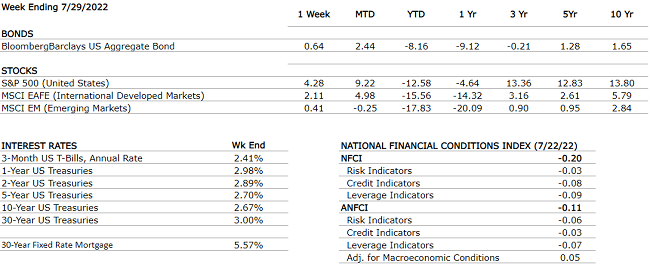

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.5% annual rate according to the second estimate. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. Real GDP for Q2 2022 decreased at an annual rate of 0.9% marking the second consecutive quarter of declining GDP. |

|

CORPORATE EARNINGS |

NEUTRAL |

The estimated growth rate for Q2 2022 is now 6.0% (up from 4.3%) which would mark a new post-pandemic low; but still solidly in the “growth” stage. 56% of S&P500 companies have now reported earnings — 73% beat earnings estimates and 66% reported actual revenue above expectations. For Q3, 28 companies issues negative EPS guidance while 17 companies issued positive guidance. |

|

EMPLOYMENT |

POSITIVE |

Total nonfarm payroll employment rose by 370,000 in June and the unemployment rate remained constant at 3.6%. Job growth was widespread, led by gains in leisure and hospitality, manufacturing, and transportation and warehousing. Employment in retail trade declined. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the US accelerated to 9.1% in June, the highest since November 1981, from 8.6% in May and above forecasts of 8.8%. Core CPI increased by 5.9%, slightly below 6% in May, but above forecasts of 5.7%. The increase in CPI was driven by major surges in food and energy prices, as food costs rose by 10.4% and energy prices by 41.6%. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the Inflation Reduction Act last Wednesday. If enacted, the bill will provide significant incentives to cut carbon emissions and promote renewable energy. It will also result in the largest increase in corporate tax in decades. |

|

MONETARY POLICY |

NEUTRAL |

Last week the Fed hiked rates by 75 basis points, raising their target to a range of 2.25% to 2.5%. This decision had unanimous agreement by the 12 members of the rate-setting committee. In a statement, members of the committee acknowledged a slowdown in the economy over the last month in terms of spending and production despite strong jobs gains. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia has defaulted on its debt as of Sunday, June 26th when the 30-day grace period on $100 million of interest payments expired. This is the first Russian default since 1918. Sanctions imposed by Western powers effectively isolated Russia and its financial system from Europe and the U.S. making it much harder for Russia to complete international financial transactions. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian- Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. Starting in June, China has started to remove some restrictions in major cities to end the COVID-19 lockdown. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.