This week our offices will be closed for the Thanksgiving holiday on Thursday, November 25. Our offices will also close early (1 p.m.) with the markets on Friday, November 26.

Daily Archives: November 23, 2021

Did You Know…?

The IRS released a one-page guide for taxpayers to protect from identity theft. The PDF includes tips on keeping your computer and mobile phone secure, advice to avoid phishing scams and malware, and resources to protect your tax return. View and download the guide at https://www.irs.gov/pub/irs-pdf/p4524.pdf.

Current Market Observations

by William Henderson, Vice President / Head of Investments

Last week saw a mixed market as the S&P 500 and the NASDAQ posted slight gains, but the Dow Jones Industrial Average sold off as industrial sectors such as materials, energy, and financials showed weakness. For the week’s end, the Dow Jones Industrial Average fell -1.4%, while the S&P 500 Index increased by +0.3% and the NASDAQ jumped by +1.2%. Across all major market indexes, year-to-date returns remain solid, pointing to a potentially record setting 2021. Year-to-date, the Dow Jones Industrial Average has returned +18.3%, the S&P 500 Index +26.7%, and the NASDAQ +25.3%. The 10-year U.S Treasury moved higher by two basis points closing the week at 1.57%, modestly below 1.74% level reached in March of this year. Strong inflation pressures are hinting that the Fed’s tapering of bond purchases may accelerate, and higher short-term rates could be sooner than mid-2022 as economists had predicted.

With the Thanksgiving holiday this week, the House narrowly passed President Biden’s $1.75 trillion social spending bill, sending it to the Senate. It is widely expected that the bill will languish in the Senate for several weeks where further revisions will take place. The only important news out of Washington this week was President Biden’s nomination for Federal Reserve Chair, Jerome Powell, to serve an additional term. The race for this critically important post had come down to either keeping Jay Powell for an additional term or nominating Fed Governor Lael Brainard as his replacement. As we have said often, uncertainty is the one thing the markets really fear so keeping Powell on board soothed the markets. Brainard was nominated as Vice Chair.

While inflation is running hot, and COVID-19 cases are rising outside of the U.S., the markets do not seem concerned. Look at the chart below from the Federal Bank of St. Louis showing the CBOE Volatility Index or VIX. The VIX measures the market expectation of near-term volatility conveyed by stock index option prices; essentially a quantitative way to measure risk, fear, and stress in the markets. The VIX is currently trading well below the “panic” levels seen at the beginning of the pandemic and arguably near its average trading level since 1990.

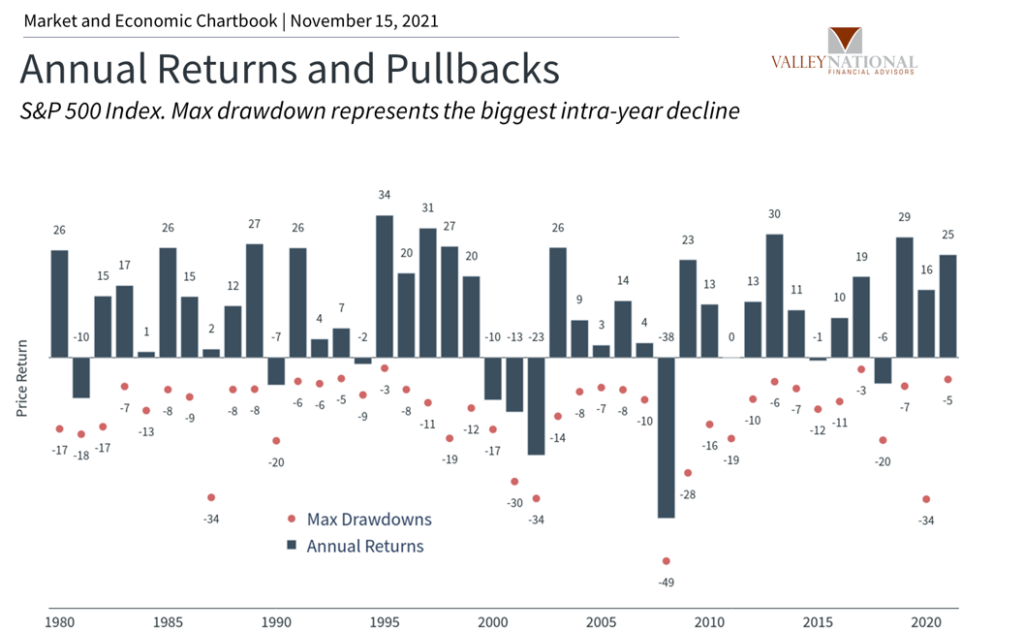

The efficient market is seeing heightened capital expenditures by corporations, positive earnings strength, healthy bank balance sheets and a consumer poised to accelerate spending, hence a very low VIX reading. The markets are quiet but are they too quiet? Remember, pull-backs happen in every bull market, and we believe pullbacks are healthy for functioning markets. See the chart below from Clearnomics and Valley National Financial Advisors showing the performance of the stock market each year (bars) and the largest intra-year decline (dots) each year. The average drop in any year is -13.5% but the long-term average of the market is +9.0% each year, regardless of the pullbacks.

Markets are efficient and volatility is a normal part of investing. The smart investor is rewarded for staying disciplined and remaining invested, especially during times of short-term market volatility.

In the United States, the CDC announced that anyone over age 18 can receive a COVID-19 booster shot. This good news comes on the heels of rising Covid-19 cases in parts of Europe. Austria, for example, initiated a national lockdown and Germany said it may consider the same as new cases continued to surge. Certainly, rising COVID-19 cases anywhere, but specifically in the EU or U.S., will weigh heavily on the financial markets and will need to be monitored closely. This week is a shortened holiday week with the markets closed for Thanksgiving on Thursday and an early close on Friday. Watch for Wednesday’s economic releases including 3Q GDP, U.S. Federal Reserve Meeting Minutes, and weekly unemployment claims – all which could give signals to market movements through year-end and into 2022.

Have a warm and family-filled Happy Thanksgiving.

The Numbers & “Heat Map”

THE NUMBERS

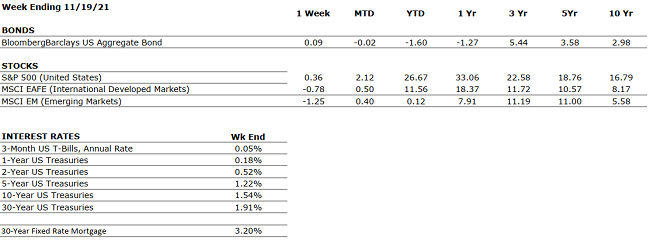

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. GDP growth decelerated to a 2% annualized pace in Q3. The slowdown was driven primarily by supply chain constraints. Economists expect a modest acceleration in Q4. |

|

CORPORATE EARNINGS |

POSITIVE |

With 95% of S&P 500 companies having reported Q3 results, sales and earnings are up 17.5% and 39%, respectively. However, company commentary suggests that the supply chain has been and will continue to be problematic in the coming quarters. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 4.6%, as of October. The labor market is very tight at present as many employers, particularly in the Leisure and Logistics sectors, are struggling to fully staff because the labor participation rate remains below pre-COVID levels. The labor shortage is one of the causes of the global supply chain glut. |

|

INFLATION |

NEUTRAL |

CPI rose 6.2% year-over-year in October, the highest increase since 1990, driven by the global supply chain backlog. Will inflation be transitory or permanent? |

|

FISCAL POLICY |

POSITIVE |

A $1.2 trillion infrastructure bill was passed by Congress. $1.75 trillion spending bill passed by Congress and also sent to Senate for revisions. |

|

MONETARY POLICY |

POSITIVE |

The Fed will begin bond tapering by November’s end. By mid-2022, all Fed bond purchases will halt. The Fed’s bong buying program works to keep interest rates low. Inflation concerns are persisting, and some are calling for faster tapering and high rates. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

COVID-19 cases are surging in parts of EU (Austria and Germany) leading to further lockdowns. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions are hampering the economy; however, demand remains very strong. While global logistics are operating far below normal efficacy, it appears the supply chain is slowly improving and may reach normalcy by mid-to-late-2022. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Be thankful for what you have. Your life, no matter how bad you think it is, is someone else’s fairy tale.” – Wayne Ayeni

“Your Financial Choices”

Tune in Wednesday, 6 PM for a pre-recorded “Your Financial Choices” on WDIY 88.1FM. Laurie will return for the next live show after the Thanksgiving holiday.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.