“Life is infinitely stranger than anything the mind could invent…” – Arthur Conan Doyle

Monthly Archives: June 2020

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY:Elements of Financial Planning

Laurie has returned to the studio which means she can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

SAVE THE DATE!

JUNE 30 – Wealth Management Trends Webinar (11 AM)

Presented by Matt Petrozelli, VNFA President & CEO and Gabe Muller, Senior Consultant at Springboard Advisory Group

TOPICS:

– Strategies to navigate the

“superstore” of options trending in wealth management.

– Understanding the different types of

financial professionals and their business models.

– The modern client experience and

client-advisor relationship – what to expect now and next.

– Digital and distanced… how to seek

financial advice during the COVID-19 global pandemic.

REGISTER

NOW – https://attendee.gotowebinar.com/register/7431122311571275021

The Markets This Week

Several authoritative institutions released troubling economic forecasts last week, as the Fed, the World Bank and the OECD all reiterated that 2020 will represent one of worst downturns in modern times. To counter, Chairman Powell shared that the FOMC is “not even thinking about thinking about raising rates.” This exemplifies the seesaw between novel monetary policy and extraordinary economic conditions that is likely to steer asset prices for the visible future. The present climate is so unusual in that the key variables determining economic health – virus-related shutdowns and the corresponding monetary stimulus – are both inorganic mechanisms; a massive external shock has been met with a previously unimaginable flood of money into the financial system. We continue to observe the phenomena closely in order to best align long-term financial plans with the ongoing developments.

Did You Know…?

One month left until the 2020 tax filing deadline – July 15. The IRS is urging efile and direct deposit to speed up processing. Additionally, the IRS is reminding taxpayers that the first and second quarter 2020 estimated payments are both due July 15. https://www.irs.gov/newsroom/irs-reminder-file-now-choose-direct-deposit-or-schedule-tax-payments-electronically-before-the-july-15-deadline

The Numbers & “Heat Map”

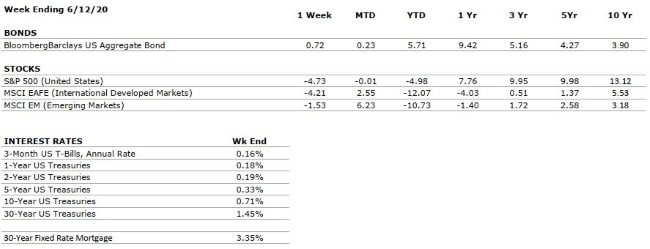

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

Social distancing has slackened in recent weeks as states reopen, Americans appear increasingly comfortable with travel and large gatherings occur via demonstrations. The extent to which these events will impact the spread of COVID-19, and thereby economic activity, will be discerned over the coming weeks. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

Coming into the year, analysts were expecting mid to single digit earnings growth, but the spread of COVID-19 is likely to have a substantial impact on near-term earnings forecasts. However, earnings could bounce back quickly once the pandemic has run its course. |

|

EMPLOYMENT |

VERY NEGATIVE |

2.5 million jobs were added in May, in large part driven by the return of furloughed workers. The figure represents the greatest monthly increase in jobs since at least 1939, and a stark divergence from economic consensus which expected further unemployment. Nonetheless, the jobless rate remains historically high at 13.3%. |

|

INFLATION |

POSITIVE |

The deflationary environment created by COVID-19 should provide additional room for robust stimulus from both fiscal and monetary policy initiatives. However, we will be watching closely in the intermediate term for second and third order effects leading to a return of inflationary pressure. |

|

FISCAL POLICY |

VERY POSITIVE |

The US Government has passed a series of fiscal measures to combat the economic impacts of the COVID-19 pandemic. The largest of these measures, known as the CARES Act, provides approximately $2.2 trillion of support for businesses and families that are impacted by business closures and unemployment. |

|

MONETARY POLICY |

VERY POSITIVE |

In response to the threat of COVID-19, the Federal Reserve has implemented two emergency rate cuts and has moved its target interest rate back to zero. Additionally, it has announced its intention to conduct further asset purchases to support markets. We believe that the Fed is doing all it can to support the economy and markets. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

Western opposition to China’s National Security Law, legislation that reduces Hong Kong’s autonomy, has amplified the discord already present between the US and China as a result of COVID-19. In addition, demonstrations across the US evidence considerable domestic unrest. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The economic impacts of the COVID-19 pandemic are likely to be substantial. However, we believe that the eventual economic recovery (which will be aided by historically large economic stimulus) may occur more swiftly than from previous economic shocks. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Every time history repeats itself; the price goes up.” – Original source unknown

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY: A potpourri of topics and listener questions.

Laurie has returned to the studio which means she can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

Limited Contactless Document Exchange Available at VNFA Bethlehem Office

While our physical offices will remain closed and our team will continue to provide services remotely, we now have someone at the front desk of our Bethlehem headquarters full time to answer the main phone line and arrange for in-person drop off and pick up of tax-related documents. These by-appointment visits will be available during our regular office hours for the duration of tax season – through July 15. Access will be limited to the front entry and guests will be required to follow VNFA’s social distancing and safety guidelines, including wearing a mask while inside.

As a result of having someone on site during normal hours, we are also able to resume delivery of UPS and FedEx packages.

Our New Jersey office will not have this same service available, but a secure drop box for documents is on site. Please call (908) 454-1000 for more information.

The Markets This Week

by Maurice (Mo) Spolan, Investment Research Analyst

The U.S. stock markets rallied last week, spurred by an employment update which indicated that the U.S. economy added 2.5 million jobs in April, the largest monthly increase since at least 1939. Approximately half of the job gains were the result of furloughed workers returning to their posts, particularly in the travel & leisure sector of the economy. The job number arrives in stark contrast to economists’ expectations, which anticipated that the unemployment rate would expand to near 20% upon the report’s release. While April’s job statistic was a positive surprise, U.S. unemployment remains historically high, at 13.3%.

Since March’s lows, U.S. equity markets have staged their most prodigious 50-day increase of all time, up over 40%. The major indices now rest within a handful of percentage points of their all-time highs achieved in February. It is confounding for many to witness stocks rise amidst a pandemic and the considerable domestic and international political tensions now present. To provide some explanation for this apparent dichotomy, we offer two thoughts. First, a stock price reflects the future profits of the company to which the stock corresponds. Because of this, news and developments are only incorporated into stock prices to the extent they impact company profits. Therefore, events which may be significant in many respects, but do not affect companies’ fortunes, will not play a role in setting stock prices. Second, in the period of time since COVID-19 has proliferated, interest rates have fallen dramatically. Because interest rates are now lower, bonds are less attractive to investors, and as a corollary, stocks look more enticing. In turn, investors have been buying stocks, and stock prices have risen.