In observance of the Christmas Holiday, our offices will be closed on Friday, December 24.

We wish everyone a safe, warm, and happy end to 2021.

In observance of the Christmas Holiday, our offices will be closed on Friday, December 24.

We wish everyone a safe, warm, and happy end to 2021.

by William Henderson, Vice President / Head of Investments

The markets digested a pile of negative news last week and reacted as expected, selling off by the week’s end with all three major indexes closing lower. The Dow Jones Industrial Average fell by -1.7%, the S&P 500 Index lost -1.9%, and the tech-heavy NASDAQ fell by -3.0%. Just last week we discussed hitting records by year end and then, as has been markets’ modus operandi lately, things whipsawed the other way when some new or semi-shocking news hit the tape. Thankfully, year-to-date returns remain healthy. Year-to-date, the Dow Jones Industrial Average has returned +17.7%, the S&P 500 Index +24.7% and the NASDAQ +18.5%.

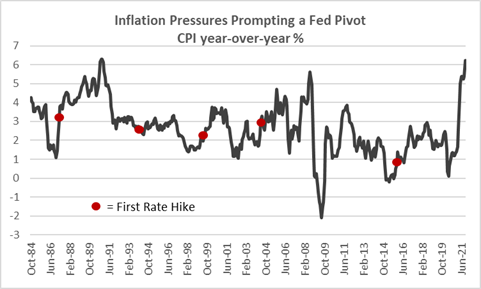

Last week the FOMC (Federal Open Market Committee) wrapped up its two-day meeting and did what the markets and economists had expected. It announced it will wind down bond purchases at a faster pace due to increased inflationary pressures on the consumer and healthy employment levels. However, there was a new “tone” in the Fed’s message that the markets read as hawkish – meaning higher rates are coming. The new outlook for rates in 2022 is showing as many as three rate hikes in the second half of the year. While not unexpected, the markets and the economy have become a little too accustomed to easy monetary policy. The chart below from Bloomberg shows how U.S. inflation, as measured by the Consumer Price Index, is higher than it has been in about 30 years, with dots indicating the timing of the Fed beginning to hike rates. The Fed’s hawkish pivot is typical behavior and standard reaction to a jump in inflationary pressures.

The omicron variant of COVID-19 is having a much bigger impact on the markets and the economy than the expectation of higher rates. We knew higher rates were coming and we believed omicron was in check but, globally and in the United States, we are seeing renewed shutdowns and closures as the omicron variant spreads more rapidly than expected. Several Broadway shows and NFL football games were canceled over the weekend just as a sense of normality was returning. Closures and cancellations are not what the economic doctor ever orders for a recovery economy. Mall activity and shopping are at decent levels and consumers are spending for the Christmas holiday. Retail sales information will be telling when released next month. It is important to note that current vaccines when taken with the booster, deliver a powerful punch to the omicron variant and most hospitalizations and severe illnesses are among the population that has yet to get vaccinated.

In our weekly

Heat Map, we moved Fiscal Policy to neutral from

positive because the Build Back Better bill looks to be dead for 2021 and

questionable for 2022. If the Biden Administration

cannot piece together a coalition to support his plan while in numerical

control of the U.S. House and Senate, their future

looks bleak, especially given 2022 is a mid-term election year. For

that reason, we believe fiscal stimulus (support for the economy from the government

rather than the Fed) will wane in 2022 and is

no longer supportive of the economy.

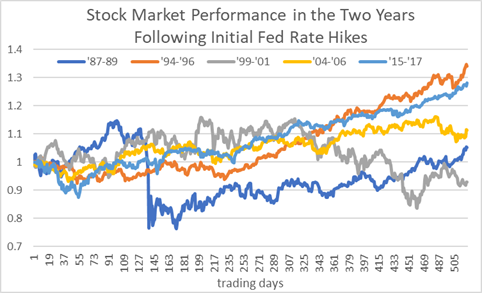

We do not want to be repetitive more than required but the negatives we point out above: omicron, Fed tapering, higher rates and removal of fiscal stimulus are not new worries. We have talked about and them for weeks and are well prepared. Stock markets can rally well into a Fed tightening cycle. The chart below from Bloomberg and Edward Jones, shows equity market returns, as represented by the S&P 500, during the two years following the first time the Fed began hiking rates in previous rate-hiking cycles over the last 35 years.

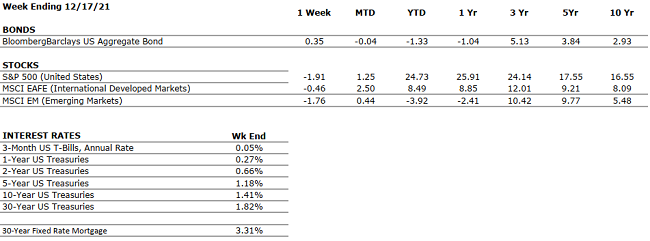

Everyone knows past performance is not indicative of future performance, but we can learn from history and history shows us that stock markets can do well even as liquidity tightens and monetary and fiscal stimulus wanes. Last week, as equity markets fell, the bond market provided needed risk management for portfolios. The yield on the 10-Year U.S. Treasury dropped seven basis points from the previous week to 1.41% as investors moved from risk assets, such as equities, to the relative safety of bonds. With only a few trading days left in the year and news, but not “new” news hitting the tape every day, investors will be challenged and whipsawed as their investment plans are tested. We remain focused on the long term rather than the short term and believe that the economy remains well on its way to a strong recovery and a healthy 2022.

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. GDP growth decelerated to a 2% annualized pace in Q3. The slowdown was driven primarily by supply chain constraints. Economists expect a modest acceleration in Q4. Early high-frequency data (shopping, travel, movie ticket sales) is showing some slowing. |

|

CORPORATE EARNINGS |

POSITIVE |

Huge year-over-year increases in corporate earnings are likely to decelerate in 2022 as CapEx begins to have an impact on income statements. The supply chain disruptions are waning, but we may have to take omicron shutdowns into account. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 4.2%, as of November. The labor market is very tight at present as many employers, particularly in the Leisure and Logistics sectors, are struggling to fully staff because the labor participation rate remains below pre-COVID levels. The labor shortage is one of the causes of the global supply chain glut. |

|

INFLATION |

NEGATIVE |

CPI rose 6.8% year-over-year in November, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Will inflation be transitory or permanent? |

|

FISCAL POLICY |

NEUTRAL |

The Build Back Better Bill looks to be swamped and pushed into 2022 by Senator Manchin. If the Biden Administration cannot pull the team together now, think about post-mid-term elections. Fiscal stimulus is waning. |

|

MONETARY POLICY |

POSITIVE |

The FOMC meets this week. Watch for wording around “transitory inflation.” By early 2022, all Fed bond purchases will halt. The Fed’s bond-buying program works to keep interest rates low. Once tapering ends, rate hikes follow. Mid-June or sooner for rate hike? |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

The new omicron COVID-19 variant has shown up in many parts of the world. This strain seems less virulent and more reactive to boosters so its impact it still yet to be calculated. President Biden threatened a 2022 Olympics boycott in China. Russia builds up its border with the Ukraine. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions are hampering the economy; however, demand remains very strong. While global logistics are operating far below normal efficacy, it appears the supply chain is slowly improving and may reach normalcy by mid-to-late-2022. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

“There has to be at least one day of the year to remind us that we’re here for something else besides ourselves.” – Eric Sevareid