by William Henderson, Chief Investment Officer

Volatility and uncertainty are the best two words to succinctly describe the first quarter of 2022 and, as we have always said, both of those are bad for markets. Markets like boring and we did not get a lot of boring in the first quarter of 2022. Instead, we had continuing high inflation data, Russia starting a war with Ukraine, and the first Fed rate hike since December 2018. Over the course of the quarter, we saw violent swings in the stock market and huge intra-day moves in prices, which were largely attributed to uncertainty around the Russia/Ukraine war. War in that region severely impacted prices for certain commodities and strained an already stressed market still suffering from global supply chain issues due to the pandemic. Ukraine and Russia are large producers of oil, natural gas, wheat, and certain rare early elements such as palladium which is used to make catalytic converters for cars and trucks. Additional shortages in these critical commodities immediately spiked higher prices across the board and sent overall inflation numbers higher.

Quarter-end returns do not accurately reflect the markets’ violent swings during the quarter. Looking at the chart below from Valley National Financial Advisors and YCharts, we see the quarter-end numbers for each major market index.

While the chart shows the NASDAQ at -9.1% for the quarter-end March 31, 2022, at the bottom of the quarter, the NASDAQ was down over -20%. The chart reflects the huge move upward during the month of March as the risk-off trade faded and investors moved again to buy equities. For the quarter-end March 31, 2022, the Dow Jones Industrial Average fell -4.75%, the S&P 500 Index fell -4.95% and the NASDAQ fell -9.10%. Fixed income investors fared no better as the Barclays Bloomberg U.S. Aggregate Bond Index (a widely used measure of fixed income investment performance) fell -6.12% in the first quarter. The benchmark 10-Year U.S. Treasury bond started the year at 1.52% and ended the quarter 80 basis point higher at 2.32%.

Around mid-March, the markets forged a dramatic turnaround as investors believed equities fell enough now warranting buying again. In our opinion, the markets were simply focusing on the strength and solid fundamentals underlying the U.S. economy: corporate profitability, bank health, the strong labor market, and consumers’ overall financial health. While these factors alone were not enough cure all the world’s ailments, specifically the Russia/Ukraine war, they were enough to pull investors back to U.S. equities.

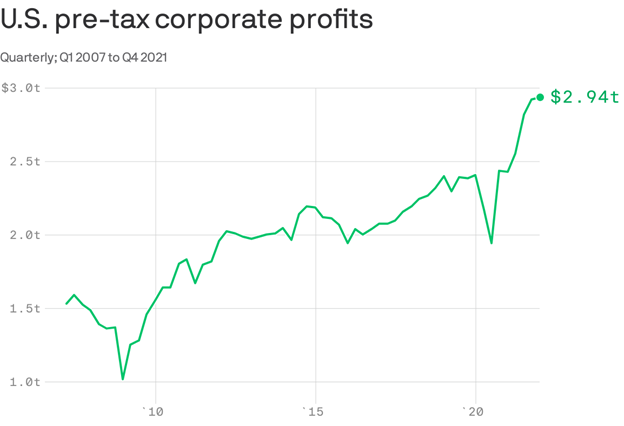

Corporate profitability,

while slowing a bit so far this year, hit a record in

2021,

and is expected to continue its upward trend in 2022. For

the full year 2021, pre-tax profits rose 25% to roughly $2.81 trillion, which

more than outpaced the 7% rise in consumer prices over the

same stretch; proving that companies were able to

pass on to their customers much

of the underlying spike in materials and

labor costs.

(See

the chart below from the U.S. Commerce Department

showing U.S. pre-tax corporate profits

2007-2021.)

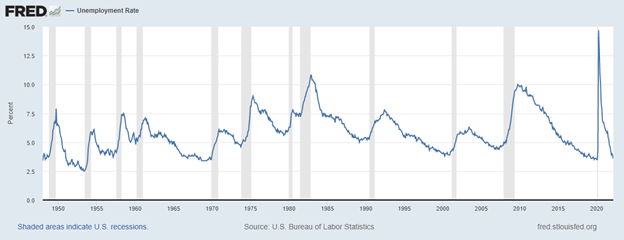

The labor market continues to be strong with new jobs being created each month. The unemployment rate fell to 3.6% in March from 3.8% a month earlier, quickly approaching the February 2020 pre-pandemic rate of 3.5%, a 50-year low. While low, the jobless rate helps to boost wages, higher inflation continues to impact workers pockets as prices for basic goods like gasoline and food creep higher each month. (See the chart below from the Federal Reserve Bank of St. Louis showing the unemployment rate since 1950).

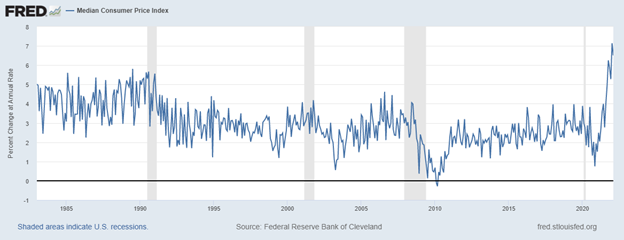

As mentioned, corporate profitability shows that companies have been able to pass on inflationary prices of materials to the consumer. Further, more people are working as evidenced by the unemployment rate. Certainly, these two factors coupled with global supply chain issues and commodity shortages exacerbated by the Russia/Ukraine war have impact inflation beyond the Fed’s 2.5% target rate. Hence, Fed Chairman Jay Powell’s response by raising interest rates at the March 2022 FOMC meeting. Given where inflation and employment levels are, we expect, along with all Wall Street economists, more rate hikes to follow in 2022. For a visual of how dramatic the inflation spike is, see the chart below from the Federal Reserve Bank of St. Louis showing the Median Consumer Price Index (common gauge of inflation) 1985-March 2022.

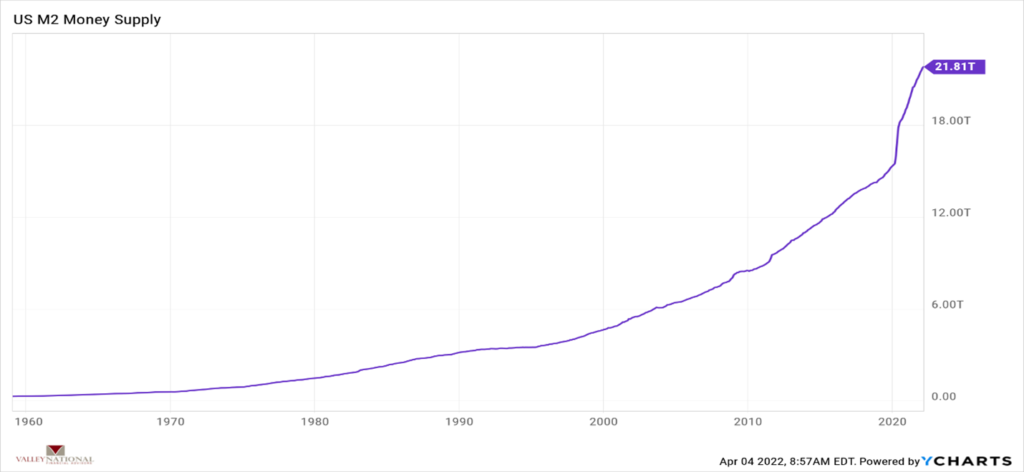

There’s an old Wall Street maxim that states: “higher prices cure higher prices.” Essentially, stating that as prices increase, fewer buyers will emerge and thereby decreasing demand and high prices. In the current case, we have very healthy consumers with a lot of cash in their coffers accumulated over the past two years as spending on leisure activities was practically halted yet cash continued to build up from savings and government stimulus funds widely distributed to Americans. M2 – the measure of the total U.S. Money Supply stands at a record $21.8 Trillion, giving consumers a lot of cash to spend – eventually. (See the chart below from Valley National Financial Advisors and YCharts showing M2).

“Eventually” is the key word here. The second quarter of 2022 brings Spring and the widespread lifting of pandemic-related lockdowns. With the grand reopening of the U.S. economy, consumers will be released to spend and enjoy travel, leisure, and other expensive activities – all at the newest, latest, and greatest “higher prices.” “High prices cure high prices.”

While the pandemic in the United States seems well behind us, other parts of the world are still suffering its devastating effects. For example, China continues to impart severe lockdowns on whole regions in an attempt to quell the spread of COVID-19. Further, the Russia/Ukraine war is far from over resulting in continued disruptions in key commodities such as oil and wheat, which are dramatically impacting prices in the EU region and beyond. The U.S. is not immune to the pandemic or inflation and the Fed continues to watch both reminding us along with way that their dual mandate of full employment and 2.5% annual inflation are front and center for Powell. While the first quarter of 2022 produced negative returns for stocks and bonds (a very rare event), we remain positive on the economy and the markets for the remainder of the year with a word of caution for investors. Volatility will be present based on continuing unrest due to geopolitical events and continued pressure due to inflation, which will certainly shape the direction and severity of interest rate hikes by the Fed.