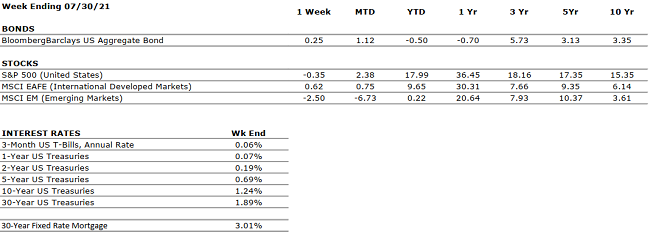

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

Q2 U.S. GDP grew at a 6.5% annualized pace; a very strong number, historically speaking, but below the 8.5% expectation. A lack of inventories, resulting from a constrained global supply chain, reduced GDP by nearly $200 billion. |

|

CORPORATE EARNINGS |

POSITIVE |

With about half of S&P 500 constituents having reported Q2 results, sales and earnings growth are running at an astonishing 21% and 86% pace when compared to the heavily depressed figures from Q2 2020. |

|

EMPLOYMENT |

POSITIVE |

In June, the U.S. economy added 850,000 jobs, beating expectations handily. The unemployment rate is 5.9%, well within normal parameters. |

|

INFLATION |

NEUTRAL |

Inflation accelerated to 5.4% in June. Jay Powell, Federal Reserve Chair, believes that the recent uptick in inflation is primarily attributable to global supply chain constraints, and that inflation will slow as such constraints resolve through the remainder of the year. |

|

FISCAL POLICY |

POSITIVE |

The Senate voted to advance the $550 billion bipartisan infrastructure bill, opening up the bill to debate and amendments. |

|

MONETARY POLICY |

POSITIVE |

The Federal Reserve indicated that it plans to hike rates twice in 2023. Previously, the Fed had suggested it would not raise rates until 2024. Nonetheless, the monetary stance is accommodative in the near future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and accommodative fiscal and monetary policies in place, 2021 is looking like one of the strongest economic years on record. The primary risk at present is that of persistent inflation which begets higher interest rates. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.