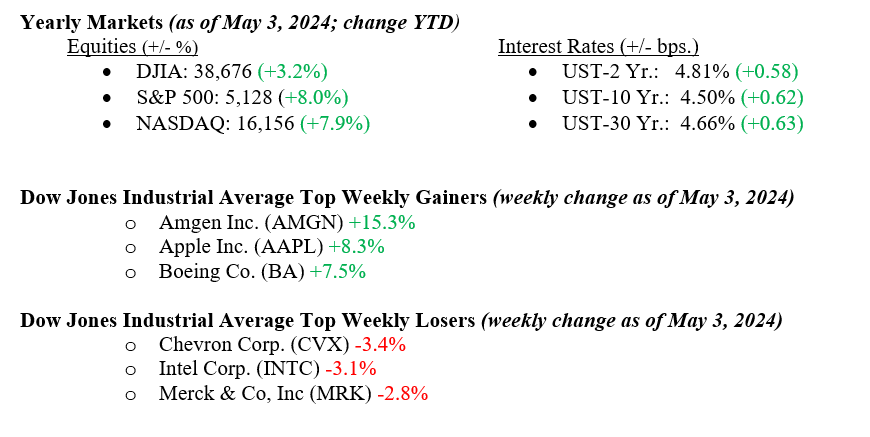

For the week, the Dow Jones Industrial Average rose 1.1%, the S&P 500 Index rose 0.6%, and the NASDAQ rose 1.4%. Utilities were the best-performing sector for the week (+3.4%), while energy was the worst-performing sector (-3.3%). Following Wednesday’s FOMC decision to leave rates unchanged, markets felt relieved that the Fed indicated it is not currently considering raising rates. Chair Powell described the current monetary policy as appropriate for handling appropriate scenarios. Overall, it is reassuring to see companies delivering robust earnings, with an impressive 79% surpassing analysts’ projections, resulting in an average upside surprise of almost 9%. The 10-year U.S. Treasury closed the week at 4.50%, a stunning 17 basis points lower than the previous week, showing that traders are finally accepting the next move the Fed will be to lower rates.

U.S. & Global Economy

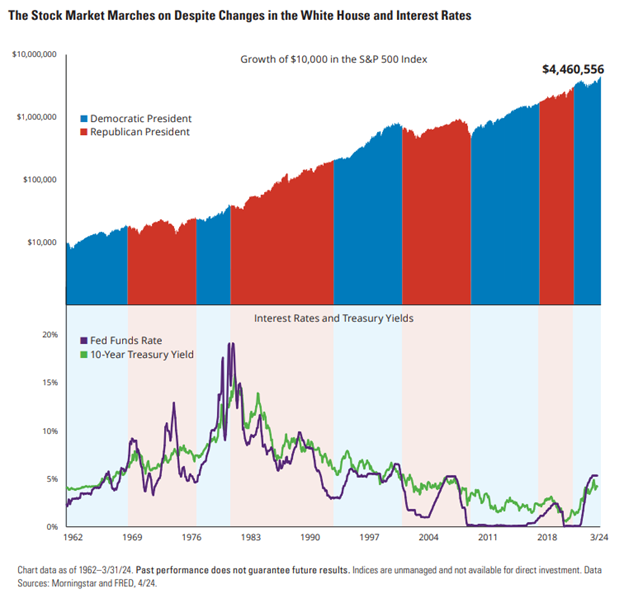

Certainly, all investors know we have a U.S. presidential election in November of this year. It is normal to have investor anxiety around events like this. Still, the markets are more efficient than investors, and the markets seem to understand that either outcome in November is a known commodity one way or another. Major elections and changes to interest rates can be two of the most unsettling things investors face. However, through presidents from both parties and countless interest-rate changes, the stock market has been resilient and has taken these changes in stride. See Chart 1 from Hartford, Morningstar, and the Federal Reserve Bank, which shows the growth in the S&P 500 and the Fed Funds Rate over the past 60+ years and multiple changes in administration showing the growth in the S&P 500 and the Fed Funds Rate over the past 60+ years and multiple changes in administrations.

Policy and Politics

Last week, Israel stated their refusal to agree to Hamas’ demands for ending the conflict in Gaza, as both sides continue to exchange accusations amidst ongoing ceasefire negotiations, which have yet to show considerable progress. On Friday, the Russia-Ukraine conflict entered its 800th day, marking another significant milestone in the prolonged battle, which shows no immediate signs of ending.

Economic Numbers to Watch This Week

- U.S. Consumer Credit for March 2024 prior $14.1 billion

- U.S. Wholesale inventories for March 2024 prior 0.5%

- U.S. Initial Claims for Unemployment Insurance for the Week of May 4th, 2024, prior 208,000

- U.S. Consumer sentiment (prelim) for May 2024, prior 77.2

- U.S. Monthly U.S. federal budget, April 2024 -$236 billion

Markets do not move in a straight line. After five consecutive monthly gains, markets moved lower in April, with the S&P 500 down by 4.2%. Despite moderation in the first quarter of GDP (Gross Domestic Product) and a slight cooling in job growth for the month of April, we continue to see the U.S. economy on solid footing. It is promising to see earnings growth and performance leadership broadening beyond the popular mega-cap tech stocks. This builds a sturdy base for the market to continue to move higher. Please contact your advisor at Valley National Financial Advisors with any questions.