by William Henderson, Vice President / Head of Investments

As the month of April 2021 wrapped up, we saw modest selling across the markets as both stocks and bonds ended the week lower in price. For the week that ended April 30, 2021, the Dow Jones Industrial Average fell by -0.5%, the S&P 500 Index was unchanged, and the NASDAQ fell by -0.4%. The 10-year U.S. Treasury Bond closed the week at 1.64%, higher by six basis points compared to the previous week. Bond yields move in the opposite direction of bond prices. While selling was evident, the resulting pressure on the markets did nothing to erase the strong year-to-date returns we have seen. Year-to-date, the Dow Jones Industrial Average has returned +11.3%, the S&P 500 Index +11.8% and the NASDAQ +8.6%.

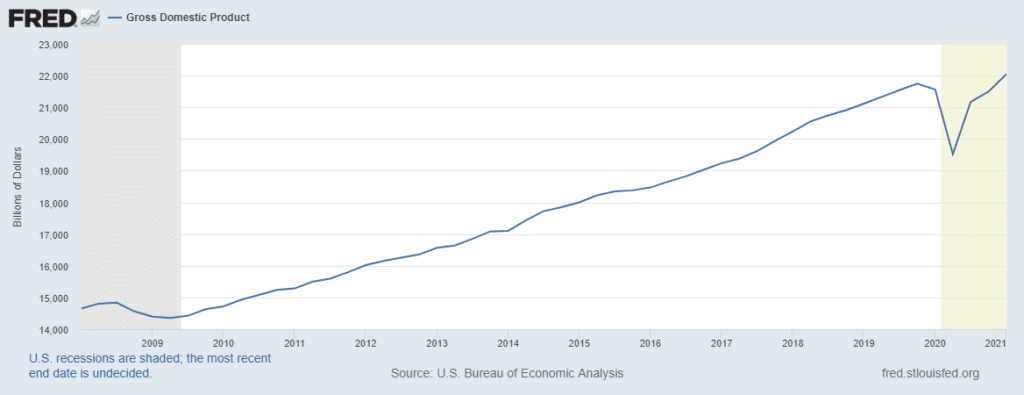

First quarter 2021 U.S. GDP was released last week, and the number was a blow out, as expected. With the help of two rounds of stimulus payments and continued progress in vaccinations, first-quarter GDP grew by 6.4% on an annualized basis up from 4.3% in the fourth quarter of 2020. The chart below from the Federal Reserve Bank of St. Louis, shows GDP is now only 1% below its previous high and is clearly on track to return to pre-pandemic levels as soon as the second quarter of 2021. Further, economic activity was strong in consumer spending, up 10.7% in the first quarter, and business investment up a solid 9.9% in the same period.

Last week’s selling took place in the technology sector, specifically production firms related to oil or oil production. The price of West Texas Intermediate crude oil fell more than 2% last week and is now running 4% below the high hit at the beginning of March 2021. While that may be bad news for oil drillers, it is good news for the rare person these days that is worried about inflation.

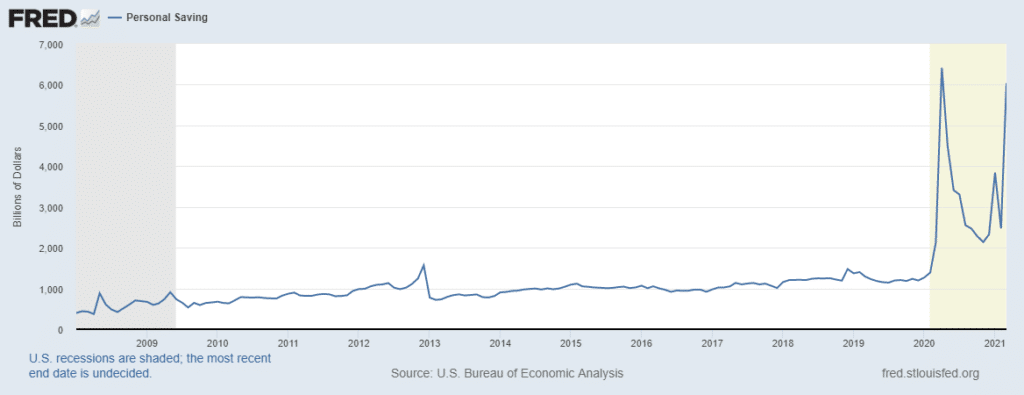

Last week also produced some winners; importantly we saw strong performance in “reopening-sensitive” stocks such as Norwegian Cruise Lines and American Airlines. As vaccine distribution continues across the country, more and more sectors of the economy will open, and the consumer will be released to spend the cash hoard they have amassed over the past year. See the graph below from the Federal Reserve Bank of St. Louis showing the personal savings rate for the U.S. households.

As we have said for many weeks now, the building blocks of vaccine distribution, healthy consumer and corporate balance sheets, record fiscal stimulus and continued monetary stimulus, are all in place to propel the economy and markets forward well into 2022. Confirming the monetary stimulus, last week U.S. Fed Chairman Jerome Powell, in his press conference after the FOMC meeting, stuck to his dovish tune on interest rates and nearly guaranteed that rates will stay low for a long time. The Fed remains laser-focused on employment and inflation and neither are meeting the target they have set: full employment and inflation averaging 2% per year.

As a final boost to consumer spirits, resulting from favorable progress on fighting the pandemic, President Biden announced eased restrictions on wearing masks outdoors and several major cities, including New York and Philadelphia, will completely “reopen” July 1. Vastly positive economic conditions exist in the U.S. and we expect continuation of the same, even in the face of potentially higher personal and corporate income tax rates.