by William Henderson, Vice President / Head of Investments

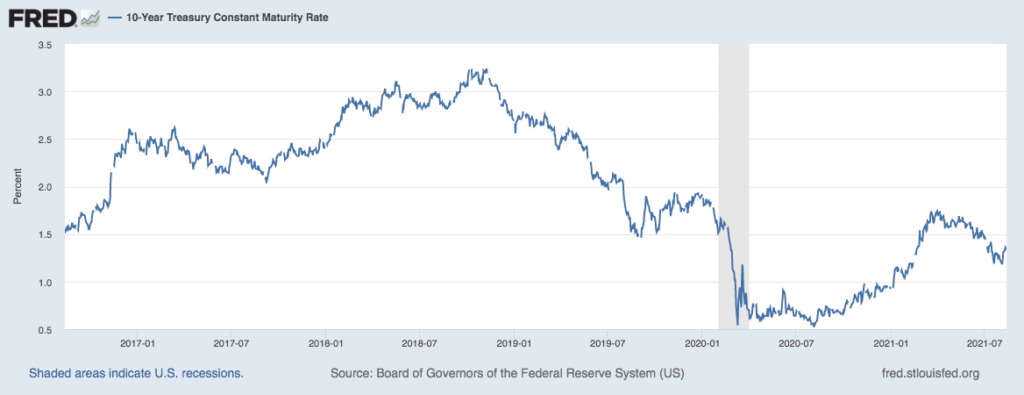

U.S. stocks finished last week in a quiet session that saw mixed results for the week. The Dow Jones Industrial Average rose +0.9%, the S&P 500 Index rose +0.7% while the NASDAQ fell by -0.1%. Full year 2021 returns remain healthy across all three indexes. Year-to-date, the Dow Jones Industrial Average has returned +17.3%, the S&P 500 Index +20.0% and the NASDAQ +15.5%; representing a wide-ranging rally across industries and sectors. Bonds changed only slightly with the yield on the 10-year U.S. Treasury dropping two basis points to 1.28% from the previous week’s 1.30% and a full 46 basis points lower than the 1.74% yield level hit in March of this year (see chart below from the Federal Reserve Bank of St. Louis). Overall, low rates continue to fuel the economic recovery and give commercial banks a leg up by borrowing low and lending higher.

The Q2 earnings season concluded with stronger than expected results from Dow Jones member Walt Disney while food delivery vendor DoorDash reported a wider than expected loss with added negative commentary. The results showed just what one would expect as the economy opens: more travel and leisure activities benefited Disney while greater restaurant openings and more diners hurt DoorDash. We may continue to see divergent trends in corporate earnings as companies react differently to the economic recovery.

The late Donald Rumsfeld, former U.S. Secretary of Defense, used to speak of the “battlefield” in terms of “knowns and unknowns.” He understood we had terrorism in the world; it was a known largely in the form of bombings. For example: the 1983 U.S. Marine Corps barracks bombing in Beirut, Lebanon or 1993 World Trade Center bombing in New York City. Terrorism existed but it was generally “known” to be suicide bombings in the form of car and truck bombs. No one expected commercial airplanes to be hijacked and used as suicide weapons on September 11, 2001; and the result was the markets tanking. It was what Mr. Rumsfeld feared the most: “unknown, unknowns.” The COVID-19 Pandemic was an “unknown” that no one was prepared for, and the markets rightly reacted by tanking again. Markets have experienced virus outbreaks before, including the bird flu, SARS, and Ebola to name a few; but COVID-19 was new and “unknown”that’s why they called it a novel coronavirus.

Right now, we have a few things people are worried about, including inflation and resurgent COVID-19 in the form of the Delta variant. So why are the markets still quietly rallying? Because these concerns are now “known”concerns, and we have the tools in place to fight them. If inflation reaches an average of 2%, along with falling unemployment, the Fed will raise interest rates. The existing vaccines for COVID-19 can protect from the Delta variant, we just need vaccination rates to keep increasing worldwide. We have talked about markets being efficient many times before, and now is a prime example. The markets see the eventual outcome and understand that concerns exist, but these concerns are “known” concerns and solutions exist to fix them. Efficient markets, a helpful Fed and a long-term investment outlook remain firmly in place.

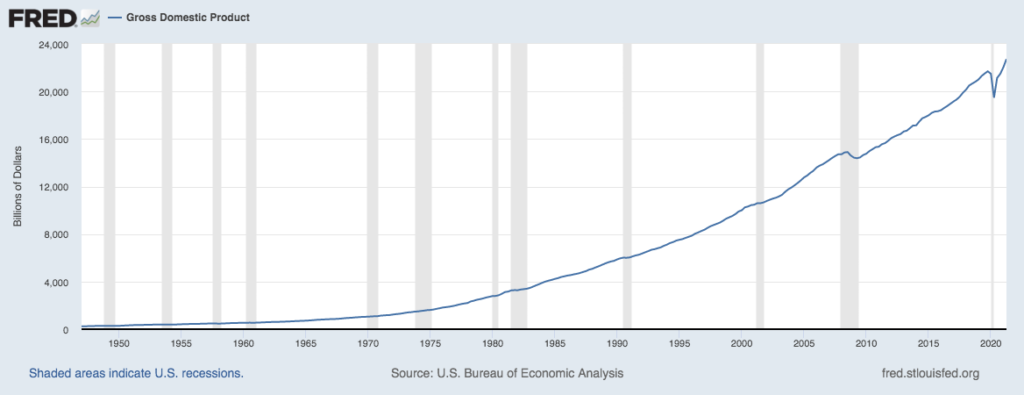

Finally, look at the graph below (from The Federal Reserve of St. Louis) showing the U.S. Gross Domestic Product since 1950. It is truly amazing. Q2 2021 GDP hit a staggering $22.7 trillion and all but erased the pandemic-related recession of 2020.