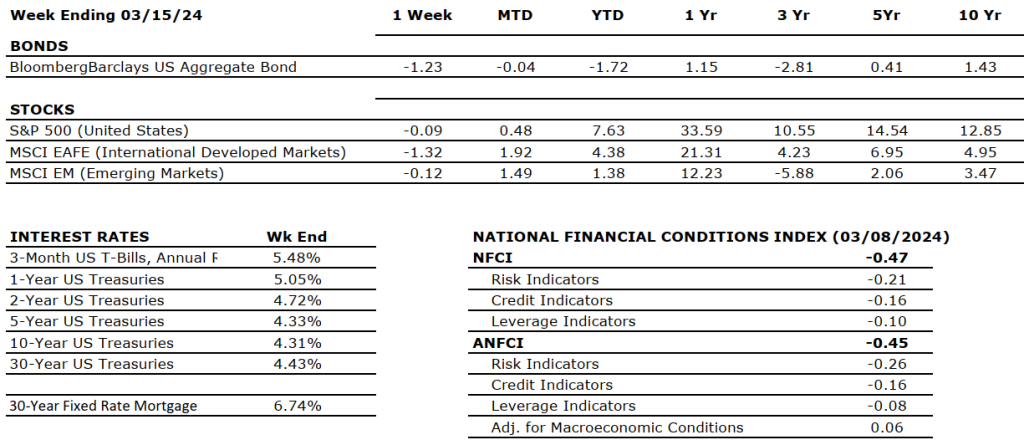

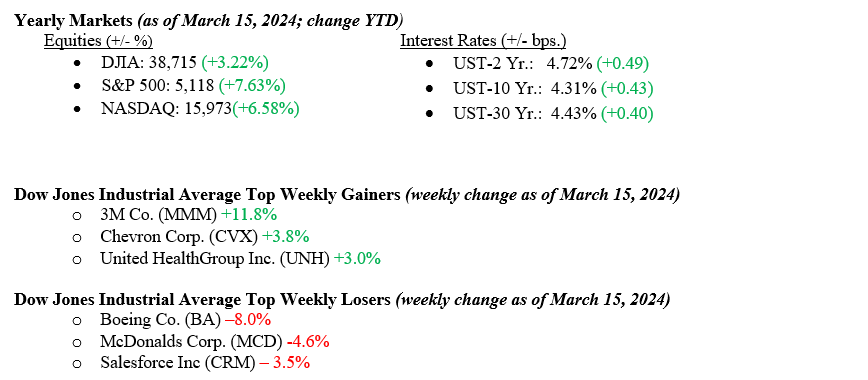

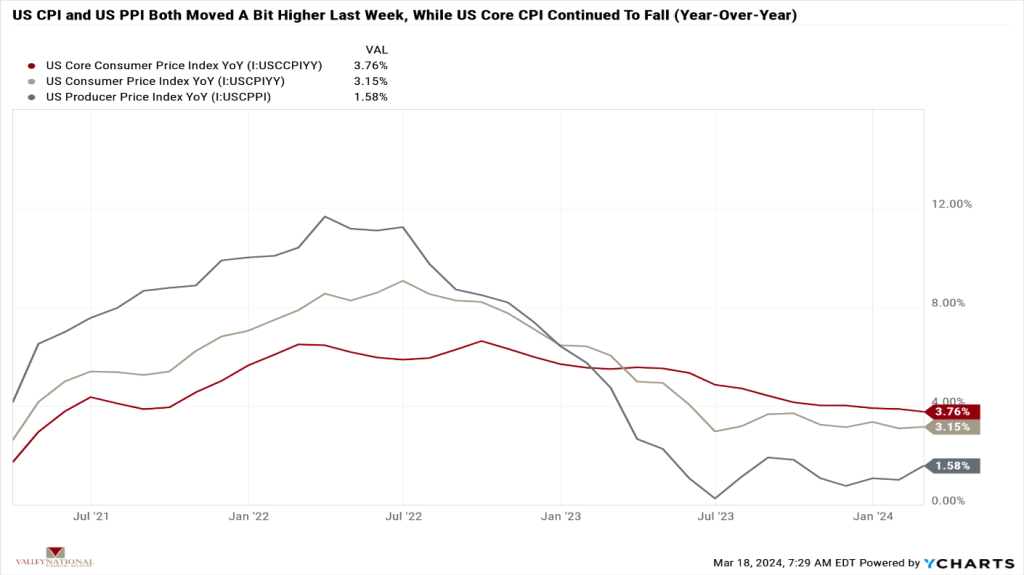

Last week marked the second week of negative returns in the equity markets, albeit modestly negative, especially given the strong price rally we have seen thus far in 2024. Dow Jones Industrial Average fell –0.02%, The S&P 500 Index fell –0.13%, and the NASDAQ fell –0.70%. Equity markets sold off as two inflation reports (CPI (Consumer Price Index) and PPI (Producer Price Index)) showed numbers slightly higher than economists had predicted, leading investors to speculate that interest rates would remain higher for longer and that rate cuts were farther off than predicted as well. We at Valley National Financial Advisors have pointed to June 2024 as the earlier point at which the Fed would start to cut interest rates, and we are sticking with that projection. The 10-year U.S. Treasury bond yield rose 22 basis points last week to close at 4.31%.

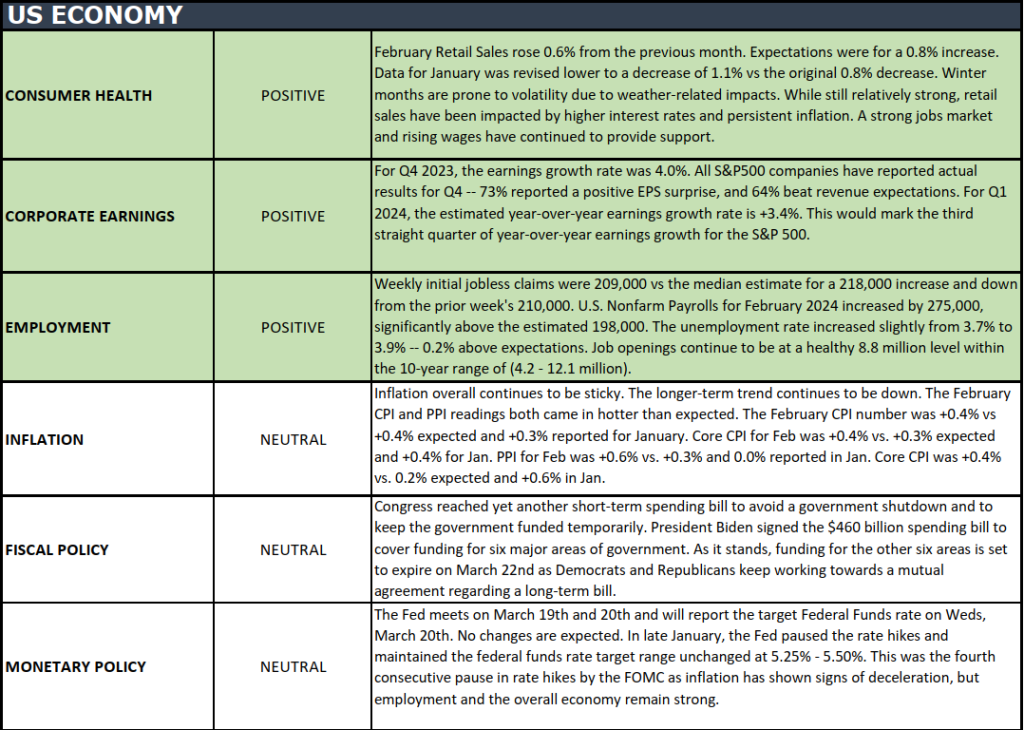

U.S. Economy

As mentioned above, two inflation reports showed that inflationary pressures are sticking around longer than economists thought. The U.S. CPI and U.S. PPI showed modest moves higher on a year-over-year basis, but the U.S. Core CPI continues to fall slowly but steadily. See Chart 1 below from Valley National Financial Advisors and Y Charts showing the inflationary trend in the above reports. While sticky inflation may seem like a problem, the path to the Fed’s 2% inflation target was never going to be linear; rather, it would be gradual and lumpy, and that is what we are seeing as higher interest rates continue to combat pandemic-related inflationary pressures. Fed Chairman Jay Powell and the FOMC will meet this week to determine interest rate policy for the next several months. We expect rates to remain unchanged, with the Fed Funds Rate at 5.50%. After the meeting, Chairman Powell’s press conference will give us some needed direction and timing on the future path of rates and potential cuts.

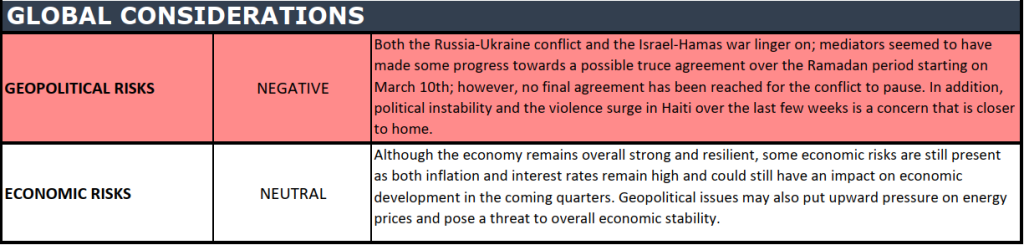

Policy and Politics

Shockingly, Vladimir Putin was re-elected to a third term as President of Russia. In a media-staged election, Mr. Putin secured 78% of the vote and will be Russia’s leader until at least 2030. Sadly, we do not expect an end to the Ukraine/Russia War as Putin will regard this “victory” as proof that his war efforts are the correct path for Russia to be taking. Global turmoil and conflict continue in Israel and Haiti, with neither region showing a cessation in troubles. Lastly, the U.S. Senate will take up a bill that the U.S. House passed last week where the massively popular app TikTok must be sold off by Chinese company Byte Dance or risk being banned in the U.S. Lobbyists for TikTok and competitor Meta are pouring money into Washington as each tries to pressure Congress for action in either direction.

What to Watch This Week

- Target Fed Funds (Upper Limit) released 3/20 current 5.50%

- U.S. Initial Claims for Unemployment Insurance week of March 16, released 3/21, prior 209,000.

- U.S. Existing Home Sales Monthly for Feb ’24, released 3/21, prior 4.00M

- 30-year Mortgage Rate for the week of March 21, released 3/21, prior 6.74%

Our weekly objective in writing The Weekly Commentary is to inform and educate our readers about the markets, economy, and risks. Of the three, risk is most important to us as it is the hardest to quantify and use when adjusting investment portfolios. Lately, we have struggled to find serious market risks or continued economic growth. Important sectors of the economy are running nicely: consumer, banks, corporate EPS, and housing; all the while, labor remains healthy, with a national employment rate of 3.9%. We expect the Fed to remain on hold as inflation remains stubbornly sticky and is not yet at 2.00%. Watch the Fed and listen to Chair Powell’s message. Please contact your advisor at Valley National Financial Advisors with any questions.