by William Henderson, Vice President / Head of Investments

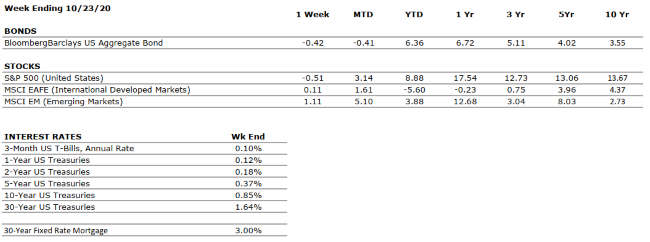

Investors remained focused on renewed talks for a stimulus package – unlikely before next week’s Presidential Election, but hopefully before year-end. House Speaker Nancy Pelosi and Treasury Secretary Stephen Mnuchin continue daily squabbling over the deal to provide fiscal assistance to Americans. This continued uncertainly made for a down week on Wall Street with the Dow Jones Industrial Average down -0.9% for the week, while the S&P 500 index was down -0.5%, and the Nasdaq down -1.1%. U.S. Treasury Bond yields continued their slow grind higher again last week and we saw the 10-year U.S. Treasury bond tick up 10 basis points to 0.84%. This move higher in bond yields added additional steepness to the yield curve. The 2s-10s spread (the difference between 2- year Treasury Notes and 10-year Treasury Bonds) widened to 69 basis points, the largest difference thus far in 2020. This is a clear indication that investors continue to bet on an economic recovery starting sooner and being stronger than expected. Year-to-date returns remain mixed with Dow Jones Industrial Average down -0.7%, while the S&P 500 index is up +7.3%, and the Nasdaq up a healthy +28.7%.

Traders and betting markets are still pointing to a Biden win on Election Day and some pointing to a “Blue Wave” victory next week. At the same time, according to Real Clear Politics, the Top Battleground States Average poll shows Biden ahead by +3.8 points; nearly identical to the spread Hillary Clinton had (+3.5 points) in 2016 vs. Donald Trump. The full U.S. Senate voted on Monday (10/25) to confirm Judge Amy Coney Barrett as a Justice of the U.S. Supreme Court. Both sides are pointing to the confirmation as a reason for larger turnout for the Presidential Election. Thankfully, the election is just a week away and that market unknown will fade away for a year or two.

While we do not know the outcome yet of the election nor the markets’ reaction to that outcome, we are certain of a few things impacting investors. First, we know the Fed is committed to all monetary stimulus, including a zero-interest rate policy, needed to fuel the economic recovery. Second, we know that corporate earnings are improving, and corporate balance sheets remain healthy. And lastly, there is hope for a vaccine for the COVID-19 pandemic before year end. Stay focused on long-term returns and proper diversification rather than political noise and short-term market moves.