-

- The Polar Express

-

- A Christmas Carol

-

- White Christmas

-

- A Boy Called Christmas

-

- Jingle All the Way

-

- Dr. Seuss’ How the Grinch Stole Christmas

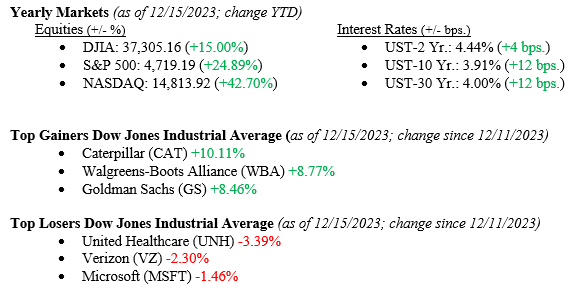

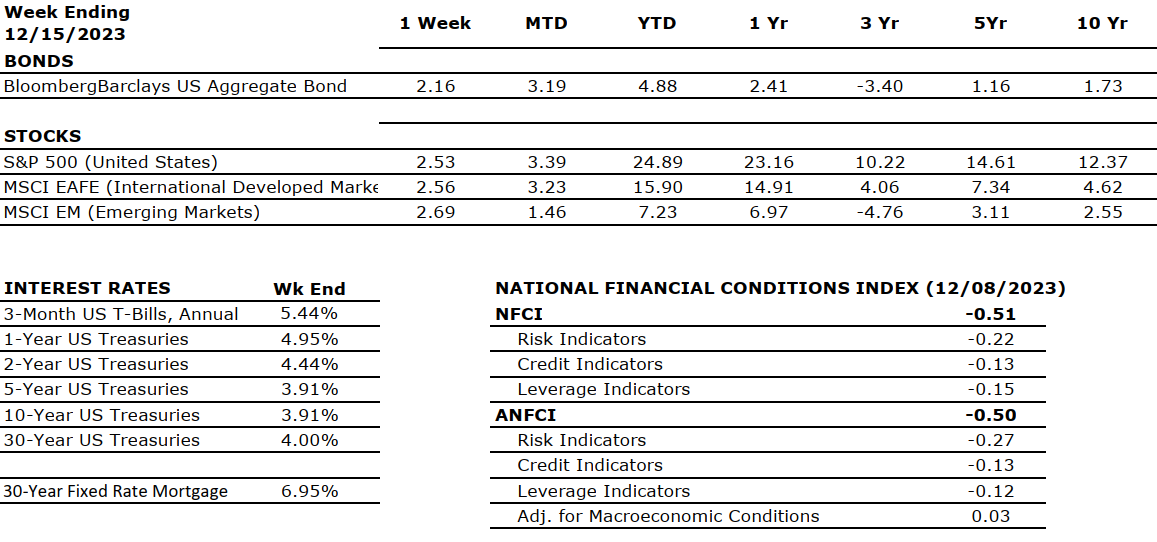

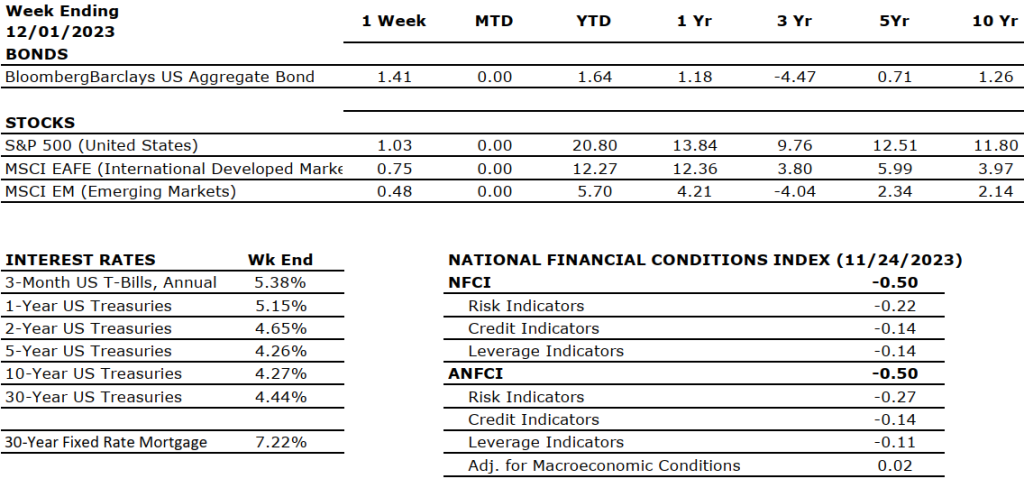

If it were not so close to Christmas, we would suggest we put a red stocking cap on Fed Chairman Powell and call him “Santa Claus,” given the Santa Rally we have had over the last seven weeks. Last week, we added another 3.0% to the major stock market indexes, bringing each well into double-digit territory on a year-to-date basis (see figures immediately below.) Of course, I am referencing Chairman Powell’s press conference last week after the FOMC (Federal Open Market Committee) meeting, where he reaffirmed the notion that inflation does not need to reach 2.00% for the Fed to start cutting rates. This comment gave the markets all they needed to prepare for lower rates in 2024. This will help all major market indexes, especially small capitalization stocks that rely heavily on borrowing for standard business activities. Further, in a stunning move lower, the 10-year US Treasury dropped 32 basis points on the same news to close the week at 3.91%.

U.S. Economy

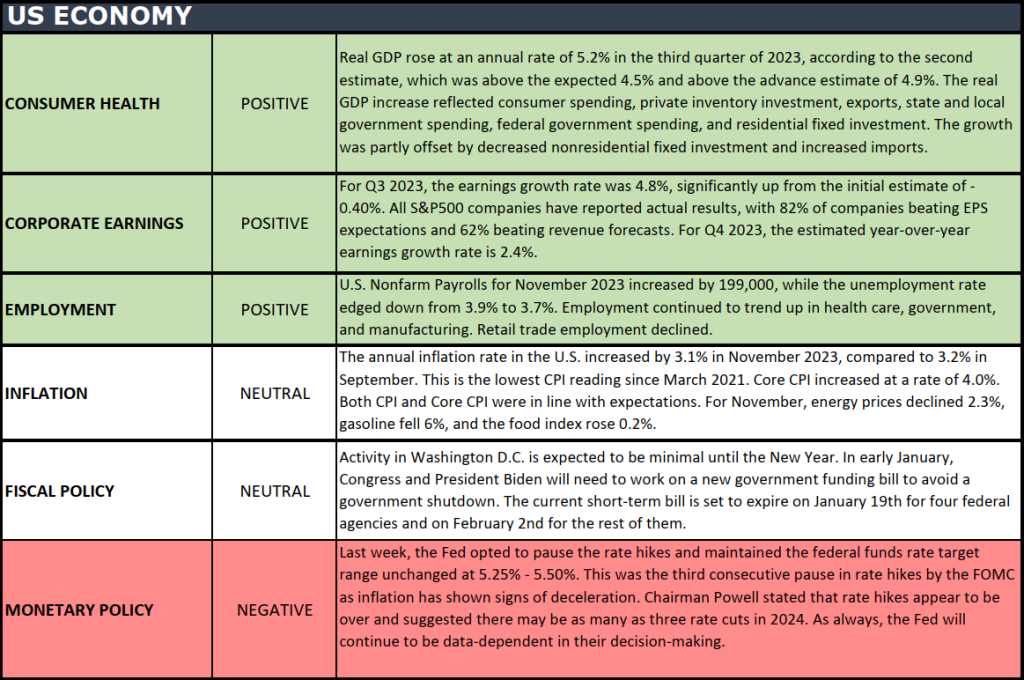

As mentioned above, the FOMC kept interest rates unchanged for the third meeting in a row, signaling the long-awaited “Fed Pivot,” meaning monetary policy moves from a tightening stance (increasing interest rates) to an accommodating stance (lowering interest rates). The Fed Funds Futures markets are pricing in rate cuts as soon as March 2024, yet the FOMC members do not see rate cuts until September 2024. Our moves in 2023 were all based on the data, particularly our call for “no recession in 2023.” We will continue to follow the data as we assess the true path of rate cuts in 2024. All parts of the U.S. economy continue to point to growth and expansion, at least into early 2024. Our thoughts are that the Fed will watch the data as well.

Policy and Politics

What to Watch

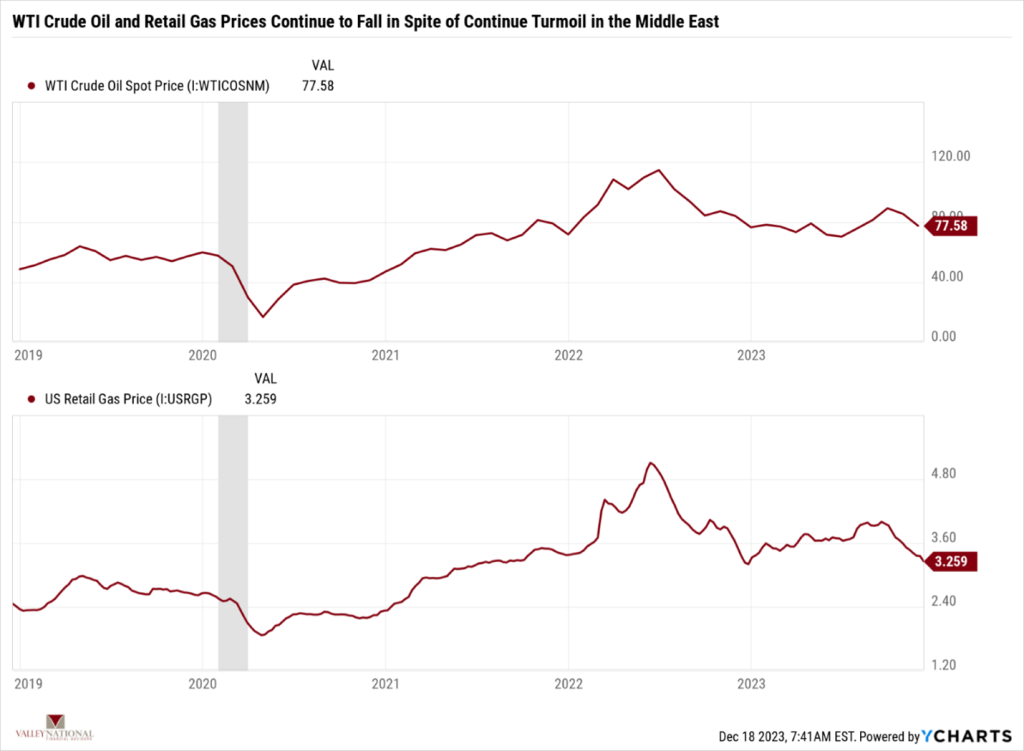

Thus far, 2023 has rewarded the patient investor with solid gains across all major stock and bond market indexes. We have seen the economy defy all the so-called experts who predicted a recession in 2023 and instead continue to grow and expand at a healthy pace. Employment remains strong, with a national unemployment rate of 3.7%. The housing market has thrived, and 30-year fixed mortgage rates are below 7.00%. This week, we will see earnings from various companies, including Nike and Accenture. Earnings are important as they prove that companies are still making money and, therefore, employing workers. While we appreciate markets’ gains this year, we continue to watch events unfolding in the Middle East with concern. Higher interest rates are off the table, but the markets may be pricing in rate cuts sooner than reality will prove. There are seven trading days left in the year, and Santa is just a few days away. Happy Trading!

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five- and 10- year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

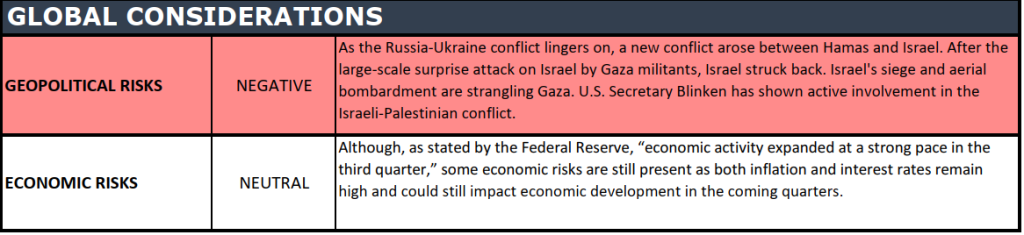

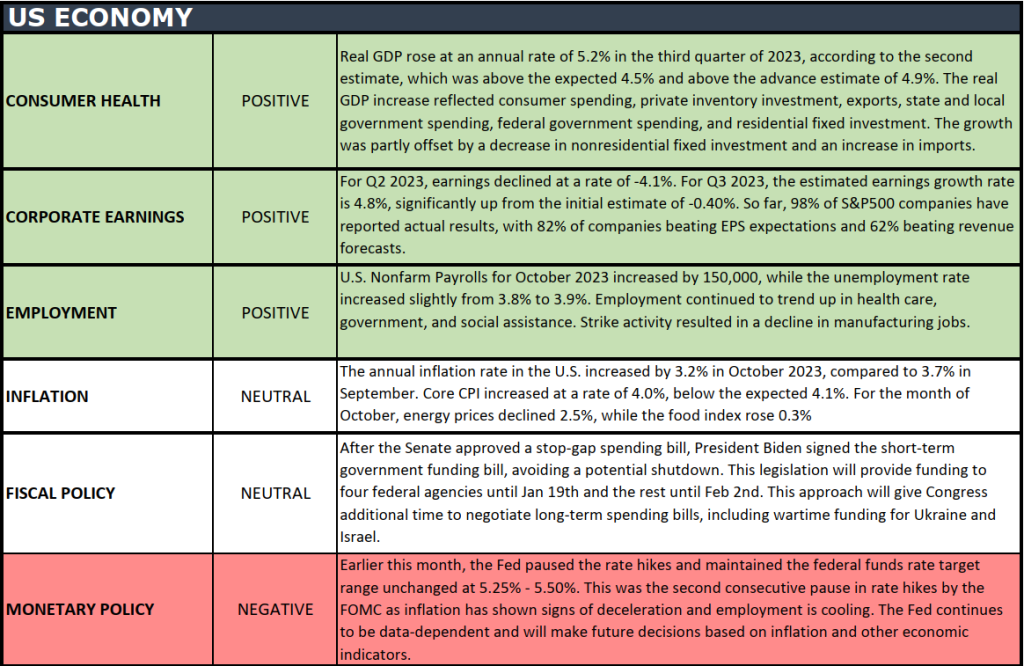

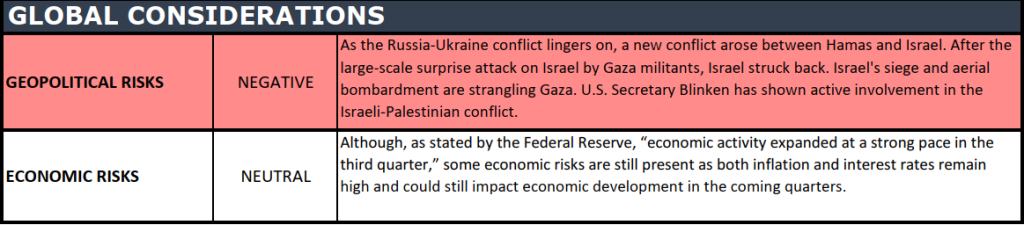

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade key economic conditions that we believe are of particular importance to investors.

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Team VNFA is seeking a Director of Research & Investments, to work as part of our Investment Department. Read more about this opportunity: Director, Research & Investments

“Kindness is like snow, it beautifies everything it covers.” -Kahlil Gibran

Tune in Wednesday, 6 PM, “Your Financial Choices” on WDIY 88.1 FM. Join Laurie for Topics of Financial Planning Interest.

Questions can be submitted at yourfinancialchoices.com in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Interesting Facts about Hanukkah:

To learn more about Hanukkah, visit 30 Amazing Facts About Hanukkah.

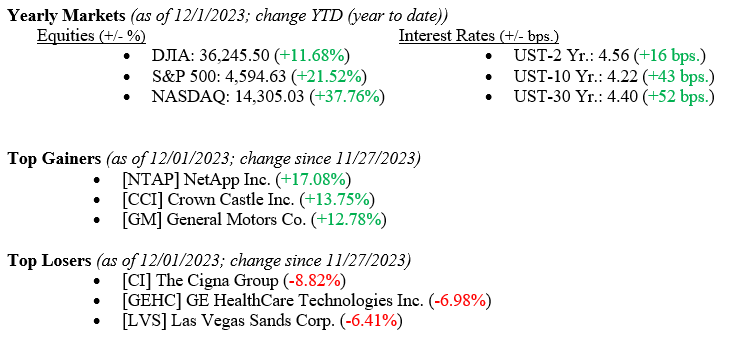

What a difference a month makes! Last month, we were lamenting the market’s shellacking it took from August – October 2023. Both stocks and bonds were negative for those three months. Fast forward to November 2023, and we see the best returns for stocks and bonds for November for the past 30 years! Last week, we saw the Dow Jones Industrial Average increase by +2.4%, the S&P 500 Index increase by +0.8%, and the NASDAQ increase by +0.4%. These gains moved each major index into double-digit returns year-to-date (see numbers immediately below). Further, the 10-year U.S. Treasury moved a stunning 25 basis points lower last week to end at 4.22% after reaching 4.98% just one month ago. Our takeaway from outsized returns like this for one month reminds us of the importance of staying invested, weathering the intermittent storms, and reaping the rewards.

US Economy

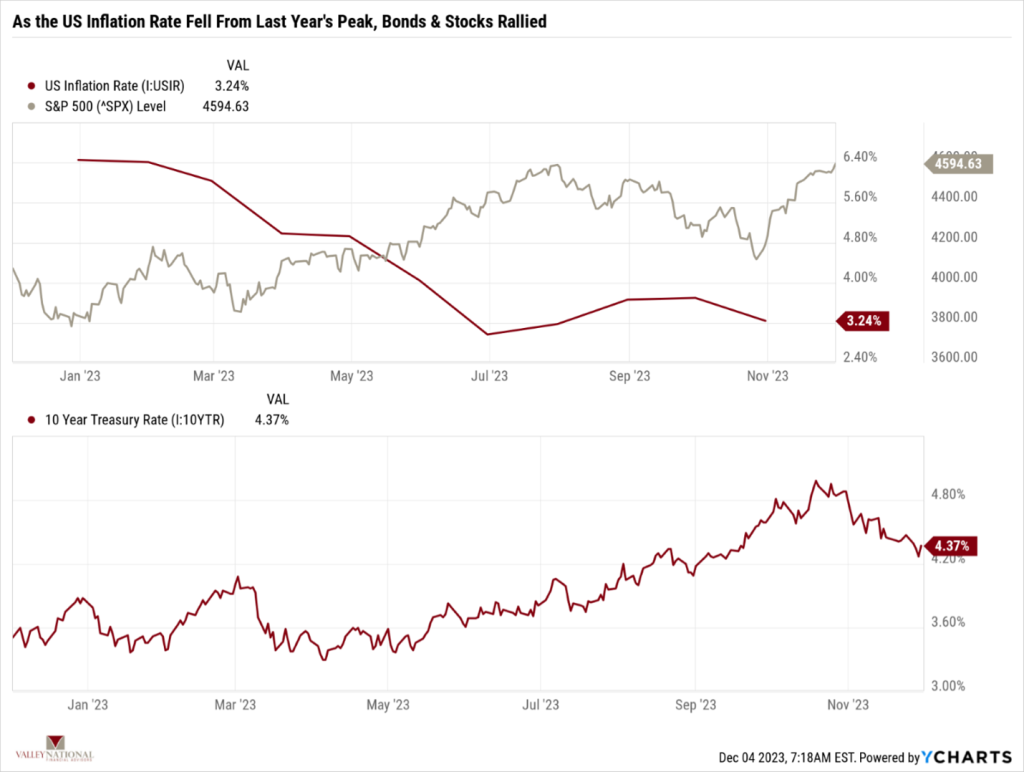

As mentioned above, stocks and bond markets began reacting positively as the U.S. Inflation fell from the August 2022 rate of 9.1%. Chart 1 below from Valley National Financial Advisors and Y Charts shows the U.S. Inflation Rate, the S&P 500 Index, and the 10-year U.S. Treasury. Of course, bonds experienced some pullbacks, especially as thoughts of continued rate hikes seeped into the market. Still, the general movement has been lower rates since the Federal Reserve paused its interest rate tightening pattern at the July 2023 FOMC meeting.

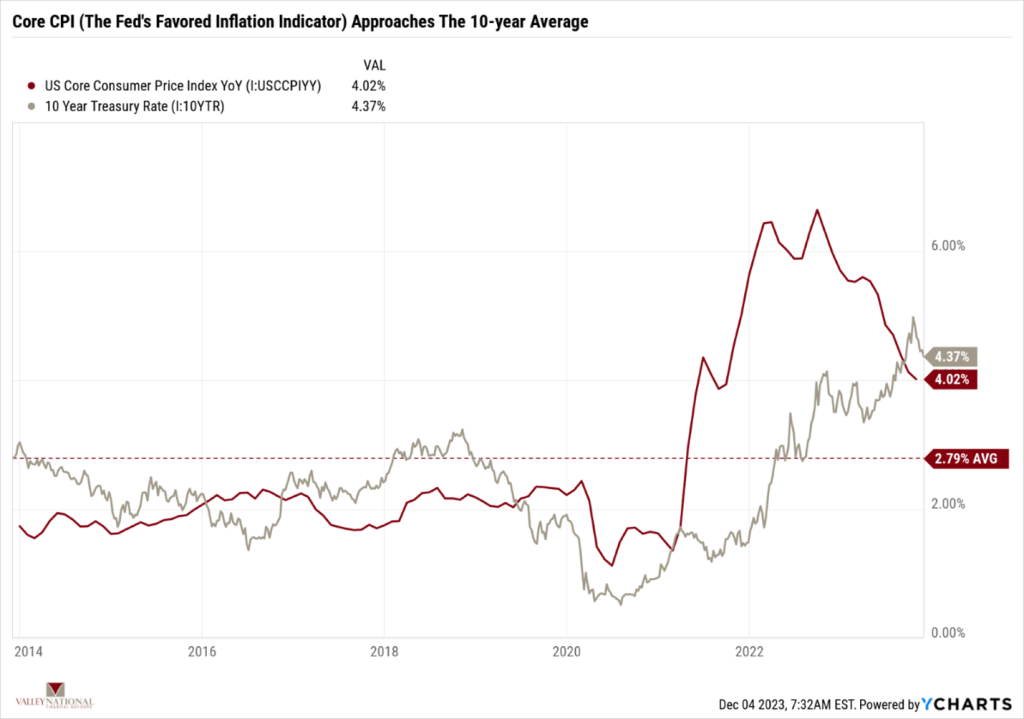

November’s returns were predicted by inflation continuing to fall, as evidenced by the chart above showing the standard U.S. inflation rate. The Federal Reserve prefers the Core CPI, which excludes volatile food, shelter, used vehicles, and energy. Core CPI has also fallen drastically as the Fed embarked on its fast-paced interest rate hiking cycle. Chart 2 below from Valley National Financial Advisors and Y Charts show Core CPI and the 10-year U.S. Treasury. While inflation has not yet reached the Fed’s 2.00% target, we are far from the 9.1% rate we saw last year. Further, Fed Chairman Jay Powell has clearly stated that higher interest rates take time to work their way through the financial system, and this cycle of rate hikes has lasted 22 months.

Policy and Politics

Washington remains quiet as the stop-gap budget was passed, and we will not discuss this again until January 2024. Next year is a presidential election cycle, and we will have a lot more to see and discuss as that cycle evolves. The FOMC meets next week, and we expect the message to be more like “wait and see” and “watch the data” than a message of rate cuts that some economists are predicting already. Chairman Powell has been noticeably clear in that message, and has avoided mentioning a time for future rate cuts. Watch the message next week in Chair Powell’s press conference rather than the action of the committee on rates. The U.S. economy remains healthy, and consumer spending looks strong thus far during this year’s retail holiday season.

What to Watch

Since joining Valley National Financial Advisors in August 2020, my message as Chief Investment Officer has been clear – watch the data, get invested, as your risk tolerance will allow you to stay invested. Yes, 2022 was painful, but in this year alone, we have seen both the stock and the bond markets regain much of the ground lost in 2022. November 2023 alone saw a +9.0% gain in U.S. equities. Think about those investors sitting out this market on the sidelines and realizing they just missed a +9.0% gain! Investing can be a painful business, but gathering generational wealth over generations is not painful; instead, it takes investors who are committed to their investment plan. Will December 2023 be a month to remember? We will watch the data.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five- and 10- year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade key economic conditions that we believe are of particular importance to investors.

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

“You don’t have to see the whole staircase, just take the first step.” – Martin Luther King Jr.