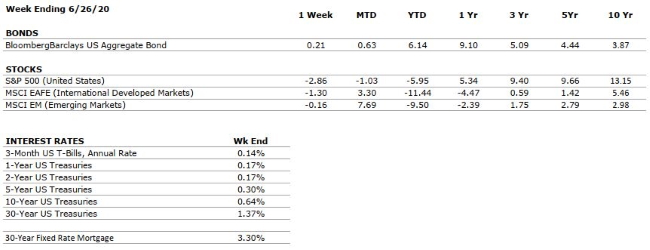

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

>

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

May’s retail sales and consumer spending rebounded at record clips month-over-month, following unprecedented declines in April. However, new coronavirus cases in the US are accelerating as social activity has increased, which threatens to rescind the gains in consumer confidence. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

Coming into the year, analysts were expecting mid to single digit earnings growth, but the spread of COVID-19 is likely to have a substantial impact on near-term earnings forecasts. However, earnings could bounce back quickly once the pandemic has run its course. |

|

EMPLOYMENT |

VERY NEGATIVE |

2.5 million jobs were added in May, in large part driven by the return of furloughed workers. The figure represents the greatest monthly increase in jobs since at least 1939, and a stark divergence from economic consensus which expected further unemployment. Nonetheless, the jobless rate remains historically high at 13.3%. |

|

INFLATION |

POSITIVE |

The deflationary environment created by COVID-19 should provide additional room for robust stimulus from both fiscal and monetary policy initiatives. However, we will be watching closely in the intermediate term for second and third order effects leading to a return of inflationary pressure. |

|

FISCAL POLICY |

VERY POSITIVE |

The US Government has passed a series of fiscal measures to combat the economic impacts of the COVID-19 pandemic. The largest of these measures, known as the CARES Act, provides approximately $2.2 trillion of support for businesses and families that are impacted by business closures and unemployment. |

|

MONETARY POLICY |

VERY POSITIVE |

In response to the threat of COVID-19, the Federal Reserve has implemented two emergency rate cuts and has moved its target interest rate back to zero. Additionally, it has announced its intention to conduct further asset purchases to support markets. We believe that the Fed is doing all it can to support the economy and markets. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

Western opposition to China’s National Security Law, legislation that reduces Hong Kong’s autonomy, has amplified the discord already present between the US and China as a result of COVID-19. In addition, demonstrations across the US evidence considerable domestic unrest. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The economic impacts of the COVID-19 pandemic are likely to be substantial. However, we believe that the eventual economic recovery (which will be aided by historically large economic stimulus) may occur more swiftly than from previous economic shocks. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.