by Connor Darrell

CFA, Assistant Vice President – Head of Investments

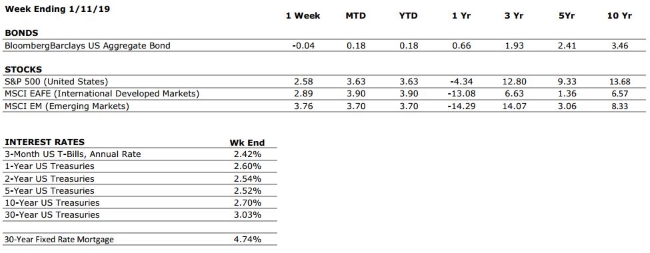

Global

equity markets extended their winning streak to four weeks and built on their

strong start to 2019, bolstered by reports of further progress in the trade

negotiations between the U.S. and China. Markets have climbed higher despite

rising uncertainty surrounding the Brexit negotiations and the government

shutdown, and there has been a meaningful positive shift in market sentiment

over the past few weeks. The market reacted positively to earnings reports from

several major S&P 500 constituents even despite results that were otherwise

less-than-stellar; a sign that market prices were reflecting overly pessimistic

expectations following December’s selloff.

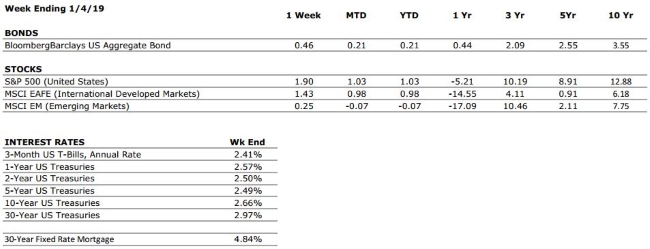

Earnings Season Underway

The quarterly earnings season kicked off last week with approximately 10% of S&P 500 constituents reporting Q4 2018 results. According to FactSet Research, the blended earnings growth rate for those companies that have reported is 10.6%, the fifth straight quarter of double-digit earnings growth. Analysts have been steadily reducing their estimates for earnings growth throughout the rest of the year, but the expectation is still for growth to remain positive. The earnings growth rate experienced during 2018 was fueled in large part by the year-over-year effects of corporate tax reform, which will no longer have an impact during 2019, so a decline from the mid-20 percent range experienced last year is to be expected.

Eric will work out of Valley National’s Bethlehem office as part of a service team supporting clients in the areas of wealth management and financial planning, as well as continuing professional development through the firm’s Entry Level Professional (ELP) program. The ELP program, now in its seventh year, is specifically designed to prepare the next generation of Financial Advisors at Valley National with key skills and knowledge.

Eric will work out of Valley National’s Bethlehem office as part of a service team supporting clients in the areas of wealth management and financial planning, as well as continuing professional development through the firm’s Entry Level Professional (ELP) program. The ELP program, now in its seventh year, is specifically designed to prepare the next generation of Financial Advisors at Valley National with key skills and knowledge.