by William Henderson, Vice President / Head of Investments

Last week saw a mixed market as the S&P 500 and the NASDAQ posted slight gains, but the Dow Jones Industrial Average sold off as industrial sectors such as materials, energy, and financials showed weakness. For the week’s end, the Dow Jones Industrial Average fell -1.4%, while the S&P 500 Index increased by +0.3% and the NASDAQ jumped by +1.2%. Across all major market indexes, year-to-date returns remain solid, pointing to a potentially record setting 2021. Year-to-date, the Dow Jones Industrial Average has returned +18.3%, the S&P 500 Index +26.7%, and the NASDAQ +25.3%. The 10-year U.S Treasury moved higher by two basis points closing the week at 1.57%, modestly below 1.74% level reached in March of this year. Strong inflation pressures are hinting that the Fed’s tapering of bond purchases may accelerate, and higher short-term rates could be sooner than mid-2022 as economists had predicted.

With the Thanksgiving holiday this week, the House narrowly passed President Biden’s $1.75 trillion social spending bill, sending it to the Senate. It is widely expected that the bill will languish in the Senate for several weeks where further revisions will take place. The only important news out of Washington this week was President Biden’s nomination for Federal Reserve Chair, Jerome Powell, to serve an additional term. The race for this critically important post had come down to either keeping Jay Powell for an additional term or nominating Fed Governor Lael Brainard as his replacement. As we have said often, uncertainty is the one thing the markets really fear so keeping Powell on board soothed the markets. Brainard was nominated as Vice Chair.

While inflation is running hot, and COVID-19 cases are rising outside of the U.S., the markets do not seem concerned. Look at the chart below from the Federal Bank of St. Louis showing the CBOE Volatility Index or VIX. The VIX measures the market expectation of near-term volatility conveyed by stock index option prices; essentially a quantitative way to measure risk, fear, and stress in the markets. The VIX is currently trading well below the “panic” levels seen at the beginning of the pandemic and arguably near its average trading level since 1990.

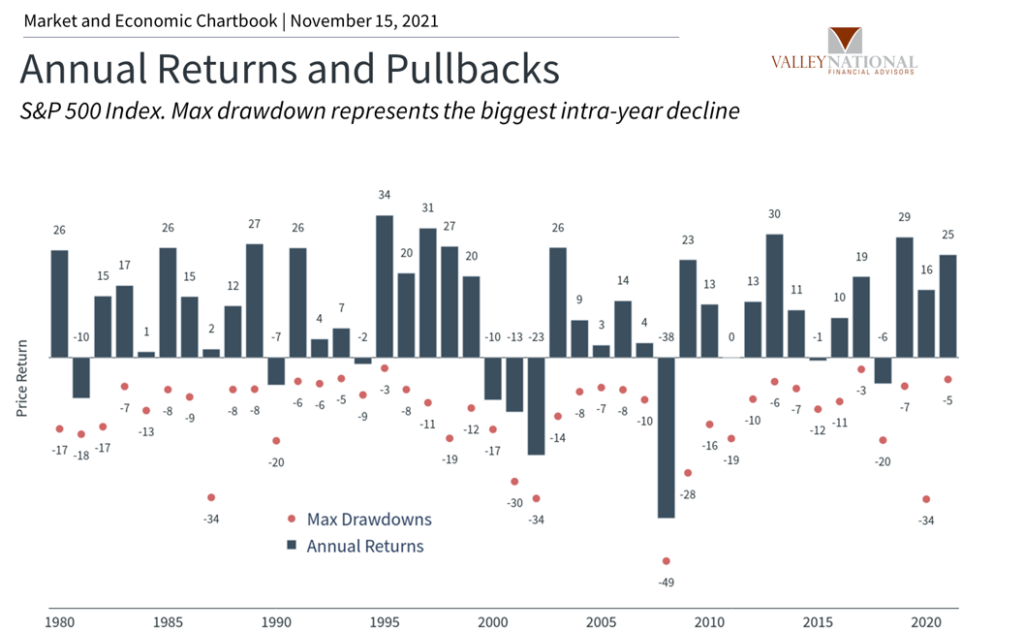

The efficient market is seeing heightened capital expenditures by corporations, positive earnings strength, healthy bank balance sheets and a consumer poised to accelerate spending, hence a very low VIX reading. The markets are quiet but are they too quiet? Remember, pull-backs happen in every bull market, and we believe pullbacks are healthy for functioning markets. See the chart below from Clearnomics and Valley National Financial Advisors showing the performance of the stock market each year (bars) and the largest intra-year decline (dots) each year. The average drop in any year is -13.5% but the long-term average of the market is +9.0% each year, regardless of the pullbacks.

Markets are efficient and volatility is a normal part of investing. The smart investor is rewarded for staying disciplined and remaining invested, especially during times of short-term market volatility.

In the United States, the CDC announced that anyone over age 18 can receive a COVID-19 booster shot. This good news comes on the heels of rising Covid-19 cases in parts of Europe. Austria, for example, initiated a national lockdown and Germany said it may consider the same as new cases continued to surge. Certainly, rising COVID-19 cases anywhere, but specifically in the EU or U.S., will weigh heavily on the financial markets and will need to be monitored closely. This week is a shortened holiday week with the markets closed for Thanksgiving on Thursday and an early close on Friday. Watch for Wednesday’s economic releases including 3Q GDP, U.S. Federal Reserve Meeting Minutes, and weekly unemployment claims – all which could give signals to market movements through year-end and into 2022.

Have a warm and family-filled Happy Thanksgiving.