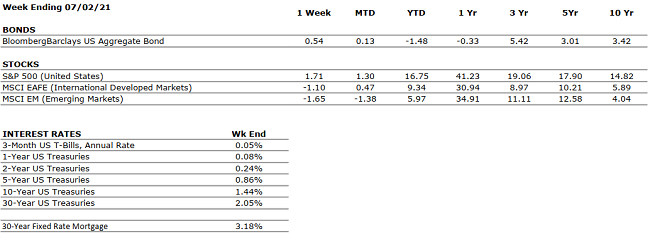

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The OECD forecasts that the global economy will grow 5.6% and 4.4% in 2021 and 2022, respectively. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q1 sales and earnings growth were very strong. Corporate earnings are likely to remain strong throughout 2021 on a “year-over-year” basis as companies compare their results to depressed 2020 numbers. |

|

EMPLOYMENT |

POSITIVE |

In June, the U.S. economy added 850,000 jobs, beating expectations handily. The unemployment rate is 5.9%, well within normal parameters. |

|

INFLATION |

NEUTRAL |

Inflation cooled somewhat in May, decelerating to a 3.5% pace year-over-year, compared to 4.5% in April. Jay Powell, Federal Reserve Chair, believes that the recent uptick in inflation is prima rily attributable to global supply chain constraints, and that inflation will slow as such constraints resolve themselves through the remainder of the year. |

|

FISCAL POLICY |

POSITIVE |

President Biden recently unveiled a stimulus package directed towards infrastructure that would total more than $2 trillion over eight years. President Biden is also considering a significant capital gains tax increase. |

|

MONETARY POLICY |

POSITIVE |

The Federal Reserve indicated this week that it plans to hike rates twice in 2023. Previously, the Fed had suggested it would not raise rates until 2024. Nonetheless, the monetary stance is accommodative in the near future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and accommodative fiscal and monetary policies in place, 2021 may be one of the strongest economic years on record. If a risk is present, it may be that the economy will overheat, thereby leading to inflation and higher interest rates. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.