We Are Hiring

Team VNFA is seeking a full-time Back Office Associate to join our operations team in Bethlehem.

Back Office Associate at Valley National Group Inc (easyapply.co)

We Are Hiring

Team VNFA is seeking a full-time Back Office Associate to join our operations team in Bethlehem.

Back Office Associate at Valley National Group Inc (easyapply.co)

With the first half of 2021 well behind us, the second half started as simply more of the same thing. We saw positive returns across all three market indexes despite concerns about COVID variants and global growth. The Dow Jones Industrial Average rose by +0.7% last week and the S&P 500 Index and the NASDAQ both increased by +1.2%. Solid weekly gains in all three indexes allowed new highs across the board and set up very strong year-to-date gains as well. Year-to-date, the Dow Jones Industrial Average has returned +15.1%, the S&P 500 Index +17.2% and the NASDAQ +14.5%. Further, the earlier rotation between value and growth has abated as markets overall have converged upon similarly strong gains thus far in 2021. Bonds continued to be well bid and the yield on the 10-year U.S. Treasury dropped 10 basis points last week to close at 1.34%, a full 40 basis points lower than the 1.74% yield level hit in March of this year.

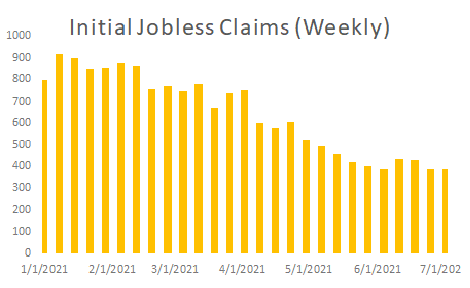

While the labor markets continue to show solid improvement, the pace of job gains has slowed a bit and last week we saw a bit of that slowness in the slight uptick the weekly jobless claims number released by the U.S. Department of Labor Department (see chart below).

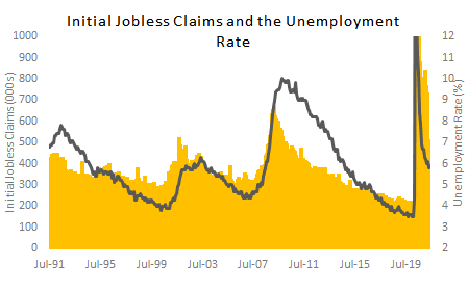

Further, while the unemployment rate continues to fall from

a pandemic high of 14.8% in April 2020 to

the current 5.9%, a

supply of and demand for labor mismatch exists (see chart below from the U.S.

Department of Labor).

One theory around this supply/demand mismatch is that during the pandemic we saw large scale demographic shifts in population as people moved residences; potentially due to COVID-19 reasons, work-from-home flexibility in family employment or simply the need to seek varied employment elsewhere. Regardless of the reasons, we may see an imbalance in worker demand and worker supply for some time and this economic oddity could weigh on the markets for a while. However, recall the Federal Reserve has been consistent in its message about two measures before they raise interest rates: the unemployment rate and inflation. We have seen inflation, transitory or not, in recent CPI numbers, but we have not seen unemployment at or near their target level of 4%, so watch for interest rates to remain low for longer, just as Chairman Jay Powell has stated repeatedly.

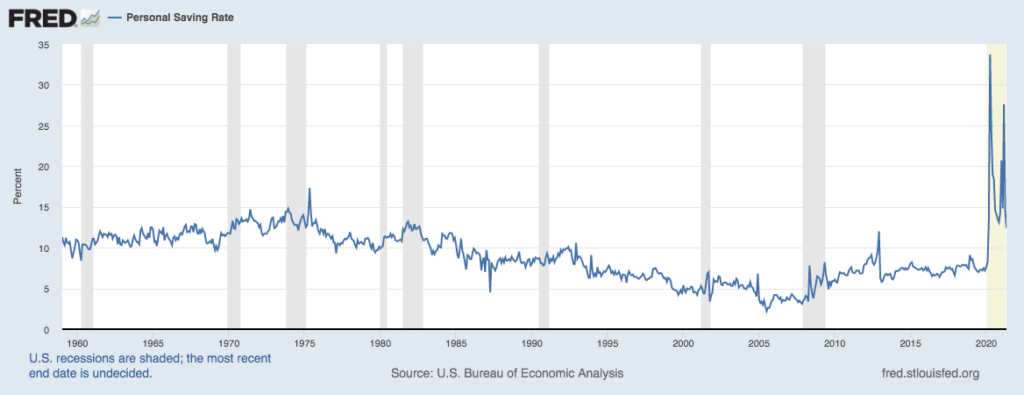

As the second half of 2021 unfolds, watch for labor to regain some strength as unemployment benefits begin to expire and workers return to work. With this acceleration in job growth, the unemployment rate will fall. As we have mentioned frequently, the consumer remains in excellent financial shape with savings rates near recent extremely high levels (see chart below from the Federal Reserve Bank of St. Louis).

Falling unemployment rates, financially healthy consumers and a cooperative Fed point to a strong economic expansion well into 2022 and certainly for the remainder of 2021. Like all economic indicators, concerns abound and can be impactful such as the emergence of a powerful COVID variant or unseen global unrest. We believe that the Federal Reserve will continue to back-stop the economy especially given an unforeseen global event.

View/Download PDF version of Q2 Commentary (or read text below)

Stocks

Each of the three major U.S. equity indices – the Dow, S&P 500, and Nasdaq – were up between 12.5-14.4% through 2021’s first six months. The Dow had a quick start to the year while the tech-heavy Nasdaq lagged, but at this point, the performance disparity between any of three indices is immaterial, illustrating the breadth of the market rally.

Generally speaking, companies in the Nasdaq are more rapidly growing but less profitable today. For companies who have the bulk of their profits in the distant future – companies disproportionately located in the Nasdaq – rising interest rates are relatively harmful. This is because all corporate profits must be discounted to the present to derive a company valuation; profits further out are discounted more. By contrast, companies in the Dow are predominantly harvesting their profits in the present moment; thus, they are more immune to rate changes. Interest rates rose sharply to begin the year; as a result of the dynamic just described, this negatively impacted Nasdaq constituents more severely than companies in the Dow. However, rates stabilized – and have even declined – over the past couple of months, during which time the Nasdaq made up ground on its counterpart indices.

Bonds

Interest rates nearly doubled during Q1, as the 10-year treasury bond increased from approximately 0.90% to greater than 1.70% in the three-month span. Bond prices fall as rates rise; thus, major bond indices declined in Q1. In Q2, however, the 10-year fell to a range between 1.40-1.50% by period-end, and bonds were buoyed to end the first half.

The rate environment must be considered both in the context of historical precedents and current inflation expectations. On the former, rates remain extremely low, as the 10-year treasury generally hovered between 4-5% prior to the Great Financial Crisis and its subsequent monetary stimulus. Low rates facilitate economic activity, as consumers and businesses alike are incented to borrow money, spend on goods and services and invest in growth initiatives.

On the other hand, central banks are averse to inflation. Their means of obstructing this insidious force is hiking interest rates. Inflation simply refers to higher prices of goods and services. Prices are driven by supply and demand. Higher rates work to offset demand for goods and services because they encourage consumers to save their money rather than spend it.

The Federal Reserve – the U.S. central bank – holds a long-term inflation target of 2%; however, Jay Powell, Fed Chairman, has stated that he is willing to let run inflation run above this target over the short and medium term in order to facilitate economic growth. In April, inflation was 4.5%, its highest figure in some time; the figure decelerated to 3.5% in May. Chairman Powell believes that the high inflation numbers are the result of pent-up demand being unleashed on a globally constrained supply chain. Powell forecasts that inflation will moderate further over the coming months as supply chain bottlenecks resolve.

Outlook

Historically, strong first-halves in the equity markets portend strong second-halves; per Refinitiv, in every year since 1950 in which the S&P and Dow were up double-digits to start the year, they were positive in the final six months. Economic indicators also suggest a healthy second half of 2021 is forthcoming. The unemployment rate is well within normal range, sitting just below 6%, while the housing economy – represented by home prices and remodeling & renovation activity – is in its strongest condition since the Great Financial Crisis. Crude oil is priced at $75 – a three-year high – as the appetite for travel and mobility are surging. As a result of these trends and more, the International Monetary Fund has increased its projection for U.S. 2021 GDP growth from 4.6% to 7%; should the forecast come to fruition, it would represent one of the strongest years on record.

If there is a risk to the economy – and therefore, possibly the markets – over the coming six months, it is that of overheating. At present, the market is expecting the Fed to hike rates twice in 2023. However, if inflation persists – contrary to Chairman Powell’s forecasts – the U.S. central bank may be forced to take hastier action. Nevertheless, modestly higher rates are unlikely to unhinge the financial markets so long as economic growth remains strong.

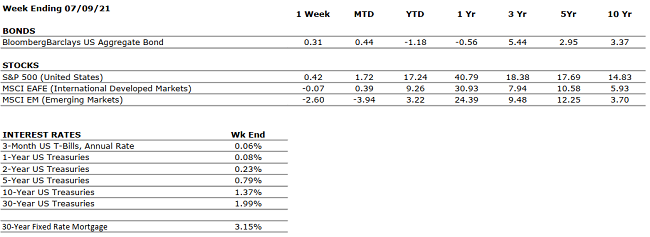

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The OECD forecasts that the global economy will grow 5.6% and 4.4% in 2021 and 2022, respectively. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q1 sales and earnings growth were very strong. Corporate earnings are likely to remain strong throughout 2021 on a “year-over-year” basis as companies compare their results to depressed 2020 numbers. |

|

EMPLOYMENT |

POSITIVE |

In June, the U.S. economy added 850,000 jobs, beating expectations handily. The unemployment rate is 5.9%, well within normal parameters. |

|

INFLATION |

NEUTRAL |

Inflation cooled somewhat in May, decelerating to a 3.5% pace year-over-year, compared to 4.5% in April. Jay Powell, Federal Reserve Chair, believes that the recent uptick in inflation is primarily attributable to global supply chain constraints, and that inflation will slow as such constraints resolve through the remainder of the year. |

|

FISCAL POLICY |

POSITIVE |

President Biden recently unveiled a stimulus package directed towards infrastructure that would total more than $2 trillion over eight years. President Biden is also considering a significant capital gains tax increase. |

|

MONETARY POLICY |

POSITIVE |

The Federal Reserve indicated this week that it plans to hike rates twice in 2023. Previously, the Fed had suggested it would not raise rates until 2024. Nonetheless, the monetary stance is accommodative in the near future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and accommodative fiscal and monetary policies in place, 2021 may be one of the strongest economic years on record. If a risk is present, it may be that the economy will overheat, thereby leading to inflation and higher interest rates. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

“Mind and heart are two cute and parallel regions; one cannot expand without the other.” – Victor-Marie Hugo

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM. Laurie and her guest, Attorney Tim Duckworth Jr from Mosebach, Funt, Dayton & Duckworth, P.C., will discuss multi-state implications in estate planning.

Laurie and her guest can address question on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.