by William Henderson, Chief Investment Officer

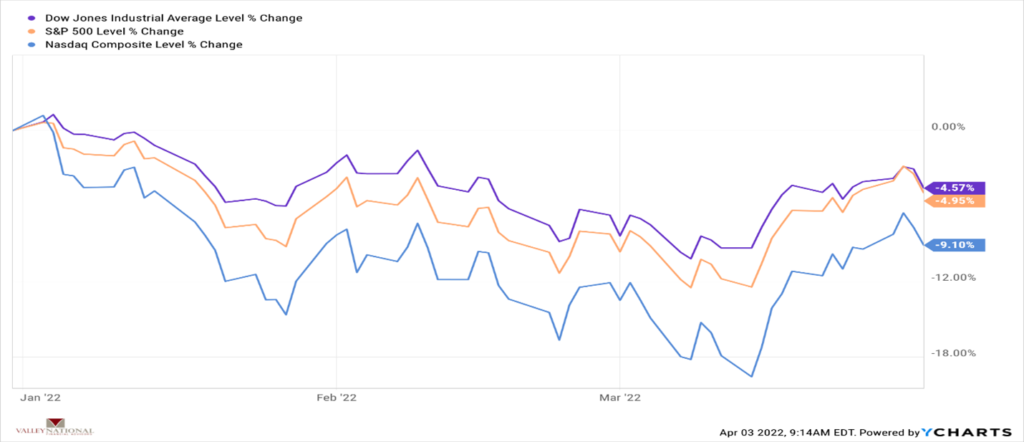

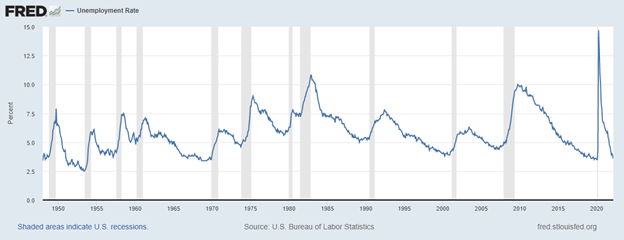

Major U.S. stock market indexes gave back some of their March gains as inflation pressures persisted, the Russia / Ukraine war dragged on and comments from the Fed about balance sheet reduction weighed on investors’ concerns. Conversely, pockets of good news persisted, oil prices, for example, again fell further and strength in the labor markets continued. For the week ending April 8, 2022, the Dow Jones Industrial Average fell -0.3%, the S&P 500 Index fell -1.3% and the NASDAQ, an index representing growth stocks which are more sensitive to higher interest rates, fell by -3.9%. Overall weakness in the equity market continues and year–to-date returns remain solidly negative. Year-to-date, the Dow Jones Industrial Average is down -3.9%, the S&P 500 Index is down -5.5% and the NASDAQ is down -12.2%. News from the Fed about continued rate hikes and balance sheet reduction weighed on bond markets and the 10-Year U.S. Treasury bond rose an additional 37 basis points to 2.76%. After starting the year yielding 1.51%, the 10-Year Treasury is up a stunning 125 basis points so far in 2022 and at its highest level since March 2019. (See the chart below from Valley National Financial Advisors and YCharts showing the 10-year U.S. Treasury rate).

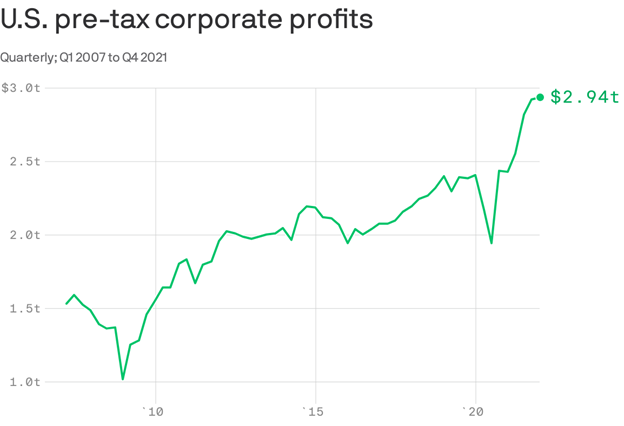

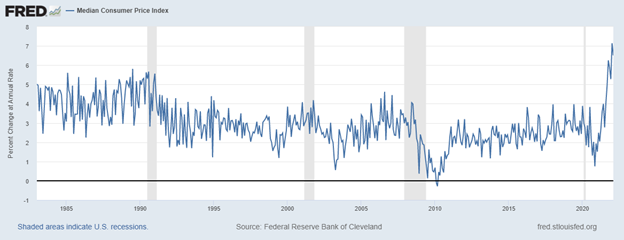

While trying not to seem repetitive, the underlying fundamental strength of the U.S. economy (labor markets, consumer heath, bank balance sheets, corporate earnings) does not seem to counter the headwinds of higher inflation and higher interest rates. This week we will get some additional information around inflation as the monthly and yearly U.S. Consumer Price Index change for March 2022 is released on Wednesday. The previous YoY (Year Over Year) reading was +7.87% and a level at or higher will certainly give the Fed all the air cover it needs to aggressively raise interest rates further. Friday begins the release of First Quarter earnings and banks will be first to report. Expectations for the first quarter are low compared with previous quarters. According to FactSet, analysts surveyed expect EPS (Earnings Per Share) increases of S&P 500 companies to average only +4.5%; which would be the first time in two years that earnings growth did not top +10%.

Turning to the Russia / Ukraine war and market implications, there was a small piece of information that may help explain why the massive move upward in the Russian Ruble. China and Russia announced commodities trading between the two countries using a Yuan / Ruble currency conversion trade. Traditionally, commodities such as oil, that trade on international markets must be traded in U.S. Dollars only. Information around the China / Russia trade has helped to buoy the Ruble bringing the level back to pre-invasion levels. (See the chart below from Bloomberg).

Trading outside of the U.S. Dollar has allowed the Ruble to rebound and shows how countries outside of NATO, China in this case, are helping Russia deal with crippling economic sanctions imposed by Western nations. Sadly, this gives us no reason to expect the Russia / Ukraine war to end anytime soon.

Next week (April 18) brings the due date for Americans to file their 2021 tax returns. Most Americans are expecting refunds on their tax filings. A piece by Goldman Sachs noted that expectations are for refunds to exceed recent years due to the expanded tax credit and other fiscal transfers (See the chart below from the Department of the Treasury and Goldman Sachs).

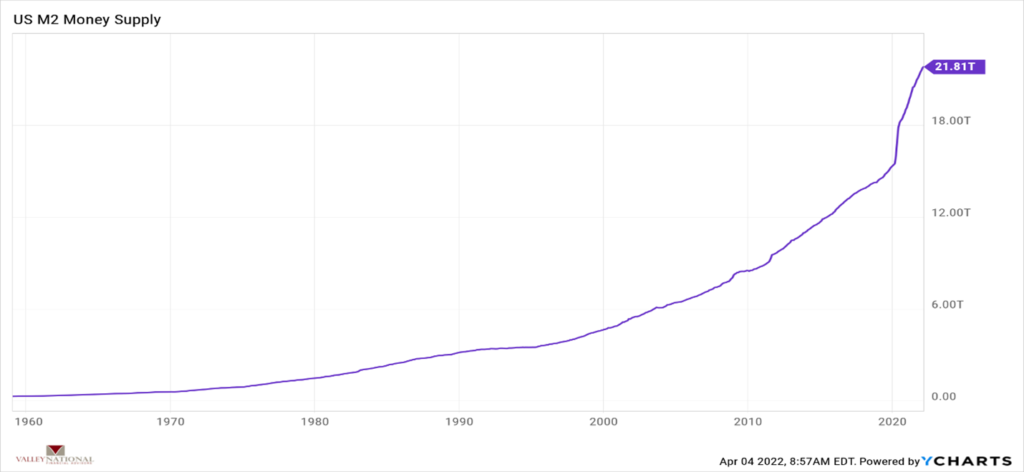

Additional cash into consumers’ pockets over the coming few weeks will pile onto the cash they have already accumulated over the pandemic from increased savings, reduced spending, and government stimulus payments. In the face of rising costs of many consumer goods and services, this additional cash will give consumers a needed cash cushion. Lastly, remember that more than 60% of the U.S. economy is consumer driven and a healthy consumer flush with cash and employed always leads to continued economic growth.