by William Henderson, Chief Investment Officer

Global anxiety bled into U.S. markets, already skittish about higher rates and sticky inflation, and left us with an extremely poor week for equity and bond returns. For the week ending April 22, 2022, the Dow Jones Industrial Average fell -1.9%, the S&P 500 Index fell -2.8% and the NASDAQ lost -3.8%. The poor returns for the week only added to poor full year returns across all market sectors. Year-to-date, the Dow Jones Industrial Average is down -6.4%, the S&P 500 Index is down -10.0% and the NASDAQ is down -17.8%. The dispersion between the Dow Jones and the NASDAQ returns reminds us of the importance of a diversified equity portfolio that crosses all market sectors. Hawkish comments (meaning – those with inflation concerns and thereby calling for higher interest rates) from several Fed governors last week pushed bond yields higher once again and the yield on the 10-Year U.S. Treasury ended the week at 2.90%, seven basis points higher than the previous week.

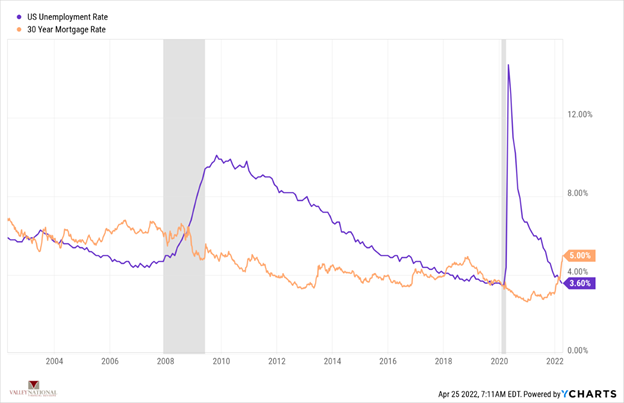

We have stated many times about the solid condition of the U.S. economy when you consider the consumer, the labor market and the health of banks and corporations. Several Wall Street prognosticators and economists are calling for a recession in either late 2023 or 2024. We are not in that camp, based solely on our long-standing view that recessions are almost always preceded by a weak housing market and poor labor conditions – neither of which are present now. The chart below from Valley National Financial Advisors and YCharts shows the 20-year unemployment rate, currently 3.6%, and the 30-year fixed mortgage rate, currently 5.00%. Both levels support the premise that the U.S. economy is in sound financial shape as employment is solid and mortgage rates remain reasonable, especially for first-time home buyers.

Yet, the markets are falling week-after-week. The markets are not digesting the global unrest (Ukraine / Russia War), global economic concerns (EUR region could see a recession as soon as 2023) and continued worrisome news on COVID lockdowns in Shanghai and Beijing, China, which risk another global supply chain meltdown. There is an old economic axiom that states: “When the U.S. gets a cold, the world gets the flu.” We are not willing to change Wall Street or economic axioms here, but it would seem to us that the world has the flu, and we are at risk of catching a cold. Our “cold” is certainly being exacerbated by the Fed’s current aggressive strategy on raising interest rates. What is most puzzling is the reaction from the market, given the fact that the Fed has been completely transparent on its path to higher rates. Fed Chairman Jay Powell is intently focused on bringing inflation under control and closer to their 2.5% target rate and the easiest way to accomplish this is through higher rates to quell hot inflationary pressures.

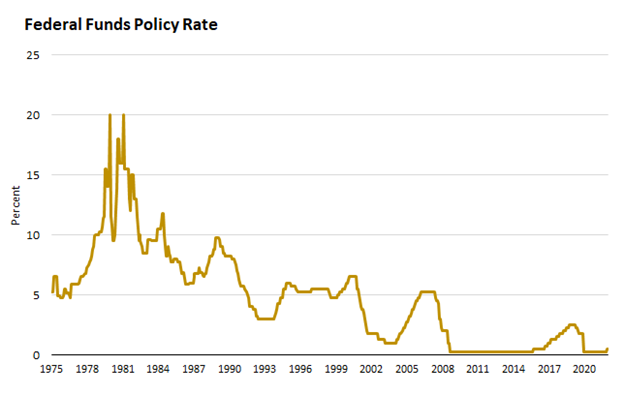

Even with higher rates on the horizon, the economy will continue to expand at an estimated 3% in 2022, which is strong by recent historical standards, and well below the 6% GDP (Gross Domestic Product) growth we saw in 2021. Markets have dealt with rising interest rates in the past and have performed quite nicely. The economy is sound, the consumer is armed with more than $2 trillion in accumulated savings and wage growth is accelerating, so consumers are not reliant on borrowing or low interest rates to fuel household consumption, which makes up 70% of GDP. Lastly, by any measure, interest rates remain historically low and are still technically fueling economic growth. (See the chart below from FactSet showing the Federal Funds Rate from 1975).

Valley National Financial Advisors recently published a piece sourced from Clearnomics, Inc. called “In times of stress on the markets, staying with a long-term investment plan is prudent” READ IT HERE. The premise of the piece is that time is the key ingredient in investing. Financial markets are inherently volatile over days and weeks. The stock market is no better than a coin flip, rising only slightly more than 50% of the time, and down days tend to be much worse than up days. This can be frustrating to investors who expect the stock market to consistently rise and achieve its 30-year average total return of 11.5% in any given year. There have been very few instances over the span of 10 or 20 years (The Great Depression being one) where stocks have had negative returns. When you add in the long-term compounding of interest and dividends, real personal wealth is created.

Global uncertainty will continue to persist, and markets hate uncertainty. Watch this week for earnings release data on several important tech stocks (Apple, Amazon & Alphabet (Google)) and key inflation data on Friday. The earnings information should help with the direction of the stock market and data will show if the Fed is starting to reel in inflation.