by William Henderson, Chief Investment Officer

Another hot inflation reading last week sent markets tumbling across all major sectors and all major indexes. Couple that with continued unrest and saber rattling between Russia, Ukraine and NATO Allies and you have the perfect recipe for poor weekly returns. The Dow Jones Industrial Average fell -1.0%, the S&P 500 Index lost -1.8% and the NASDAQ lost -2.2%. Poor weekly returns piled on to weak year-to-date returns and as a result all three major indexes remain well into negative territory for 2022. Year-to-date, the Dow Jones Industrial Average is down -4.3%, the S&P 500 Index is down -7.2% and the NASDAQ is down -11.8%. Fixed income, while weak for most of the year, provided a modicum of safety for risk averse investors. Thus far in 2022, fixed income has fared just as poorly as equities; however, global uncertainty always moves investors to safety. We saw that last week as bonds rallied ever so slightly. The 10-year U.S. Treasury Bond fell one basis point to end the weak at 1.92%.

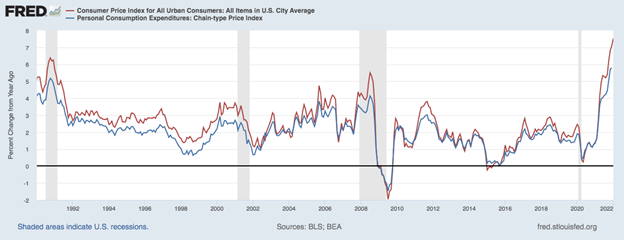

As mentioned, last Thursday the government reported that inflation rose at a 7.5% annual rate in January, the highest level since 1982. January’s report piled onto the December 2021 level of +7.0%, both of which are well above the Fed’s target inflation level of +2.0% annually. (See the chart below from the Federal Reserve Bank of St. Louis).

Inflation certainly seems to be out of control and well past the Fed’s target level and many economists now believe the Fed and the FOMC (Federal Open Market Committee) are behind the eight ball with respect to rate hikes. While Fed Chairman Jay Powell has preached patience and a need for moderate rate hikes; futures markets are pricing in a 50-basis point rate hike at the March meeting, according to the CME FedWatch tool. It is important to view the above chart as a whole and look at past recessions, past spikes in inflation and then a resultant calming of inflation as interest rates rose and slowed inflation. While some believe the Fed is behind, it seems to us that the Fed has effectively created their desired inflation and now will deal with it as is their design and plan. The Fed will be monitoring market data and economic indicators between now and the March meeting and that information will determine the magnitude and pace of future rate hikes.

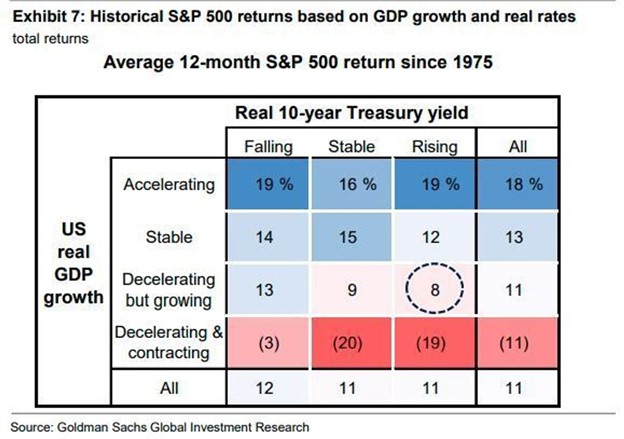

As we have mentioned before, positive returns in equities are possible in years where interest rates are rising. Further, Goldman Sachs published a chart showing varying outcomes for 2022 looking at economic growth and interest rates. Certainly, the economy is slowing from the robust growth we saw immediately after the pandemic-related recession. It is still growing, just at a slowing pace.

We have certainly seen rising interest rates this year, but as bond yields rise, their attractiveness, especially for pension funds increases as well and buyers eventually return pushing yields lower. One potential outcome for 2022, based on data since 1975, shows modest S&P 500 returns given a growing but decelerating economy and rising yields. (See chart above).

The uncertainty around the Russia / Ukraine situation is real and markets hate uncertainty, as we know. Outcomes here are too risky to predict but it is widely expected that the issue will not result in a global calamity and cooler heads, somewhere, will prevail. On a different note, Bank of America economist, Anna Zhou, reported last week that credit card spending showed a noticeable uptick (+20.2% vs same period in 2020) in the previous two weeks and that the huge increase was due to a surge in services-related spending. This should not be seen as surprising given the recent drop in COVID cases and resultant decreases in mandates by states, including New York, Illinois, and New Jersey. Once the consumer, with a $22 trillion war chest, is free to spend, especially in the travel and leisure sector, we will see continued strong economic growth. Spending coupled with strong employment and inflation absolutely gives the Fed reasons to raise short-term interest rates; and that is what the market has already priced in as we have seen with rises in the two-year (1.57%) and 10-year (1.92%) U.S. Treasury bonds. Watch for a “second reopening” of the economy as the consumer is freed to spend and pandemic fades.