We Are Hiring!

Our VNFA team is seeking an experienced individual to take over as our Head of Investments. This position is responsible for coordinating and managing the activities of the investment team, which oversees the development and implementation of the investment strategies employed in the management of client portfolios.

https://valleynationalgroup.com/about-vnfa/join-our-team/

Daily Archives: June 2, 2020

The Markets This Week

by

Connor Darrell CFA, Assistant Vice President – Head of Investments

Global equities advanced considerably from week-ago

levels as the “great reopening” continued in earnest. Consumer activity has

begun to show signs of picking up, and images of large crowds celebrating the

holiday weekend in several popular vacation destinations provided visual proof.

However, while encouraging from an economic activity standpoint, the images

have created a sense of unease for many leaders and have highlighted how

difficult it will be to achieve a measured reopening.

The market rebound has continued to remain resilient in the face of a variety of geopolitical challenges. With each passing day, the durability of the US-China trade deal faces tougher tests as the relationship and trust between the two superpowers continues to erode. Not only has the origins of the virus created a growing sense of mistrust, but news that China will impose new national security restrictions in an attempt to suppress ongoing protests in the city of Hong Kong sparked a slew of international condemnation last week. U.S. Secretary of State Mike Pompeo stated that the city of Hong Kong no longer possesses autonomy from the central Chinese government, an issue that could further jeopardize ongoing trade discussions.

Domestically, geopolitical concerns have increased in recent weeks as well, with footage of civil unrest in cities across the country going viral. The relative stability of financial markets compared to the mounting tensions both at home and abroad have underscored the contrast between “Wall St” and “Main St”, and have caused many to continue questioning the strength of the market’s recovery. From an investment standpoint, this dynamic continues to underscore the divergences that can occur between financial markets and geopolitics and serves as further evidence of the difficulty of market timing.

Did You Know…?

The IRS has begun issuing Economic Impact Payments in the form of Visa debit cards.

The cards can be used to:

- Make purchases online and at any retail location where Visa is accepted

- Get cash from in-network ATMs

- Transfer funds to a personal bank account

Read more about how to recognize, verify, activate, and use an Economic Impact Payment Card at irs.gov and eipcard.com.

The Number & “Heat Map”

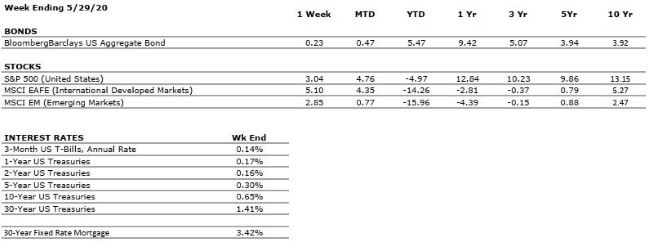

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

VERY NEGATIVE |

The consumer was the bedrock of the US economy through much of the previous decade. However, our Consumer Health grade remains VERY NEGATIVE as a result of the unprecedented social distancing and quarantining efforts currently being employed to fight the spread of COVID- 19. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

Coming into the year, analysts were expecting mid to single digit earnings growth, but the spread of COVID-19 is likely to have a substantial impact on near-term earnings forecasts. However, earnings could bounce back quickly once the pandemic has run its course. |

|

EMPLOYMENT |

VERY NEGATIVE |

April’s nonfarm payrolls report was historically ugly. We expect continued stress in the labor market due to the suppression of economic activity necessary to combat the spread of COVID- 19. |

|

INFLATION |

POSITIVE |

The deflationary environment created by COVID-19 should provide additional room for robust stimulus from both fiscal and monetary policy initiatives. However, we will be watching closely in the intermediate term for second and third order effects leading to a return of inflationary pressure. |

|

FISCAL POLICY |

VERY POSITIVE |

The US Government has passed a series of fiscal measures to combat the economic impacts of the COVID-19 pandemic. The largest of these measures, known as the CARES Act, provides approximately $2.2 trillion of support for businesses and families that are impacted by business closures and unemployment. |

|

MONETARY POLICY |

VERY POSITIVE |

In response to the threat of COVID-19, the Federal Reserve has implemented two emergency rate cuts and has moved its target interest rate back to zero. Additionally, it has announced its intention to conduct further asset purchases to support markets. We believe that the Fed is doing all it can to support the economy and markets. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

With COVID-19 being declared a global pandemic, our geopolitical risks rating is VERY NEGATIVE. However, we think it is important for investors to disentangle the public health concerns over the near-term from the expectations for markets over the long-term. The pandemic will ultimately prove to be transitory in nature. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The economic impacts of the COVID-19 pandemic are likely to be substantial. However, we believe that the eventual economic recovery (which will be aided by historically large economic stimulus) may occur more swiftly than from previous economic shocks. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“The art of life is a constant readjustment to our surroundings.” – Kakuzo Okakaura

“Your Financial Choices”

Tune in Wednesday for another new “Your Financial Choices” show on WDIY – Revisiting the CARES Act provisions and timelines.

Laurie will be recording the show Tuesday to air at the normal time, Wednesday, 6-7 p.m. She will answer questions that have been submitted via yourfinancialchoices.com and discuss:

Live episodes of “Your Financial Choices” are postponed until further notice as Laurie and her guests are working from home in response to guidance around the COVID-19 pandemic. WDIY will continue to broadcast prerecorded local shows as well as available NPR programming. Please continue to support local radio!

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.