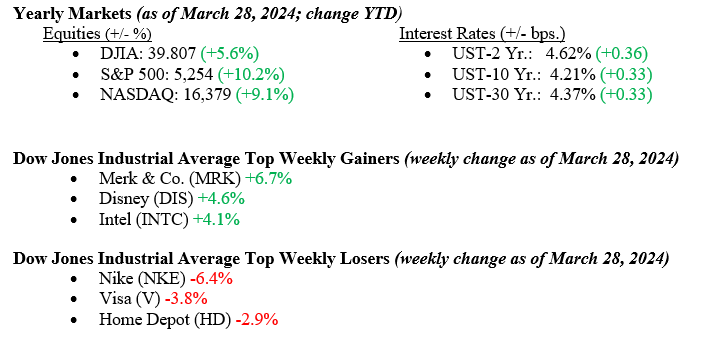

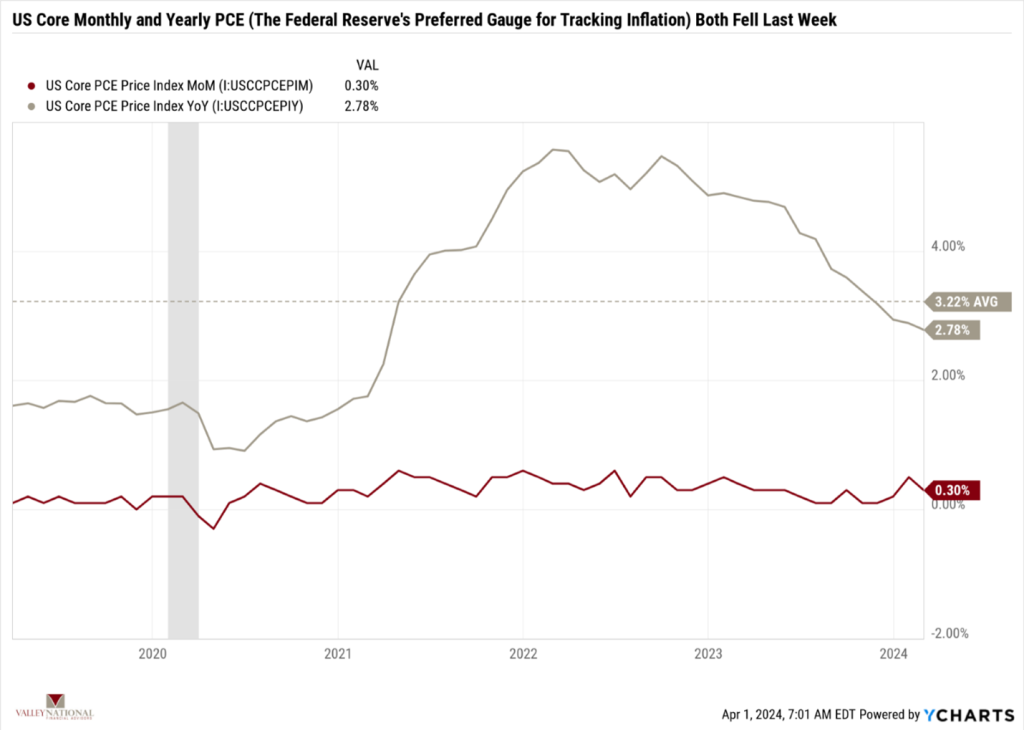

Markets were mixed on a holiday-shortened trading week, with the Dow Jones Industrial Average rising 0.8%, the S&P 500 Index increasing by 0.4%, and the NASDAQ falling -0.3%. Utilities were the best-performing sector for the week (+2.9%), while information technology was the worst-performing sector (-1.3%). Oil prices continued to move higher, finishing the week with a 3.2% gain. Friday saw the Fed’s preferred gauge for inflation, the Personal Consumption Expenditure Index, rise 0.3% (excluding food & energy), matching economists’ expectations. The 10-year Treasury saw continued buying last week, pushing yields down four bps for the week, finishing at 4.21%.

U.S. Economy

Although last week was a quiet week for economic releases, on Friday, we saw the Federal Reserve’s preferred gauge of inflation, U.S. Core Monthly and Yearly PCE (Personal Consumption Expenditures) for February, and both measures were lower, signaling that inflation continues to fall, see Chart 1 below from Valley National Financial Advisors and Y Charts shows U.S. Core Monthly and Yearly PCE for five years. Federal Reserve Bank Chairman Jerome Powell has stated very clearly that they are watching the inflation data and will be data-dependent in terms of rate movements. The current Fed has been the most transparent we can remember regarding interest rate movements, which is why we do not expect any rate cuts until well into the second half of 2024, and even then, those movements in rates, if any, will be mild and data dependent.

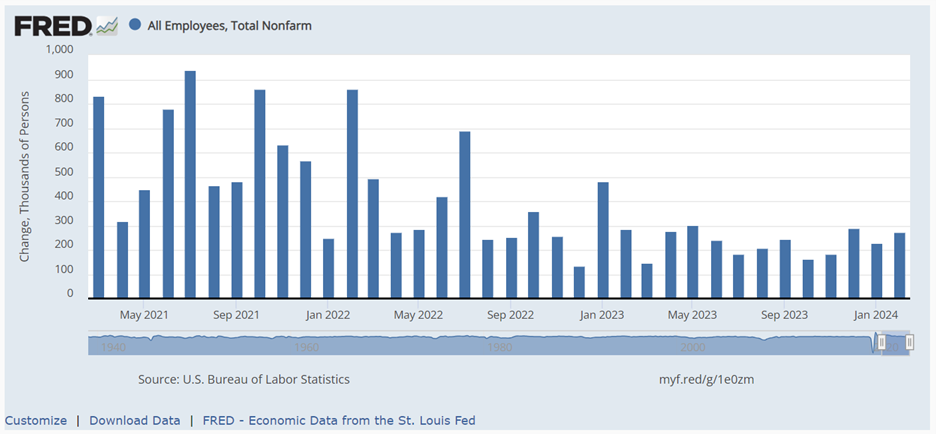

This week, we will see numbers for new payrolls and unemployment insurance for March 2024, and companies will start to prepare for 1st Q EPS reports. Otherwise, we will have a quiet week regarding economic releases.

Policy and Politics

Last week saw a holiday-shortened week for Washington, with Good Friday on March 29th. Elevated geopolitical tensions persist amid the ongoing conflicts in the Middle East and the Russia-Ukraine war. U.S.-China trade tensions continue to be elevated with recent news of China’s oversupply of solar energy, electric vehicles, and lithium-ion batteries impacting U.S. producers. President Biden trails former President Trump by around two points in national polling and around three points in swing states. Prediction markets show roughly even odds of a Democratic or Republican win.

Economic Numbers to Watch This Week

- U.S. ISM manufacturing for March 2024, prior to 47.8

- U.S. Factory Orders for February 2024, prior –3.6%

- U.S. Job Openings for February 2024, prior to 8.9 million

- U.S. ADP Employment for March 2024, prior 140,000

- U.S. ISM Services for March 2024, prior 52.6

- U.S. Employment Report for March 2024

- Nonfarm payrolls, prior 275,000

- Unemployment rate prior 3.9%

Updates from Federal Reserve Board Members continue highlighting lower inflation readings, improved outlook for GDP growth in coming quarters, and healthy job growth. Markets appear to be warming to the idea that stronger growth for longer is preferred over lower rates. We are encouraged by signs of housing supply improvement, which should help this year’s spring selling season. As earnings season kicks off in the coming weeks, we will be listening to any signs of economic softness communicated by corporate management teams. We continue to monitor geopolitical risks for signs of increased tension and spillover into new areas. Please reach out to your advisor at Valley National Financial Advisors with any questions.