by William

Henderson, Vice President / Head of Investments

The first full

week of November gave the markets a solid boost and moved to set up 2021 as

a banner

year for equity returns. Last week, the Dow Jones

Industrial Average rose +1.4%,

the S&P 500 Index increased by +2.0% and

the NASDAQ moved higher by +3.1%. Year-to-date,

the Dow Jones Industrial Average has returned +20.1%,

the S&P 500 Index +26.6%

and the NASDAQ +24.6%. The

stock market shrugged off Fed Chairman’s Jay Powell’s commitment to begin

tapering the Fed’s Treasury Bond purchases next month and to continue

through June 2022. Normally, news from the Fed like that would have pushed

interest rates higher but the reaction by the bond market (rates moved lower)

simply showed that this information was fully priced into

bond yields and Chairman Powell’s comments at his press conference were widely

expected and previously well telegraphed. We have said it many times, that

this Fed, under the direction of Powell, is one of the

most transparent Feds we have seen. As mentioned, the

10-year U.S Treasury closed the week at 1.53%, down four basis

points from the previous week and well below

the 1.74% level reached in March of this year. Lastly,

even after being pushed by reporters, Powell was reticent to discuss a concrete

plan for higher interest rates next year. While expected, this comment reminded

the stock markets that monetary stimulus, in the form of low interest rates, is

going to remain in place for a bit longer.

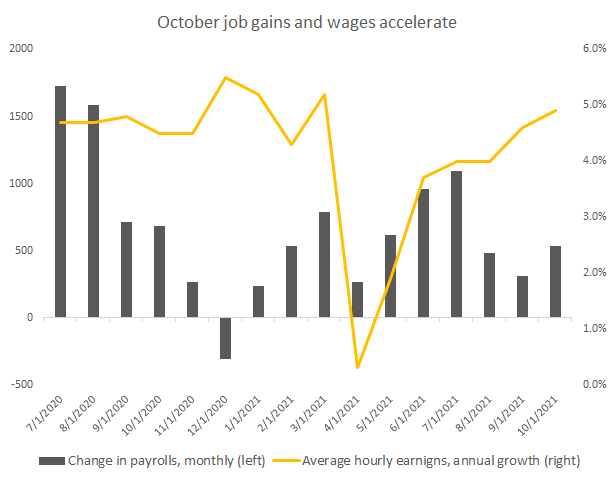

Chairman Powell reminded reporters that their dual mandate – inflation and jobs, remains front and center of their agenda and while we have seen inflation numbers well above their 2% target, full employment has not yet been reached. Clearly, last week’s jobs reports were strong as the report showed the U.S. economy added 531,000 new jobs in October, the most since July and the first upside surprise in three months. Prior months’ data was also revised higher, and hiring was broad-based across all sectors of the economy. (See chart below from Bloomberg.) However, the report showed that despite solid growth in new jobs and wages, the labor participation rate held steady, and unemployment only modestly ticked down to 4.6%.

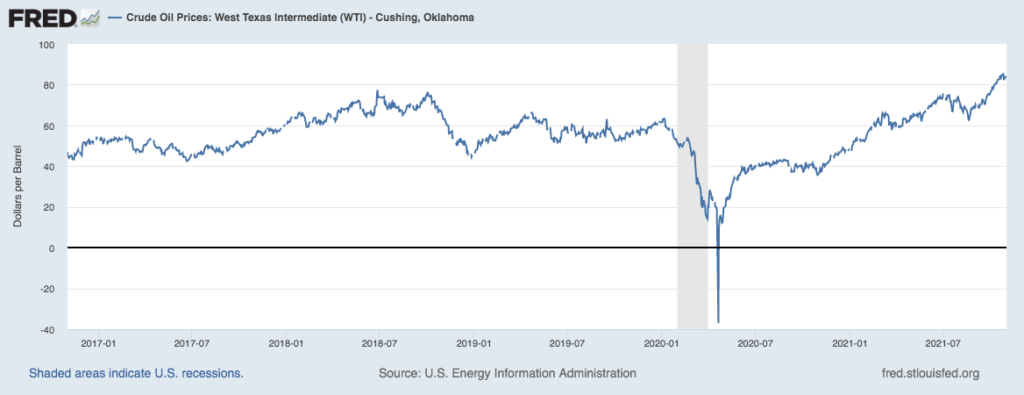

We are definitely seeing inflation as strong demand for goods coupled with continued supply-chain disruptions and delivery bottlenecks persist, pushing prices for goods and services higher. One simple measure of inflationary pressures is to look at crude oil prices. A barrel of West Texas Intermediate crude (WTI) hit $84 last week, a post-pandemic high and higher than levels prior to the pandemic. (See chart below from Federal Reserve Bank of St. Louis. Remember, crude oil is the base for gasoline, heating oil, and most plastics.

It is important to keep things in perspective and remember that short-term trends are just that – short term. The economy is absolutely on a solid road to recovery with jobs being created and consumers and businesses in good shape financially. With low interest rates persisting, companies can continue to borrow at favorable rates giving them access to cash for capital expansion, workforce expansion and dividends. Banks, the engines of economic growth, love low borrowing costs which allow them to lend higher. Lastly, the consumer remains flush with cash, has a historically low debt burden and is pent up with demand for spending. These factors are the important things to watch and study. The stock market is a perfect predictor of inflation and we are seeing higher prices as a result of inflation in the economy, whether it is transitory or not. Stay focused on long-term trends. The Dow Jones Industrial Average is up nearly 95% since the bottom of the pandemic. (See chart below from the Federal Reserve Bank of St. Louis).

Technology, whether Fin-Tech, Biotech or Real-Tech, will continue to improve and create efficiencies that the experts will fail to predict or understand, but the markets will always price into future expectations.