by William Henderson, Vice President / Head of Investments

Markets ended mixed last week with the broader markets closing higher and the technology-heavy NASDAQ closing lower on the week. For the week that ended May 7, 2021, the Dow Jones Industrial Average gained +2.7%, the S&P 500 Index rose by +1.2% and the NASDAQ fell by –1.5%. On the heels of a weak jobs report and resultant flight to quality, the 10-year U.S. Treasury Bond fell by six basis points to close the week at 1.58%. Value stocks, led by energy, materials and financials proved to be the best performing sectors, while growth stocks and utilities underperformed. While the NASDAQ struggled, we saw record levels hit on the Dow and the S&P. Year-to-date, the Dow Jones Industrial Average has returned +14.3%, the S&P 500 Index +13.3% and the NASDAQ +6.9%.

As mentioned, the latest U.S. jobs figure, released last week, reported just +266,000 new jobs created in April 2021 vs. Wall Street Economists’ estimate of +1,000,000. In the annals of forecasting this was a huge miss, and a lot of uncertainty remains around the weak job numbers. Certainly, forecasting in the age of the COVID-19 Pandemic, is not a simple predictable science. Shortages of microprocessors and lumber could explain some of the job losses as they likely caused cancelled or delayed business production. Further, the relative generosity of unemployment insurance benefits for low-wage workers could be discouraging the jobless from accepting certain offers. Uncertainty in jobs reports will likely continue as a combination of varied openings of state economies and slowing vaccine distribution weigh heavily on hiring by leisure-related industries.

Despite the weak job market, investors overall were pleased because the weakness further supports the Federal Reserve’s stance on interest rates, essentially assuring rates remain low for longer, which is generally good news for equities. Federal Reserve Chairman, Jay Powell, remains committed to seeing average inflation of 2% before raising interest rates. We are certainly seeing signs of inflation especially in certain building related commodities. Copper, lumber, and iron ore all hit new all-time highs last week; and Brent Crude Oil ended the week 2% higher, putting the price of a barrel of oil at just under $70.The chart below from the Federal Reserve Bank of St. Louis, shows the breakeven inflation rate derived from the yield on the 10-year U.S. Treasury and the level at which market participants “expect” inflation to be over the next 10 years. Higher or increasing spreads, as is evident in the chart, represents higher inflation expectations.

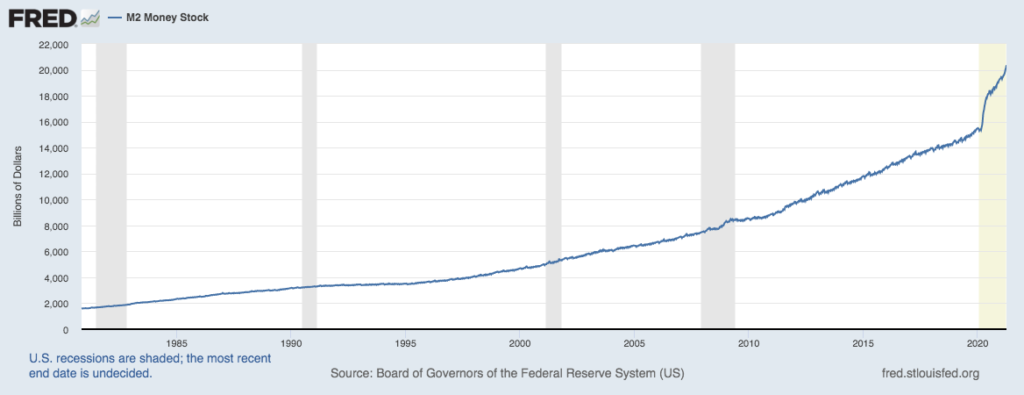

Unsteady job reports, inflation concerns, and lingering pandemic worries weigh heavily on the markets, but the Fed remains committed to a strong recovery. We are certainly seeing healthy data from corporate America. So far, according to Goldman Sachs, 68% of first quarter results of S&P 500 companies reported earnings that beat expectations. While this is strong performance, the markets are more focused on future guidance and that is where uncertainty continues. Travel and leisure services are gaining strength and opening at faster rates than expected. To that end, the consumer remains poised to contribute to the economic recovery in a big way. Cash on hand and savings accounts remain at record high levels. Shown again in the graph below from the Federal Bank of St. Louis on M2 – Money Stock (sum of bank deposits and retail money market funds).