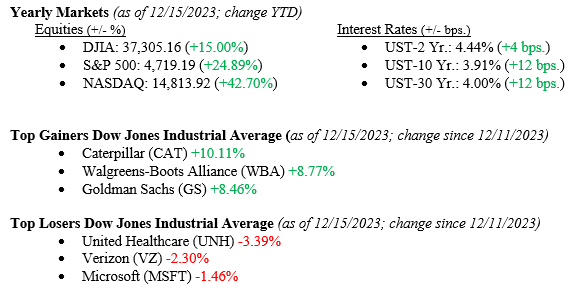

If it were not so close to Christmas, we would suggest we put a red stocking cap on Fed Chairman Powell and call him “Santa Claus,” given the Santa Rally we have had over the last seven weeks. Last week, we added another 3.0% to the major stock market indexes, bringing each well into double-digit territory on a year-to-date basis (see figures immediately below.) Of course, I am referencing Chairman Powell’s press conference last week after the FOMC (Federal Open Market Committee) meeting, where he reaffirmed the notion that inflation does not need to reach 2.00% for the Fed to start cutting rates. This comment gave the markets all they needed to prepare for lower rates in 2024. This will help all major market indexes, especially small capitalization stocks that rely heavily on borrowing for standard business activities. Further, in a stunning move lower, the 10-year US Treasury dropped 32 basis points on the same news to close the week at 3.91%.

U.S. Economy

As mentioned above, the FOMC kept interest rates unchanged for the third meeting in a row, signaling the long-awaited “Fed Pivot,” meaning monetary policy moves from a tightening stance (increasing interest rates) to an accommodating stance (lowering interest rates). The Fed Funds Futures markets are pricing in rate cuts as soon as March 2024, yet the FOMC members do not see rate cuts until September 2024. Our moves in 2023 were all based on the data, particularly our call for “no recession in 2023.” We will continue to follow the data as we assess the true path of rate cuts in 2024. All parts of the U.S. economy continue to point to growth and expansion, at least into early 2024. Our thoughts are that the Fed will watch the data as well.

Policy and Politics

- While Washington, DC, is closed for the holidays, we are looking to January 2024, when budget talks will need to start quickly to avoid the risk of a government shutdown. Next year remains a presidential election year, so we also expect minimal disruption from Washington so President Biden can point to the healthy U.S. economy while campaigning for reelection.

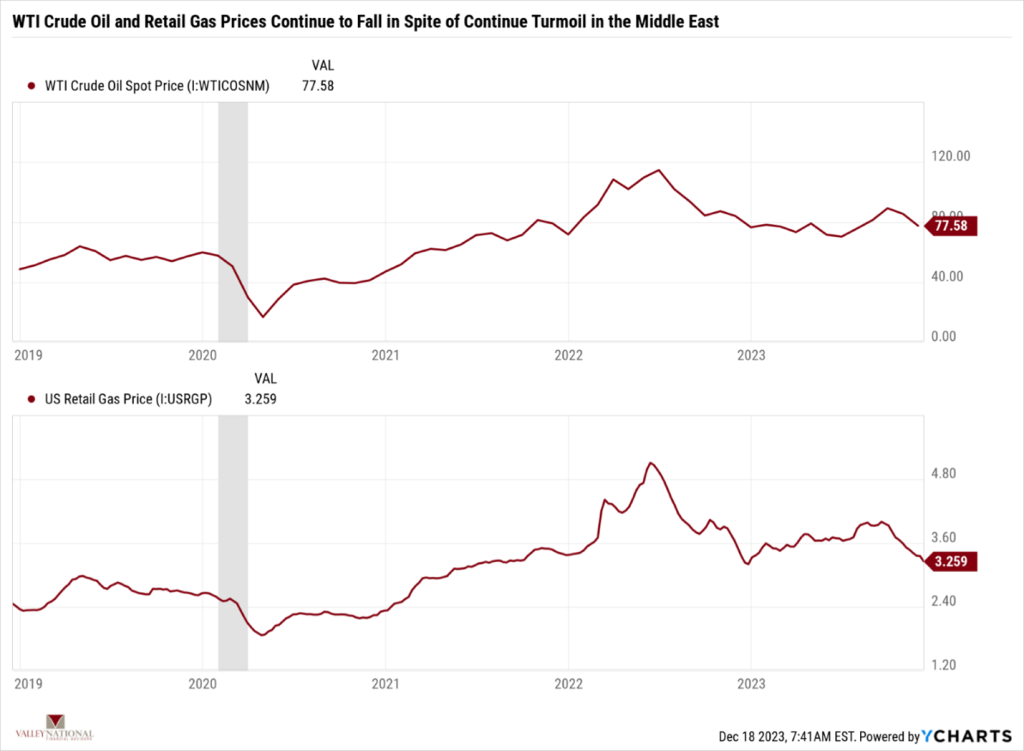

- Globally, we are ramping up our concerns about the Israel/Hamas War and the risks of it spreading beyond the localized region. Rockets flying between Israel and Hezbollah in Lebanon and Yemeni militants seizing shipping tankers in the Red Sea have caused enough chaos that shipping firms, including Maersk and B.P., have either paused or re-routed container and oil tankers. While there is not yet a major military escalation, the disruption in shipping and supply chain management will cause problems in the global economy. Thus far, oil, a major commodity of the Middle East, has yet to react to the problems. See Chart 1 below from Valley National Financial Advisors and Y Charts showing WTI Crude Oil and Retail Gas Prices. Both continue to fall, with the U.S. Average retail price of gasoline hitting $3.26/gallon. Petroleum is a critical component of manufacturing and transportation and a key to keeping inflation at bay.

What to Watch

- U.S. Real GDP (Gross Domestic Product) Quarter over Quarter for 3rd Quarter 2023, released 12/21/23, prior +5.20%

- 30 Year Mortgage Rate for week of December 21, 2023, released 12/21/23, prior 6.95%

- U.S. Core PCE Price Index Year over Year for November 2023, released 12/22/23, prior 3.46%

- U.S. Index of Consumer Sentiment for December 2023, released 12/22/23, prior 69.40.

Thus far, 2023 has rewarded the patient investor with solid gains across all major stock and bond market indexes. We have seen the economy defy all the so-called experts who predicted a recession in 2023 and instead continue to grow and expand at a healthy pace. Employment remains strong, with a national unemployment rate of 3.7%. The housing market has thrived, and 30-year fixed mortgage rates are below 7.00%. This week, we will see earnings from various companies, including Nike and Accenture. Earnings are important as they prove that companies are still making money and, therefore, employing workers. While we appreciate markets’ gains this year, we continue to watch events unfolding in the Middle East with concern. Higher interest rates are off the table, but the markets may be pricing in rate cuts sooner than reality will prove. There are seven trading days left in the year, and Santa is just a few days away. Happy Trading!