by Maurice (Mo) Spolan, Investment Research Analyst

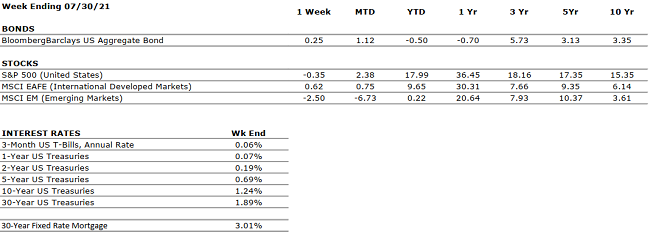

The Dow Jones, S&P 500 and Nasdaq 100 returned -0.36%, -0.35%, and -1% last week. Nonetheless, July represented the sixth straight positive month for the S&P and all three indices are up healthily – between 15% and 18% – year-to-date.

In economic news, U.S. GDP increased at a 6.5% annualized pace in Q2. While a very high number, based on historical standards, the result was far below expectations of 8.4%. At least some of the shortfall is attributable to the global supply chain constraints, as lack of inventory decreased GDP by nearly $200 billion. On the positive side, the U.S. has now recovered all its GDP losses incurred during the pandemic. Consumer spending increased at an average 12% pace and consumer confidence is at a 17-month high. Economists expect U.S. GDP to decelerate to some degree in the second half of the year, but overall, for growth to remain very healthy.

Q2 S&P 500 results are incredibly strong, as sales and earnings are up 21% and 86%, respectively; growth rates in both metrics are near or at record levels. Similar to GDP, corporate results are exacerbated because they are compared to a period in 2020 in which economic activity was extremely limited. On the other hand, many companies are struggling with inventory shortages, which curbed results. Analysts anticipate that corporate performance will remain strong through this year and into next.

The Fed concluded its two-day meeting by leaving rates near zero, as expected. Jay Powell cautioned that the economy has a way to go before the Fed moves rates upwards but has made significant progress towards the Fed’s goals. Powell reiterated, yet again, his view that inflation is transitory. By contrast, the IMF (International Monetary Fund) expressed the opposite view and recently encouraged global central banks to take preemptive action to prevent inflation.