by William Henderson, Chief Investment Officer

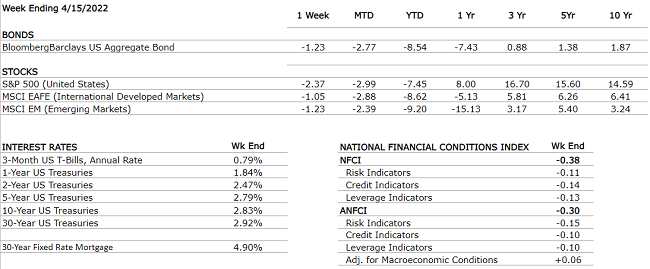

A holiday-shortened trading week with minimal major news or economic releases did little to quell the continued downward slide in U.S. equity and bond markets. Even news that inflation may be peaking did little to alleviate uncertainty in the markets. For the week ended April 15, 2022, the Dow Jones Industrial Average fell -0.4%, the S&P 500 Index fell -2.4% and the tech-heavy NASDAQ, fell by -3.9%. Negative returns for the week added to already weak year-to-date returns. Year-to-date, the Dow Jones Industrial Average is down -4.7%, the S&P 500 Index is down -7.5% and the NASDAQ is down -14.5%. Bonds fared no better than stocks with the yield on the 10-Year U.S. Treasury bond rising another eight basis points during the week to close at 2.83%, the highest level since April 2018.

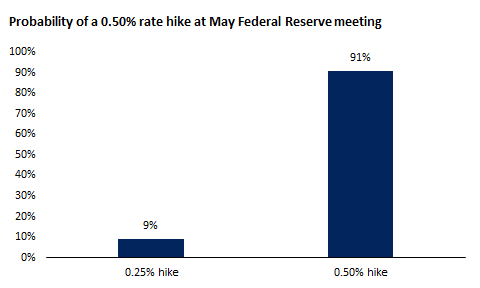

The bond market seems to have priced in much of the aggressive Federal Reserve Bank tightening that Chairman Jay Powell has alluded to for 2022. Further, the Two-Year U.S. Treasury has moved from 0.73% at the beginning of 2022 to its current level of 2.47%, after briefly touching a higher level of 2.52%. The move in Treasury yields across the yield curve certainly puts a 3.00% yield on the 10-Year Treasury in range before year end. With much of the rate hike expectations priced into bond yields, futures markets are also now predicting a 50-basis point rate hike at the May Fed meeting. (See the chart below from FactSet showing a 91% possibility of 50-basis point rate hike vs. just 25 basis points.)

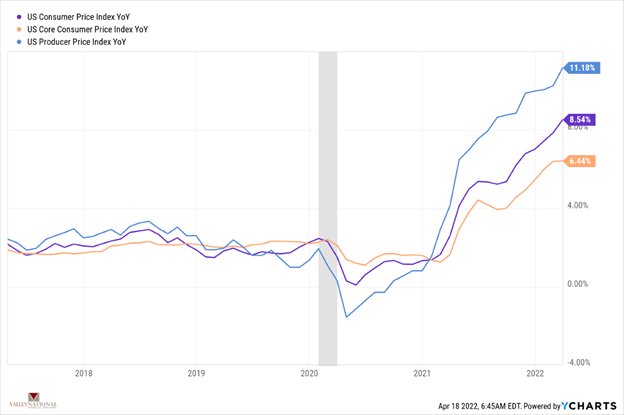

As mentioned, last week saw three important inflation indicators released: U.S. CPI (Consumer Price Index), U.S. Core CPI and U.S. PPI (Producer Price Index). While each came in at record-high or near-record levels, Core CPI came in below expectations, flattening its rate at the same time. The CPI (which measures prices consumers pay for goods) figure came in at 8.5% year-over-year, in line with economists’ expectations while Core CPI (which excludes food and energy costs) came in at 6.5%, below forecasts of 6.6%. Lastly, U.S. PPI, (which measures prices paid by domestic producers), came in at 11.2% year-over-year, the highest level on record. (See the chart below from Valley National Financial Advisors and YCharts).

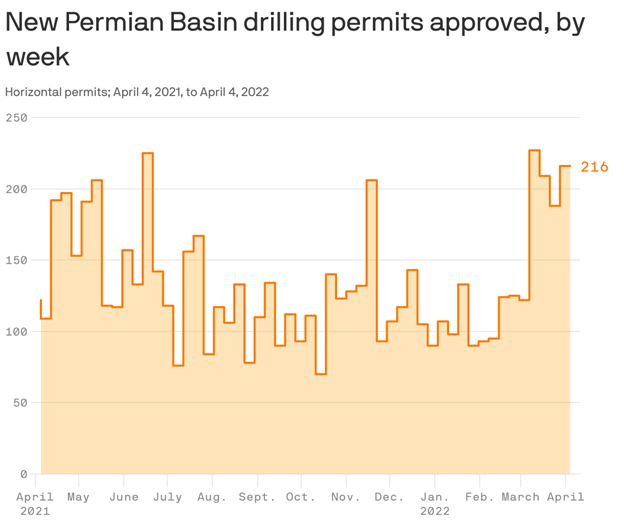

While headline inflation remains heated, there are signs inflation may be peaking especially in two key components: energy and housing. The Russia / Ukraine crisis continues to put upward pressure on oil and other commodities, but the average price of WTI (West Texas Intermediate) crude oil was $108 in March while it has averaged $99 in April. A continued downward trend will certainly impact CPI in the coming months. We previously noted the flexibility the U.S. energy industry built into its production cycle with pumps and wells having the ability to turn on and off as energy prices fluctuate. With WTI prices near $100 a barrel, drilling and fracking become profitable again. A natural way to measure this is the rate of new drilling permits granted. (See the chart below from Axios showing new Permian Basin drilling permits approved). More permits will pump more oil into the global oil markets which are fungible but do not expect the impact on oil supplies until 2023.

Another component of core inflation that may start to show some moderation in the coming months is shelter (homes prices and rents) which accounts for about 1/3 of all consumer spending as measured by the Core CPI component. Mortgage rates have been rising throughout the year and recently touched 5.0%. As mortgage rates rise, shelter pricing typically declines as demand falls off, but this will take some time, just as increased drilling permits will, to flow through to inflation data. The point is that lower prices for some key consumer goods and services are coming, they are just not coming tomorrow.

April 18, 2022 was the final day to file personal income taxes (without an extension) and thus far in 2022, the Federal government has collected a record $2,121,987,000,000 in taxes from individuals and corporations–yes that is $2.2 trillion. Earnings season gets underway this week with important banks and corporations releasing first quarter earnings. Wall Street analysts are expecting increases in earnings, but those expectations have been tempered recently as increasing prices and higher interest rates are impacting the bottom line for many companies. We are going to see a protracted period of uncertainty as the markets digest higher interest rates and higher inflation; however, relief on both fronts is starting to materialize. Lastly, the consumer, which makes up more than 60% of the U.S. economy, remains financially healthy with vast savings and historically low debt burdens. These are the times for investors to really stay focused on the long-term.