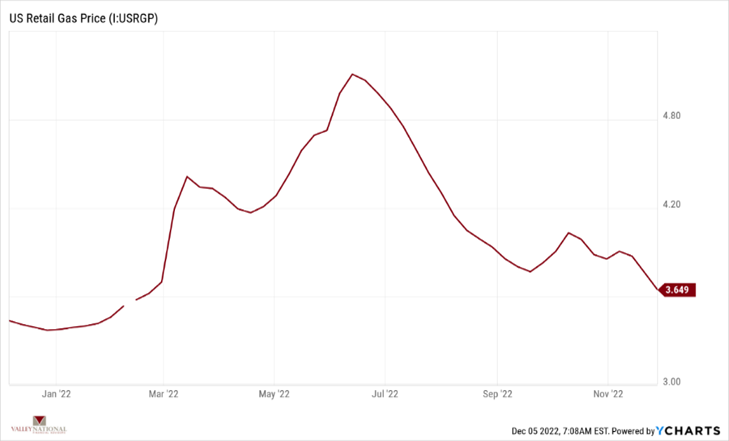

Financial markets posted another weekly gain pushing November to a positive month overall and helping equities post back-to-back monthly gains for October and November 2022. Further, bonds posted positive returns; in fact, their largest monthly gain since 2008. Positive returns in both markets helped balanced portfolios regain a lot of lost ground in markets since the beginning of 2022. See the summary returns immediately below but note importantly that the NASDAQ returned +2.09% for the week while the 10-Year U.S. Treasury fell 18 basis points to close the week at 3.56%. Just over one month ago, the 10-Year Treasury was 69 basis points higher at 4.25%.

Global Economy

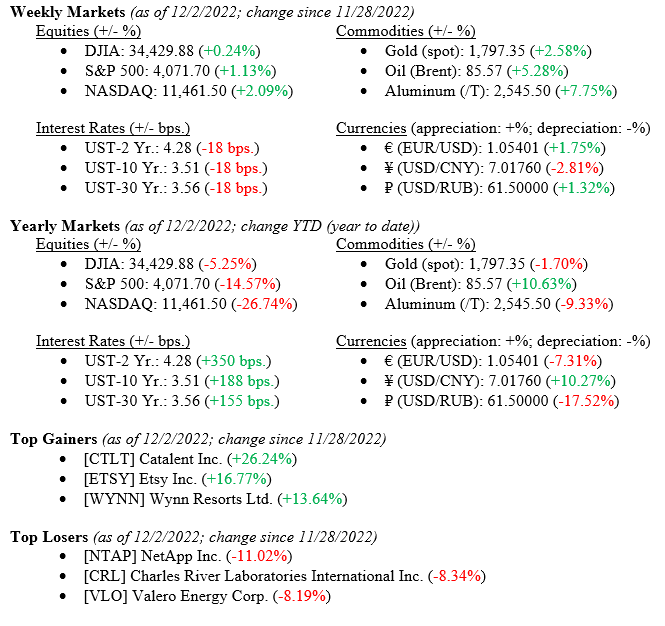

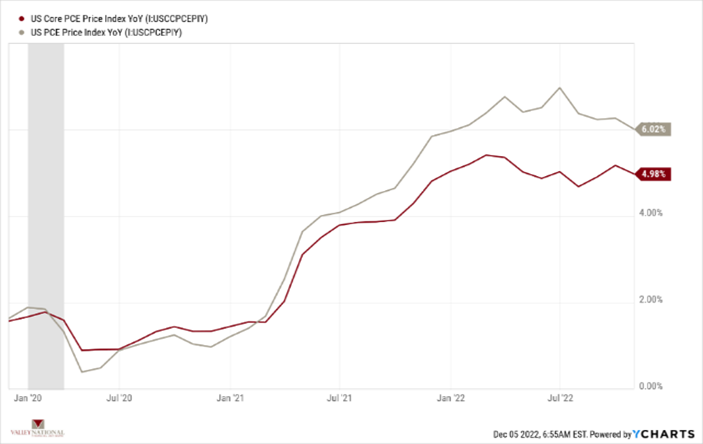

Big news last week was Fed Chairman Jay Powell’s speech at the Washington, D.C. Brookings Institute where he confirmed that smaller interest rate increases are ahead and mostly likely as soon as the December FOMC (Federal Open Markets Committee) meeting. Chairman Powell further cautioned that monetary policy would remain restrictive until progress on combating record high inflation continues. Charts 1 and 2, both by Valley National Financial Advisors and Y Charts, show recent downward inflationary trends – PCE (Personal Consumption Expenditures) and Core PCE and U.S. Retail Gas Price.

As demonstrated by both charts, the Fed’s tight monetary policy is impacted inflation but clearly more work is needed. We expect to see several rate hikes in 2022-23; albeit modest hikes such as +0.25-0.50%, rather than the aggressive +0.75% rate hikes we have seen thus far in 2022.

Most market prognosticators are still calling for a recession in 2023 solely based on historic patterns and economic data. While a recession may happen in 2023 – by whichever measure is popular now since NBER (National Bureau of Economic Research) does not seem to be the decider any longer – looking at market indicators today (labor, consumer health, bank balance sheets and loan delinquency rates, and corporate earnings), any recession will most likely be modest and short-lived.

Policy and Politics

Several key U.S. and Global issues remain:

- China is easing COVID-19 lock-down rules, easing supply chain concerns, and helping to open Chinese global supply chains.

- Russia/Ukraine War shows no signs of abating even as we move closer to winter and the resulting impact on Euro-zone energy prices.

- OPEC votes to keep crude oil production at current levels which helps Russia (OPEC member) rather than disrupts Russia’s oil revenue stream.

- The bankruptcy filing of cryptocurrency FTX continues to unwind but one clear outcome from this will be deeper and further government oversight and regulation of this nascent industry.

What to Watch

- U.S. Durable Goods New Orders for October 2022, released 12/5/22 (prior +0.39%)

- U.S. Initial Claims for Unemployment for week of Dec 3, 2022, released 12/8/22 (prior +225k)

- U.S. Core Producer Price Index Year Over Year for November 2022, released 12/8/22 (prior +6.68%)

- U.S. Index of Consumer Sentiment for December 2022, released 12/8/22 (prior 56.8)

Mixed messages abound in the markets today. So-called market experts all suggest a recession is coming in 2022. But U.S. equity markets are rallying (the Dow Jones Industrial Average is up +20% since its October 2022 lows) and U.S. fixed income markets have found a sweet spot as the 10-Year U.S. Treasury has fallen nearly 70 basis points since peaking in October. A recent post by asset manager BlackRock noted that the TINA Trade (There Is No Alternative) has given way to BARB (Bonds Are Back). We believe both remain in place—meaning a balanced and diversified portfolio is the surest path to long-term wealth creation.