by William Henderson, Vice President / Head of Investments

Fed Chairman Jay Powell gave the markets what they expected during his virtual Jackson Hole speech. He offered calming words around the effect of modest tapering of bond purchases by year-end and no rate hikes until unemployment is at or near the 4.5% target and average inflation hits 2%. Those few words gave solace to the markets and we saw a nice rally at the end of the week. Last week, the Dow Jones Industrial Average gained +1%, the S&P 500 Index gained +1.5% and the tech-heavy NASDAQ gained a juicy +2.8%. Strong weekly gains added to already strong year-to-date gains, shaping 2021 into quite a year for stock market returns. Year-to-date, the Dow Jones Industrial Average has returned +17.3%, the S&P 500 Index +21.2% and the NASDAQ +17.9%. The Fed’s dovish tone during Powell’s speech kept Treasury Bonds from drastically selling off on the bond tapering news. The yield on the 10-year U.S. Treasury rose five basis points to 1.31% from 1.26% the previous week. The current rate is 43 basis points lower than the 1.74% yield level hit in March of this year.

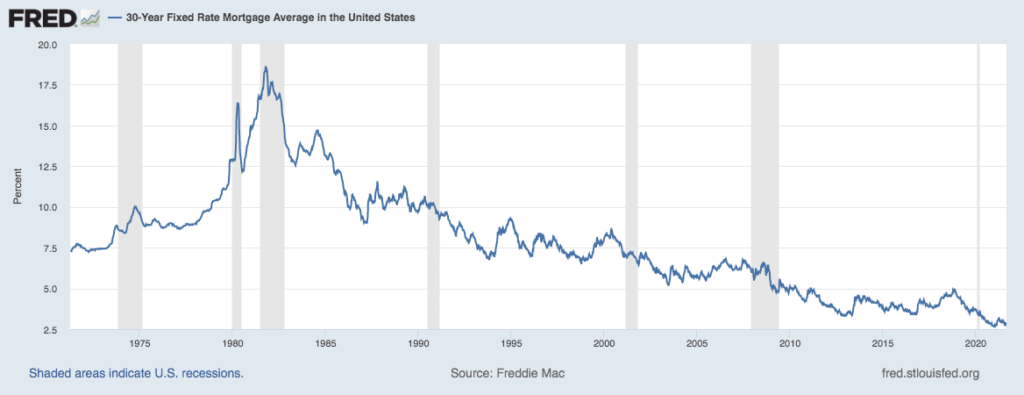

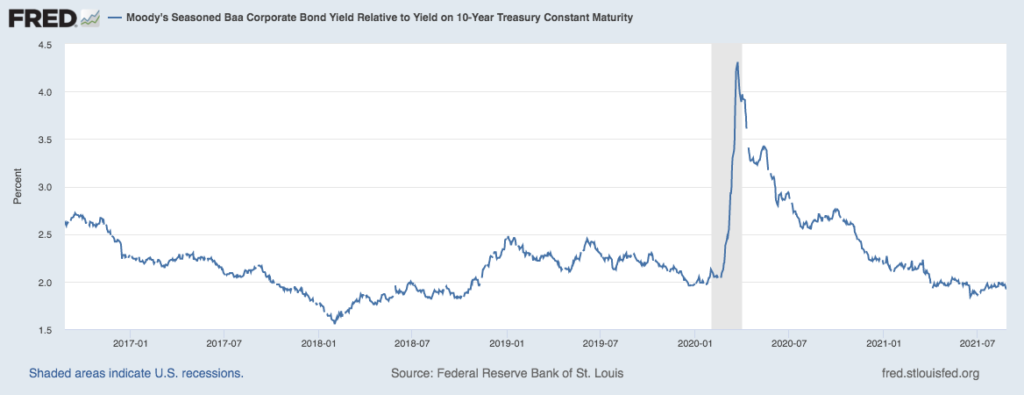

Low Treasury Bond yields impact corporate borrowing levels and mortgage rates, both of which have positive implications on the overall economy. Corporations can borrow at historically low levels and low mortgage rates also continue to boost the U.S. housing market. (See the two charts below, both from the Federal Reserve Bank of St. Louis). The first chart shows the 30-year fixed rate mortgage average in the United States and the second, by Moody’s, shows corporate bond yields relative to the 10-year Treasury (commonly called the “spread” to treasuries). Both charts are at or near record low levels.

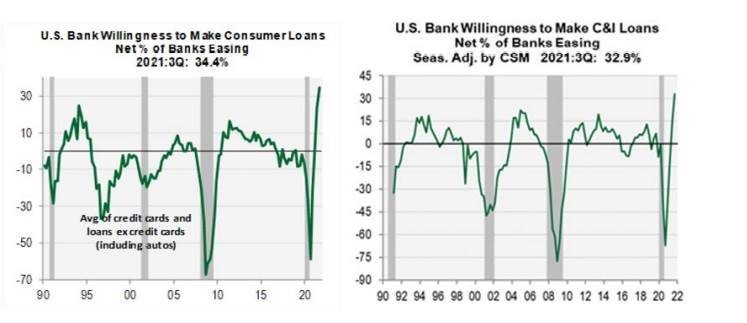

Several issues remain solidly behind the markets and the economy. First, as we have shown many times, the consumer is flush with cash (from stimulus money, decreased spending over the past year and increased savings). Second, the banking system is in great shape to fuel an already expanding economy. Two charts by Cornerstone Macro show U.S. banks willingness to make consumer loans and Commercial and Industrial Loans (C&I) at or near record levels in both cases. Low rates and banks’ strong willingness to lend make a good partnership.

And third, as mentioned above, Treasury yields remain low, allowing mortgage rates to stay low and corporations to borrow at near record low levels. All three issues point to the continuation of a healthy growing economy and a strong finish to 2021.

It would not be prudent to speak only in terms of positive indicators. Truthfully, each week we scour the headlines searching for headwinds and pockets of negativity. Concerns about unrest in Afghanistan and elsewhere across the globe, supply chain disruptions, and uncertainty around COVID-19 variants seem to always be bubbling just under the surface. Remember, every healthy bull market has frequent selloffs (sometimes by 5% or more), so it is important to realize that markets go down and markets go up; we just hope that in the end, there are more ups than downs. Like a broken record going around a turntable (are we dating ourselves?), we repeat: a long-term outlook and sound financial plan is a solid recipe for success. Pay attention to what’s behind the growth story and the solid economic foundation the Fed has built.