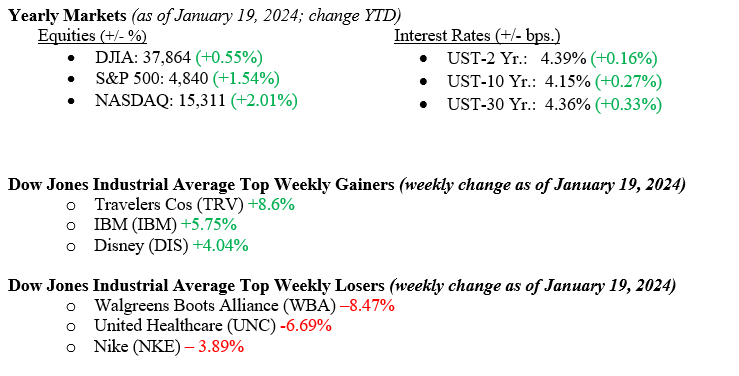

Equity markets ended last week by setting new all-time high records for the Dow Jones Industrial Average (+0.41%) and the S&P 500 Index (+1.25%), while the NASDAQ notched another winning week as well (+2.28%). Last week, the modest but record-setting move placed all three indexes in the green on a year-to-date basis (see numbers immediately below). The early slowness we saw in equity markets thus far in January resulted from investors and markets accurately resetting the timing and pace of the coming Fed rate cuts. At the end of 2024, futures markets were pricing in Fed rate cuts (often deemed positive actions for equity markets) as soon as March 2024. We have said previously, and stick to the conviction, that March was too soon and the likely path to lower Fed Funds Rates would be closer to June 2024. Futures markets have moved from a 100% chance of a cut in March to a 50% chance, which we believe is more accurate as inflation still has a bit more cooling to do before it settles around 2.00%. Interest rates increased last week, with the 10-year U.S. Treasury rising 19 basis points to 4.15%. Some strong economic data was released last week, including 4th quarter retail sales and consumer sentiment, which we will detail below.

U.S. Economy

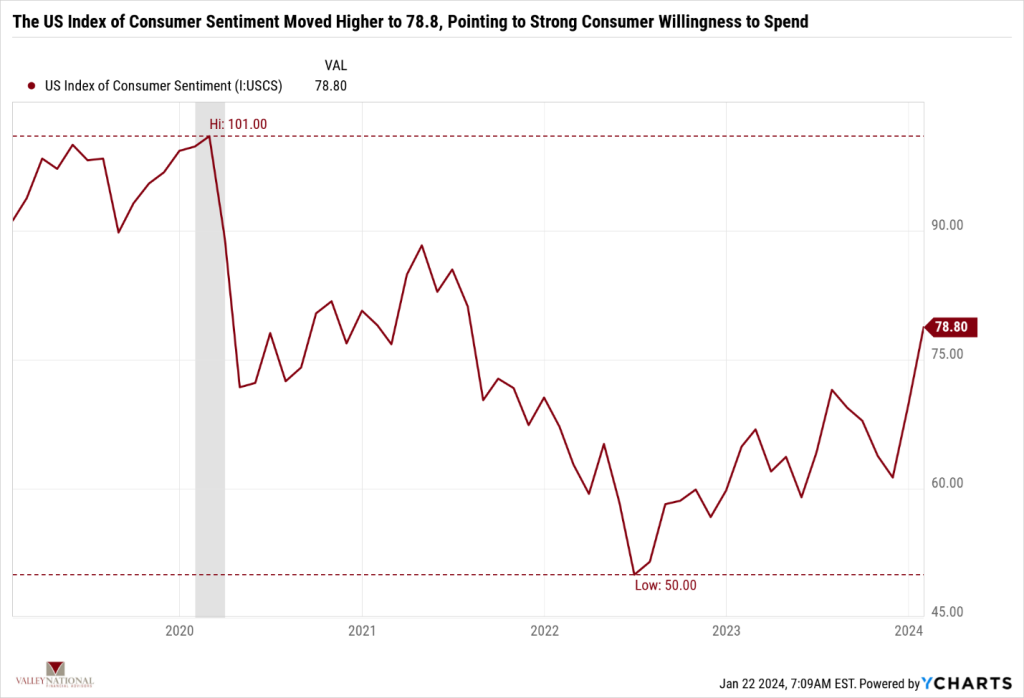

As mentioned above, U.S. Retail & Food Service Sales jumped +0.55% for December 2023, up from +0.35% for November 2023 and above the long-term average of +0.40%. This was confirmation that the year-end holiday shopping season was strong and, importantly, shows that consumers are not yet too tired to continue fueling the growing U.S. Economy. On the heels of that news, the U.S. Index of Consumer Sentiment, as the University of Michigan reported, jumped to 78.8, well off the recent low of 50.0 set in 2023. See Chart 1 below from Valley National Financial Advisors and Y Charts. It is important to note that a rising consumer sentiment index shows increased consumer confidence, which is generally evident in economic expansionary periods. While not the only predictor of future economic growth, this measure tells us what the consumer thinks about the future. This week, we will see real economic data when the 4th quarter of 2023 GDP is released. Additionally, we continue to monitor corporate earnings releases, which thus far have beaten, frequently softer, Wall Street analysts’ expectations.

Policy and Politics

In positive news, the U.S. has avoided an embarrassing government shutdown as the dueling parties finally reached a budget deal. This week is the New Hampshire primary, where we get further indications of the presidential candidates for U.S. President in November 2024. While it is a foregone conclusion that President Biden will be the Democratic candidate, with Florida Governor Ron DeSantis dropping out, we are down to Nikki Haley and former President Donald Trump on the Republican ticket. All we have to say in this regard is that drama will follow. Markets are efficient, but politics are not. Stay tuned because as we move into the South Carolina primary and Super Tuesday in March, the final presidential battle will be formed.

What to Watch This Week

• U.S. Durable Goods Monthly Orders for Dec 2023, released 1/25, prior 5.39%

• 30-year US Mortgage rate for week of Jan 25, released 1/25, prior rate 6.60%

• U.S. Initial Claims for Unemployment Insurance for week of Jan 20 released 1/25, prior 203,250.

• U.S. Core PCE Price Index for Dec 2023, release 1/26, prior 3.16%

• U.S. Real GDP for 4th Quarter 2023, released 1/26, prior 4.90%

It is not news to The Weekly Commentary readers that the U.S. economy is ~70% consumption-based, meaning U.S. Consumers drive the largest part of the U.S. economic growth. Consumer sentiment is rising, and U.S. unemployment remains at historic low levels (3.6%). This is a simple equation – Americans are working, feel good about the economy, and will continue to spend. However, globally, turmoil and unrest abound. China continues to founder and is struggling to reach government-invented GDP targets. A brief look at headlines from the Middle East drums up issues that have lasted 75+ years with no end in sight for the Israel/Hamas War. The conflict has bubbled over into Iran, Yemen, and Lebanon and has impacted Red Sea commerce. The Russia/Ukraine War will soon move into its 3rd year, with no end in sight. While it is easy to see the U.S. as an island and immune to the World’s problems, our involvement with every conflict is usually inevitable. We expect markets to underprice the global turmoil and focus instead on eventual Fed rate cuts in 2024 as inflation moves closer to the Fed’s target of 2.00%. Corporate earnings growth in 2024 remains important, and we expect technology to remain the driver of growth and expansion this year. Expect volatility all year – but every year brings volatility, as we all know by now. Please reach out to your advisor at Valley National Financial Advisors for assistance.