If you owe Federal taxes, you can pay them online! EFTPS® is a free system offered by the U.S. Department of Treasury to pay your federal taxes. However, new enrollments for the system can take up to five days to process. With the payment deadline of May 17 less than a week away, enrollment is encouraged ASAP. Visit IRS.gov for more information.

Monthly Archives: May 2021

Current Market Observations

by William Henderson, Vice President / Head of Investments

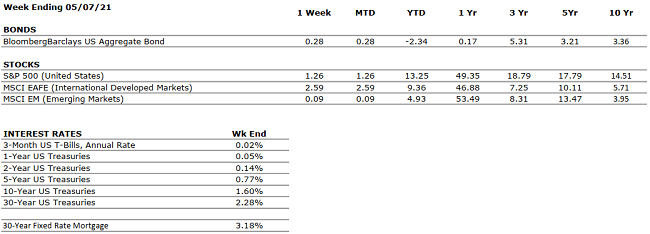

Markets ended mixed last week with the broader markets closing higher and the technology-heavy NASDAQ closing lower on the week. For the week that ended May 7, 2021, the Dow Jones Industrial Average gained +2.7%, the S&P 500 Index rose by +1.2% and the NASDAQ fell by –1.5%. On the heels of a weak jobs report and resultant flight to quality, the 10-year U.S. Treasury Bond fell by six basis points to close the week at 1.58%. Value stocks, led by energy, materials and financials proved to be the best performing sectors, while growth stocks and utilities underperformed. While the NASDAQ struggled, we saw record levels hit on the Dow and the S&P. Year-to-date, the Dow Jones Industrial Average has returned +14.3%, the S&P 500 Index +13.3% and the NASDAQ +6.9%.

As mentioned, the latest U.S. jobs figure, released last week, reported just +266,000 new jobs created in April 2021 vs. Wall Street Economists’ estimate of +1,000,000. In the annals of forecasting this was a huge miss, and a lot of uncertainty remains around the weak job numbers. Certainly, forecasting in the age of the COVID-19 Pandemic, is not a simple predictable science. Shortages of microprocessors and lumber could explain some of the job losses as they likely caused cancelled or delayed business production. Further, the relative generosity of unemployment insurance benefits for low-wage workers could be discouraging the jobless from accepting certain offers. Uncertainty in jobs reports will likely continue as a combination of varied openings of state economies and slowing vaccine distribution weigh heavily on hiring by leisure-related industries.

Despite the weak job market, investors overall were pleased because the weakness further supports the Federal Reserve’s stance on interest rates, essentially assuring rates remain low for longer, which is generally good news for equities. Federal Reserve Chairman, Jay Powell, remains committed to seeing average inflation of 2% before raising interest rates. We are certainly seeing signs of inflation especially in certain building related commodities. Copper, lumber, and iron ore all hit new all-time highs last week; and Brent Crude Oil ended the week 2% higher, putting the price of a barrel of oil at just under $70.The chart below from the Federal Reserve Bank of St. Louis, shows the breakeven inflation rate derived from the yield on the 10-year U.S. Treasury and the level at which market participants “expect” inflation to be over the next 10 years. Higher or increasing spreads, as is evident in the chart, represents higher inflation expectations.

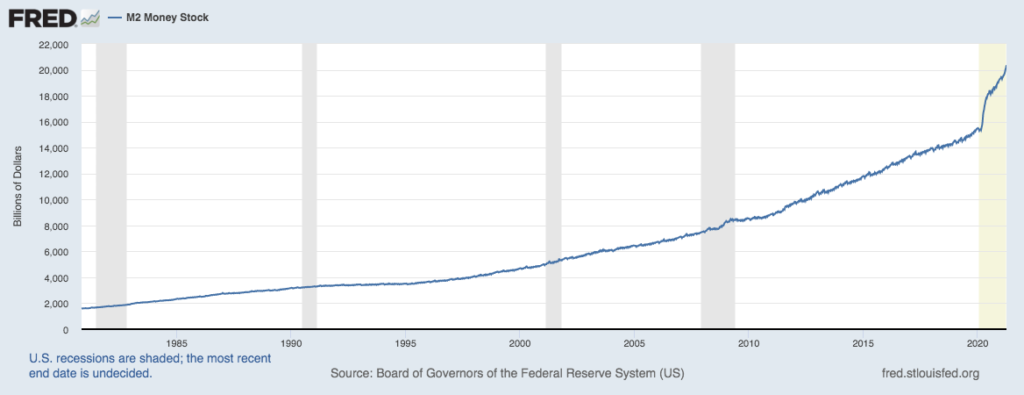

Unsteady job reports, inflation concerns, and lingering pandemic worries weigh heavily on the markets, but the Fed remains committed to a strong recovery. We are certainly seeing healthy data from corporate America. So far, according to Goldman Sachs, 68% of first quarter results of S&P 500 companies reported earnings that beat expectations. While this is strong performance, the markets are more focused on future guidance and that is where uncertainty continues. Travel and leisure services are gaining strength and opening at faster rates than expected. To that end, the consumer remains poised to contribute to the economic recovery in a big way. Cash on hand and savings accounts remain at record high levels. Shown again in the graph below from the Federal Bank of St. Louis on M2 – Money Stock (sum of bank deposits and retail money market funds).

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The economy expanded at a 6.4% annualized pace in Q1. At the current rate, U.S. GDP will return to pre-COVID levels by mid year. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q1 sales and earnings growth have come in at 9% and 45%, respectively, representing extremely strong results. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate increased to 6.1% in April, from 6% in March. |

|

INFLATION |

POSITIVE |

Inflation was 4.5% in April. The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has generally been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden recently unveiled a stimulus package directed towards infrastructure that would total more than $2 trillion over eight years. President Biden is also considering a significant capital gains tax increase. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve continues to indicate that the monetary environment will remain very accommodative for the foreseeable future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and highly accommodative fiscal and monetary policies in place, 2021 may be one of the strongest economic years on record. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“If today were the last day of your life, would you want to do what you are about to do today?” – Steve Jobs

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM. Laurie will discuss Employer retirement plans and benefits.

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Welcome Dulce Cardinal to Team VNFA

We are pleased to welcome Dulce Cardinale to our team as an Administrative Assistant. Dulce has more than 18 years of experience in the financial services industry.

She will be supporting multiple financial advisors and collaborating across our team to serve clients out of our Bethlehem headquarters.

Current Market Observations

by William Henderson, Vice President / Head of Investments

As the month of April 2021 wrapped up, we saw modest selling across the markets as both stocks and bonds ended the week lower in price. For the week that ended April 30, 2021, the Dow Jones Industrial Average fell by -0.5%, the S&P 500 Index was unchanged, and the NASDAQ fell by -0.4%. The 10-year U.S. Treasury Bond closed the week at 1.64%, higher by six basis points compared to the previous week. Bond yields move in the opposite direction of bond prices. While selling was evident, the resulting pressure on the markets did nothing to erase the strong year-to-date returns we have seen. Year-to-date, the Dow Jones Industrial Average has returned +11.3%, the S&P 500 Index +11.8% and the NASDAQ +8.6%.

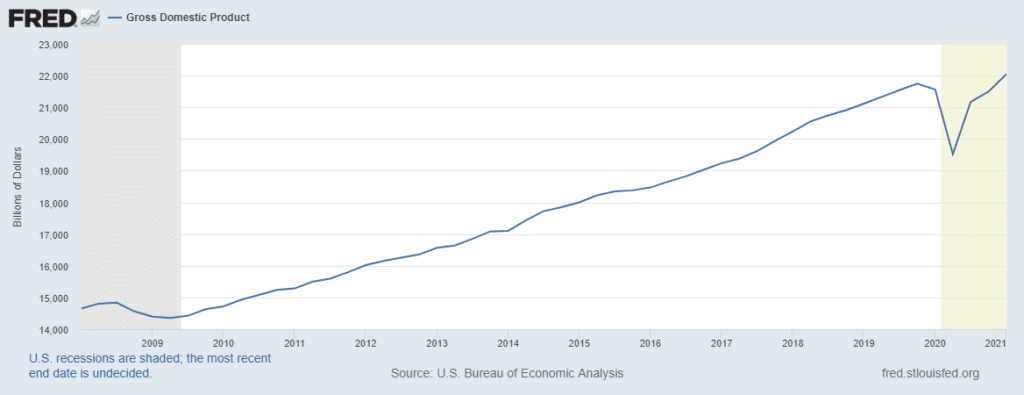

First quarter 2021 U.S. GDP was released last week, and the number was a blow out, as expected. With the help of two rounds of stimulus payments and continued progress in vaccinations, first-quarter GDP grew by 6.4% on an annualized basis up from 4.3% in the fourth quarter of 2020. The chart below from the Federal Reserve Bank of St. Louis, shows GDP is now only 1% below its previous high and is clearly on track to return to pre-pandemic levels as soon as the second quarter of 2021. Further, economic activity was strong in consumer spending, up 10.7% in the first quarter, and business investment up a solid 9.9% in the same period.

Last week’s selling took place in the technology sector, specifically production firms related to oil or oil production. The price of West Texas Intermediate crude oil fell more than 2% last week and is now running 4% below the high hit at the beginning of March 2021. While that may be bad news for oil drillers, it is good news for the rare person these days that is worried about inflation.

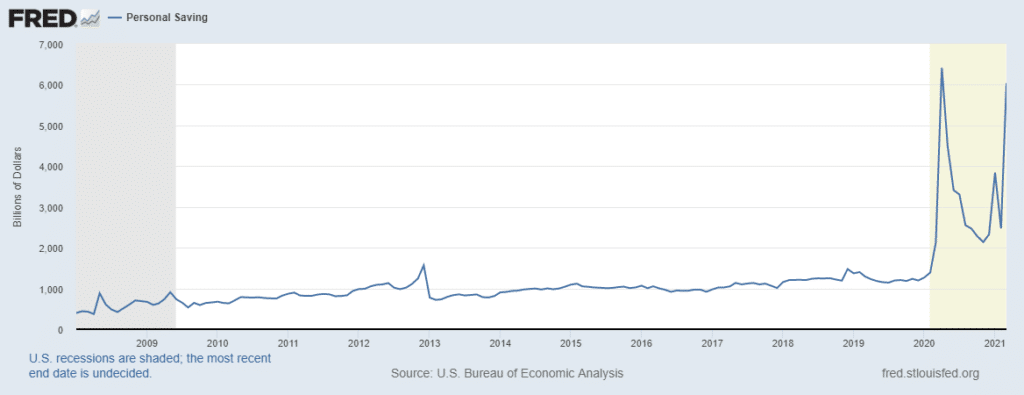

Last week also produced some winners; importantly we saw strong performance in “reopening-sensitive” stocks such as Norwegian Cruise Lines and American Airlines. As vaccine distribution continues across the country, more and more sectors of the economy will open, and the consumer will be released to spend the cash hoard they have amassed over the past year. See the graph below from the Federal Reserve Bank of St. Louis showing the personal savings rate for the U.S. households.

As we have said for many weeks now, the building blocks of vaccine distribution, healthy consumer and corporate balance sheets, record fiscal stimulus and continued monetary stimulus, are all in place to propel the economy and markets forward well into 2022. Confirming the monetary stimulus, last week U.S. Fed Chairman Jerome Powell, in his press conference after the FOMC meeting, stuck to his dovish tune on interest rates and nearly guaranteed that rates will stay low for a long time. The Fed remains laser-focused on employment and inflation and neither are meeting the target they have set: full employment and inflation averaging 2% per year.

As a final boost to consumer spirits, resulting from favorable progress on fighting the pandemic, President Biden announced eased restrictions on wearing masks outdoors and several major cities, including New York and Philadelphia, will completely “reopen” July 1. Vastly positive economic conditions exist in the U.S. and we expect continuation of the same, even in the face of potentially higher personal and corporate income tax rates.

The Numbers & “Heat Map”

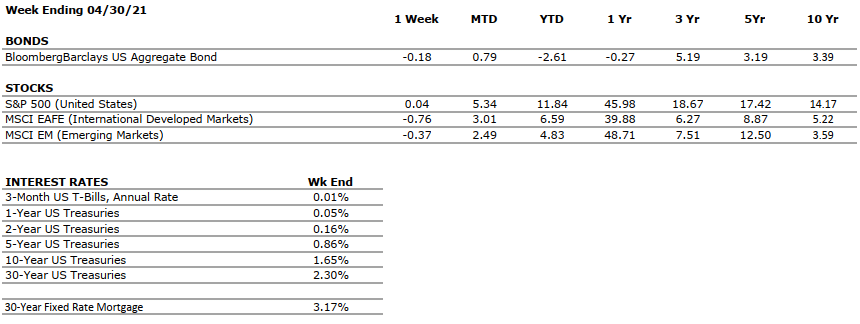

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The economy expanded at a 6.4% annualized pace in Q1. At the current rate, U.S. GDP will return to pre-COVID levels by midyear. |

|

CORPORATE EARNINGS |

POSITIVE |

With over half of S&P constituents having reported Q1 earnings, sales and earnings growth have come in at 9% and 45%, respectively, representing extremely strong results. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate declined to 6% in March, from 6.2% in February |

|

INFLATION |

POSITIVE |

Inflation was 2.6% in March. The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has generally been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden recently unveiled a stimulus package directed towards infrastructure that would total more than $2 trillion over eight years. President Biden is also considering a significant capital gains tax increase. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve continues to indicate that the monetary environment will remain very accommodative for the foreseeable future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and highly accommodative fiscal and monetary policies in place, 2021 may be one of the strongest economic years on record. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Pass on what you have learned. Strength, mastery. But weakness, folly, failure also. Yes, failure most of all. The greatest teacher, failure is.” – Yoda

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM. Laurie and her guest David Ellowitch, CFP® will discuss: The SECURE ACT – New Planning

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.