so watch for interest rates to remain low for longer, just as Chairman Jay Powell has stated repeatedly.

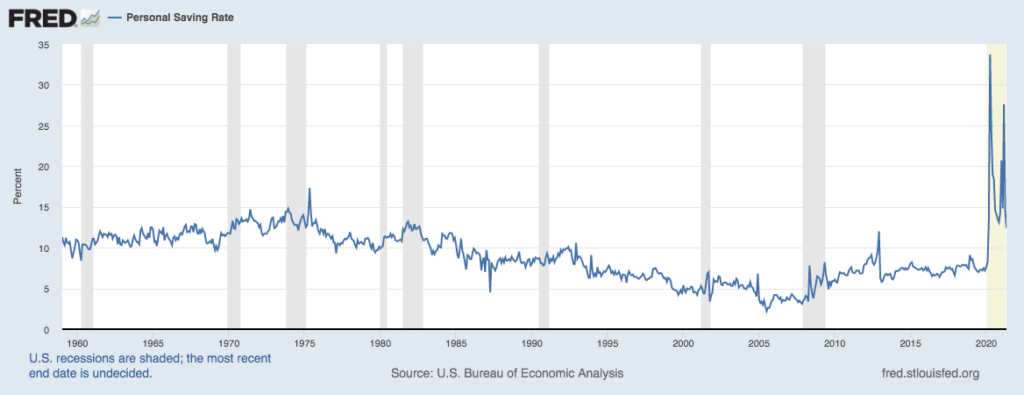

As the second half of 2021 unfolds, watch for labor to regain some strength as unemployment benefits begin to expire and workers return to work. With this acceleration in job growth, the unemployment rate will fall. As we have mentioned frequently, the consumer remains in excellent financial shape with savings rates near recent extremely high levels (see chart below from the Federal Reserve Bank of St. Louis).

Falling unemployment rates, financially healthy consumers and a cooperative Fed point to a strong economic expansion well into 2022 and certainly for the remainder of 2021. Like all economic indicators, concerns abound and can be impactful such as the emergence of a powerful COVID variant or unseen global unrest. We believe that the Federal Reserve will continue to back-stop the economy especially given an unforeseen global event.