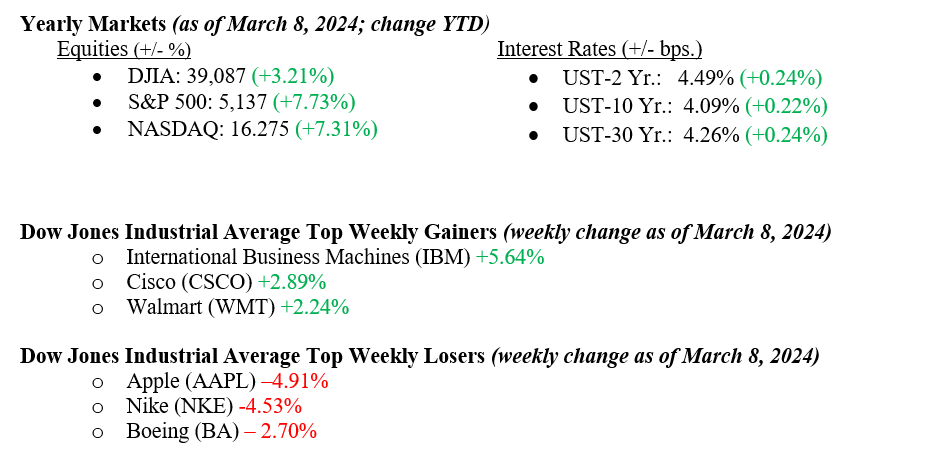

Equity markets were down last week, with all three major indexes reporting negative results. The S&P 500 Index fell –0.26%, the NASDAQ -1.17%, and the Dow Jones Industrial Average –0.93%. Fixed income markets saw lower yields last week as Fed Chair Powell gave an indication that rate cuts are “not far” off. Also impacting rates was the February jobs number, which showed lower wage pressure and revisions lower than the hot January jobs numbers. A big test for bond markets will come later this week when the CPI (Consumer Price Index) and PPI (Producer Price Index) numbers are reported for January. The 10-year U.S. Treasury bond yield fell 9.4 basis points last week to close at 4.09%.

U.S. Economy

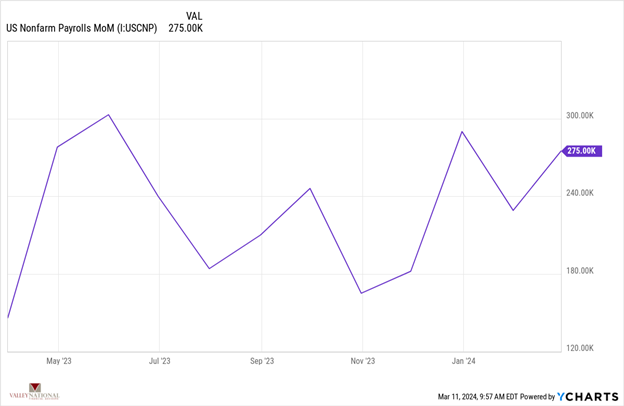

The February jobs report from Friday indicates job growth remains healthy, with nonfarm payrolls increasing 275,000 jobs, above consensus expectations for a rise of 198,000. This follows a downwardly revised 229,000 increase in January. Despite encouraging headline figures, prior estimates of job expansion in December and January were revised down to 167,000 jobs. The unemployment rate rose to a two-year high of 3.9%, and wage momentum cooled, indicating less inflationary pressure.

Policy and Politics

During testimony last week, Fed Chair Powell indicated a softening of banking rules, specifically stating that proposed new rules to force lenders to strengthen their balance sheets (Basel III) would be scaled back or reworked. This comes in response to complaints from industry leaders about the overall cost and economic impact of enacting the original proposed changes.

What to Watch This Week

- U.S. Consumer Price Index released 3/12/24, prior +0.3%

- U.S. Retail Sales released 3/14/24, prior –0.8%

- U.S. Producer Price Index released 3/14/24, prior +0.3%

- U.S. Consumer Sentiment (prelim) released 3/14/24, prior 76.9%

In the current market landscape, the stock market and the broader economy demonstrate robust performance buoyed by several factors. Healthy corporate earnings bolstered by resilient consumer spending, economic productivity gains, and increased business technology spending are driving equities to continued new highs. Additionally, recent data pointing to a soft landing for the economy continues to provide a supportive backdrop, instilling confidence among investors. With a healthy labor market combined with the prospects for lower rates later this year, the overall economic and market outlook remains optimistic. It should provide help to the housing market. However, prudent risk management and close monitoring of potential inflationary pressures, geopolitical tensions, and trade disputes remain essential. Overall, the positive momentum in both the stock market and the economy reflects a favorable environment for investors.

In navigating volatile markets, it is important to maintain a long-term perspective grounded in the fundamentals of the economy and industry-leading companies. While short-term fluctuations and unforeseen challenges may arise, staying committed to well-thought-out investment strategies is key. As we move forward, let us remain optimistic about the future and recognize that overly emotional markets often pave the way for opportunities and growth.