1099 Tax Reminders

Once again, it is the time of year for small business owners, self-employed individuals, and rental property owners to consider your filing requirements. When you operate your business for a profit, the IRS considers you engaged in a trade or business, and therefore you are required to file certain informational returns. Information relating specifically to Form 1099-MISC, Miscellaneous Income, and Form 1099-NEC, Nonemployee Compensation, can be found at https://www.irs.gov/instructions/i1099mec.

Form 1099-NEC is due to the recipient and IRS by January 31, using either paper or electronic filing procedures. Form 1099-MISC is due to the recipient by January 31, and to the IRS by February 28 if you file on paper, or March 31, if you file electronically.

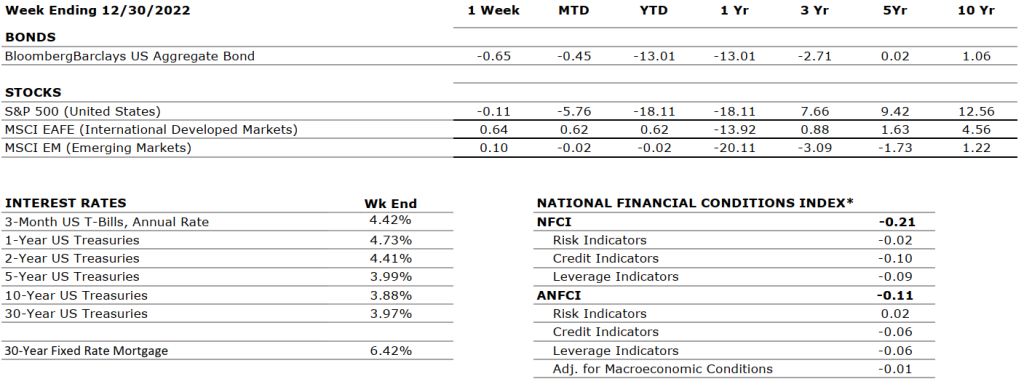

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.